Shares of Chegg (NYSE:CHGG) lost over 32% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.27, which beat analysts’ consensus estimate of $0.26 per share. Sales decreased by 7.2% year-over-year, with revenue hitting $187.6 million. This beat analysts’ expectations of $185.17 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Chegg lost ground in both subscription revenue and total subscribers as well. Subscription Service revenues lost 3% against this time last year, slipping to $168.4 million. Subscription Services subscriber count, meanwhile, stood at 5.1 million, which is down 5% year-over-year.

Chegg’s management also offered projections for the second quarter, which proved disappointing. Chegg looked for total net revenues to come in between $175 million and $178 million, which was a clear miss compared to analyst expectations of $193.65 million. Subscription Services revenue, meanwhile, is projected between $159 million and $162 million, which is a decline on a quarter-over-quarter basis.

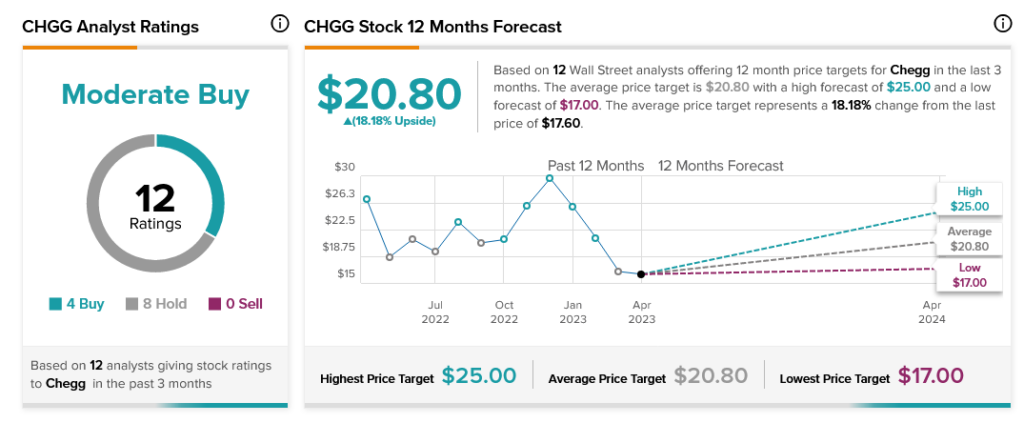

Overall, Wall Street has a consensus price target of $20.80 per share on Chegg stock, implying 18.18% upside potential, as indicated by the graphic above.