Bank of Montreal (TSE:BMO) (NYSE:BMO) revealed its Q3-2023 earnings results earlier today, which missed analysts’ expectations, as earnings fell and provisions for credit losses rose more than forecast. As a result, the stock has been underperforming the broader market today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q3-2023 Results

BMO’s adjusted net earnings fell modestly to C$2.04 billion compared to C$2.13 billion in the prior year. However, on a per-share basis, the drop was more significant. Adjusted EPS fell from C$3.09 to C$2.78, missing the consensus estimate of C$3.13 per share.

BMO set aside more provisions for credit losses compared to last year — its provisions expanded to C$492 million in the second quarter from C$136 million a year earlier. This caused the bank’s adjusted return on equity to fall from 13.8% to 11.7%. Notably, BMO’s CET1 ratio (a liquidity ratio — the higher, the more liquidity) fell from 15.8% to 12.3%.

Meanwhile, Bank of Nova Scotia (TSE:BNS) (NYSE:BNS) also reported its Q3 earnings this morning, with its CET1 ratio of 12.7% and its adjusted return on equity of 12.2% both coming in slightly better than BMO’s. Further, BNS only missed earnings per share estimates by one penny (C$1.73 reported vs. C$1.74 expected), so its results weren’t as disappointing. However, BNS’s EPS fell by 17.6% year-over-year, while BMO’s EPS fell by a less worrying 10%.

On a year-to-date basis, BMO’s adjusted earnings per share came in at C$8.93 compared to C$10.20 in the same period last year, and adjusted return on equity fell from 16% to 12.6%.

Is BMO Stock a Buy, According to Analysts?

According to analysts, BMO stock comes in as a Strong Buy based on seven Buys and two Holds assigned in the past three months. The average BMO stock price target of C$133.18 implies 16.8% upside potential.

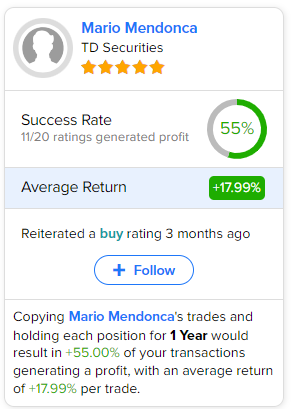

If you’re wondering which analyst you should follow if you want to buy and sell BMO stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mario Mendonca of TD Securities, with an average return of 17.99% per rating and a 55% success rate. See below.