The “Big Six” Canadian Banks — Royal Bank of Canada (TSE:RY), TD Bank (TSE:TD), Canadian Imperial Bank of Commerce (TSE:CM), Bank of Montreal (TSE:BMO), Bank of Nova Scotia (TSE:BNS), and National Bank of Canada (TSE:NA) — all reported earnings recently. Which bank performed the best? Let’s compare their earnings results to find out.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Which Banks Beat Earnings Expectations?

Surprisingly, the only bank to beat earnings-per-share expectations this time around was Royal Bank of Canada, with the bank clocking in adjusted EPS of C$2.84 compared to the consensus estimate of C$2.70, a 5.2% earnings surprise. This represents a growth rate of 11% on a year-over-year basis.

Which Banks Missed Earnings Expectations?

Every other big bank missed EPS estimates. Let’s sort the earnings misses from biggest to smallest.

- Bank of Montreal: Adjusted EPS of C$2.78 missed the consensus estimate of C$3.14, a more than -11% earnings surprise.

- Canadian Imperial Bank of Commerce (CIBC): Adjusted EPS of C$1.52 missed the consensus estimate of C$1.68, a -9.7% earnings surprise.

- National Bank of Canada: Adjusted EPS of C$2.21 missed the consensus estimate of C$2.37, a -6.74% earnings surprise.

- TD Bank: Adjusted EPS of C$1.99 missed the consensus estimate of C$2.04, a -2.4% earnings surprise.

- Bank of Nova Scotia: Adjusted EPS of C$1.73 missed the consensus estimate by just one penny, a -0.41% earnings surprise.

All Banks Except for RY Saw Earnings Declines

Notably, every big bank saw year-over-year declines in adjusted EPS, except for Royal Bank. As mentioned earlier, RY’s EPS grew by 11%. Meanwhile, TD’s EPS fell by 4.8%, NA’s fell by almost 6%, BMO’s dropped by 10%, BNS’s EPS fell by 17.6%, and finally, CIBC’s earnings declined by 17.8%.

Which Bank Had the Highest Return on Equity?

Return on equity is a measure commonly used by banks to measure profitability. It’s measured as a company’s net income divided by its total average equity over a specified period. The higher the number, the better. Let’s sort each company’s ROE from best to worst.

- National Bank of Canada: This bank actually had the highest adjusted ROE, coming in at 15.3%. However, it was 17.9% last year.

- Royal Bank of Canada: RBC’s adjusted ROE came in at 15.1% and grew by 30 basis points year-over-year.

- TD Bank: TD’s ROE fell to 14.1% from 16.1% last year.

- Bank of Nova Scotia: Scotiabank’s ROE also fell year-over-year, coming in at 12.2%, down from 15.4%.

- CIBC: Adjusted ROE of 11.9% fell from a very respectable 15.1% last year.

- Bank of Montreal: Adjusted ROE came in at 11.7%, down from 13.8% in Q3 2022.

What’s the Best Canadian Bank Stock to Buy?

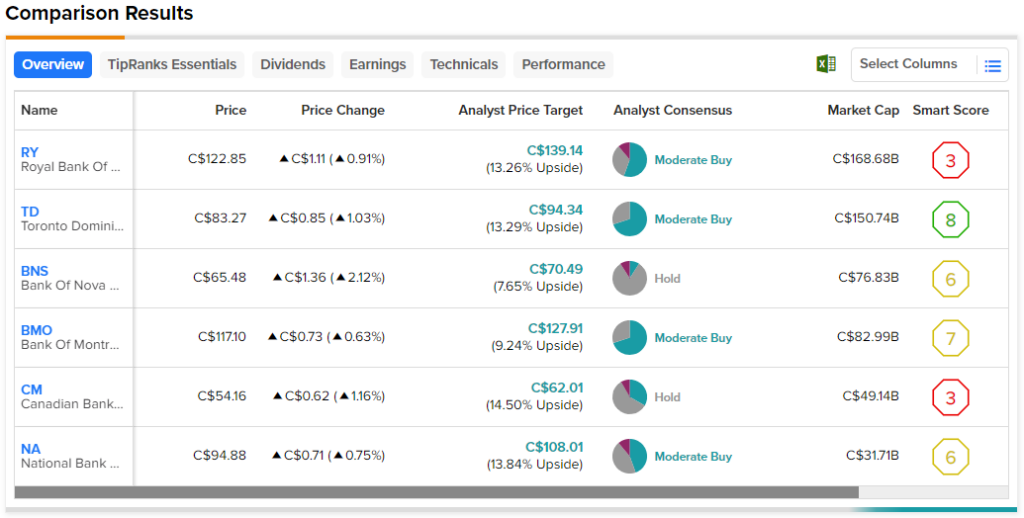

Using TipRanks’ comparison tool, we compared all six banks to see which ones analysts are most bullish on and which have the highest Smart Scores. While analysts see the most upside ahead (14.5%) from CM stock, it has an Underperform Smart Score of 3 out of 10. Also, NA, TD, and RY are all close to CM in terms of upside potential. Meanwhile, TD is the only one with an Outperform Smart Score, indicating that it may have the highest chance of outperforming the market from here.

The Takeaway: Royal Bank Clearly Had the Best Results

Looking at the results, it’s clear that Royal Bank had the best results this earnings season. Not only was it the only bank that beat expectations, but it was also the only one whose adjusted EPS and ROE improved year-over-year. Also, its ROE was the second highest, only coming in 20 basis points lower than that of National Bank.