Cathie Wood’s flagship, the ARK Innovation Exchange Traded Fund (ETF) (ARKK) has had a turbulent 2022. The ETF has slid 29.7% year-to-date amid a widespread technology sector sell-off. The ARK Innovation ETF, which was incepted in 2014, is an actively managed fund that looks at investing in companies who are at the forefront of “disruptive innovation.”

ARK defines “disruptive innovation as the introduction of a technologically enabled new product or service that potentially changes the way the world works.”

On Thursday, Cathie Wood admitted to CNBC that the ETF is not doing so well and commented, “We’ve had a significant decline. We do believe innovation is in the bargain basement territory. … Our technology stocks are way undervalued relative to their potential. … Give us five years, we’re running a deep value portfolio.”

However, according to CNBC, citing data from Factset, ARKK still had more than $70 million in net inflows year-to-date.

Using the TipRanks stock comparison tool, we compared the top holdings of ARKK against each other, based on stocks on which Wall Street analysts are most bullish about, and offered the most potential for significant upside over the next 12 months.

Let us look at three of these top stocks.

Block (NYSE: SQ)

Block, formerly Square, headed by Jack Dorsey, is a top holding on the ARK Innovation ETF list with a weightage of 4.27% in ARKK’s portfolio. SQ provides an ecosystem of commerce solutions business software, and banking services to sellers, and it is now venturing into cryptocurrency.

Shares of Block have dropped by approximately 20% in the past month. Investors have become bearish about SQ after Apple (AAPL) unveiled a Tap to Pay service, which essentially renders Square dongles obsolete.

Are investor concerns regarding the company justified?

Mizuho Securities analyst Dan Dolev thinks, in fact, that AAPL’s Tap to Pay could be “more long-term beneficial for SQ, further proliferating its two-sided commerce ecosystem on a broader and more global basis.”

Elaborating further, the analyst pointed out that while earlier, Block’s hardware sales, including the dongle, were a major part of its business and branding, now these sales account for less than 1% of its total revenue.

As a result, Dolev thinks that investors have likely misinterpreted that “SQ is the main target for Apple.”

Moreover, the analyst believes that with SQ eyeing international growth, not needing to ship, deploy or pay for hardware “could help SQ focus solely on its software” and grow rapidly in international markets.

The analyst is also optimistic about its Cash App and believes, “superior unit economics” for this app could help drive substantial growth for the company’s gross profits.

For now, Dolev is upbeat about the stock with a Buy rating and a price target of $210. It remains to be seen how SQ will perform in fiscal Q4 as it is expected to announce its results on February 24.

The rest of the analysts on the Street echo Dolev and are optimistic about the stock with a Strong Buy consensus rating based on 19 Buys and 2 Holds. The average SQ stock prediction of $212.48 implies upside potential of approximately 104.3% to current levels for this stock.

Intellia Therapeutics (NASDAQ: NTLA)

Intellia Therapeutics is one of the top holdings of the ARK Innovation ETF and makes up 4.4% of the ETF. The company is a clinical-stage genome editing company that uses CRISPR-based technologies to develop potentially curative therapeutics.

CRISPR is an acronym for Clustered, Regularly Interspaced Short Palindromic Repeats. NTLA believes that this technology has the potential to produce therapeutics that may edit or correct genes associated with the disease with a single treatment course.

Last week, the company entered into a licensing and collaboration agreement with ONK Therapeutics. This agreement would grant ONK a non-exclusive license to Intellia’s proprietary ex vivo (outside the organism) CRISPR gene editing platform, and its “lipid nanoparticle (LNP)-based delivery technologies to develop up to five allogeneic NK [natural killer] cell therapies.”

Under the agreement, ONK will be responsible for the clinical and preclinical development of the NK cell therapies that are a part of this agreement. As a part of this agreement, Intellia will be, “eligible to receive up to $184 million per product in development and commercial milestone payments, as well as up to mid-single digit royalties on potential future sales.”

In addition, NTLA will also have the option to co-develop and co-commercialize up to two products worldwide.

NK cells are, “naturally occurring immune cells that play a critical role in immune activation against abnormal cells, including cancer cells.”

H.C. Wainwright analyst Michael G. King, Jr. views this agreement as, “another example of strategic partnerships Intellia has made in its quest to become a dominant player in the cell therapy space by leveraging its core technology and IP [intellectual property]” portfolio.

The analyst is bullish on the stock with a Buy rating and a price target of $182 (101.3% upside) on the stock.

The rest of the analysts on the Street are also bullish on the stock with a Strong Buy consensus rating based on 10 Buys and 2 Holds. At the time of writing, the average Intellia Therapeutics stock prediction was $154.38, which implies upside potential of approximately 70.7% to current levels for this stock.

Roku (NASDAQ: ROKU)

Shares of Roku tanked 27.1% in early morning trading after the television streaming platform delivered disappointing Q4 results.

Interestingly, Roku is one of the top 3 holdings of the ARKK ETF with a weightage of 6.2% in the portfolio. The other two top holdings are Tesla (TSLA) and Teladoc Health (TDOC).

Looking at the Q4 results, the company’s revenue growth slowed during Q4 to 33% year-over-year to $865.3 million. However, this figure failed to meet the consensus estimates of $896.54 million. While Roku’s diluted earnings of $0.17 per share in Q4 meaningfully surpassed the Street estimates of $0.07 per share, this figure still came in below the Q4 FY20 earnings of $0.49 per share.

However, the Q4 results notwithstanding, Needham analyst Laura Martin is still bullish on the stock. The analyst pointed out some key positives for the stock.

Martin noted that Roku’s traditional linear TV advertising total addressable market (TAM) is worth $60 billion in the U.S.

Moreover, the analyst thinks that ROKU stands to benefit from the, “long-term secular growth in CTV [connected TV] ad growth” and other trends. These trends include rising cord-cutting, higher political ad spend, and more streaming devices at every home.

As a result, the analyst has a Buy rating and a price target of $205 (41.6% upside) on the stock.

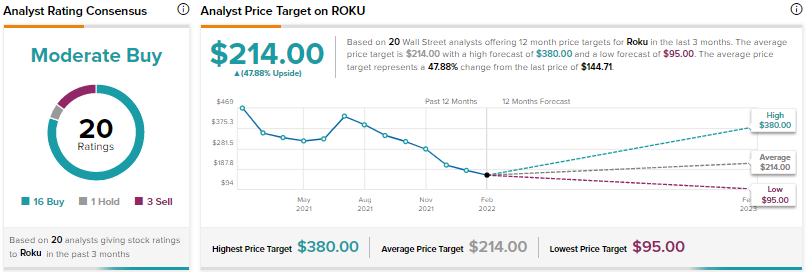

However, the rest of the analysts on the Street are cautiously optimistic about the stock following the Q4 earnings with a Moderate Buy consensus rating based on 16 Buys, 1 Hold and 3 Sells. At the time of writing, the average Roku stock prediction was $214, which implies upside potential of approximately 47.8% to current levels for this stock.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.