Toronto-Dominion Bank (NYSE:TD) (TSE:TD), one of Canada’s largest banks, released its Q3-2023 financial results earlier today. The bank slightly missed earnings estimates, sending the stock lower. TD’s adjusted diluted earnings per share (EPS) were C$1.99, missing the consensus estimate of C$2.04 and lower than last year’s EPS of C$2.09. For the first nine months of TD’s fiscal year, adjusted diluted EPS came in at C$6.16, two cents lower year-over-year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TD Bank Group also intends to terminate its current program to buy back 30 million shares after its completion and plans to initiate a new one, aiming to repurchase as much as 90 million shares, or approximately 4.9% of its total share count as of July 31, 2023.

How Each Segment Performed

Delving into the details, TD’s Canadian Personal and Commercial Banking arm saw an increase in revenue by 7%, reaching C$4.57 billion. However, net income took a slight dip of 1% from last year, primarily attributed to increased provisions for credit losses. Further, the U.S. Retail Banking segment reported a 6% decrease in adjusted net income.

Similarly, the Wealth Management and Insurance segment saw a 12% drop in net income due to “higher insurance claims and related expenses.” On the other hand, Wholesale Banking net income stayed flat year-over-year.

Is TD Stock a Buy, According to Analysts?

According to analysts, TD stock comes in as a Moderate Buy based on seven Buys and three Holds assigned in the past three months. The average TD stock price target of C$91.57 implies 12% upside potential.

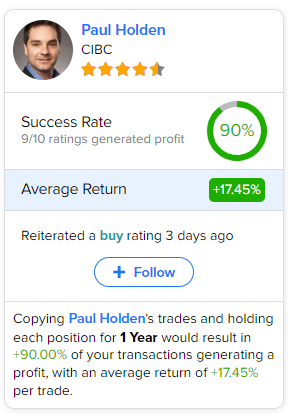

If you’re wondering which analyst you should follow if you want to buy and sell TD stock, the most profitable analyst covering the stock (on a one-year timeframe) is Paul Holden of CIBC, with an average return of 17.45% per rating and a 90% success rate. Click on the image below to learn more.