Shares of electric vehicle maker Lucid Group (NASDAQ:LCID) have tanked from the $55 highs seen two years ago to the current $4 level. The stock is now trading well below the crucial $6 support level, and despite some of its recent moves, investors are far from being impressed.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company recently slashed the prices of its Air luxury sedans for the holiday season and has received a dose of liquidity from the Public Investment Fund of Saudi Arabia. Additionally, Lucid opened its first international car manufacturing facility in Saudi Arabia.

Last week, the company introduced the Gravity SUV at the Los Angeles Auto Show. The vehicle can accelerate from 0 to 60 mph in less than 3.5 seconds and offers a range of over 440 miles.

In the third quarter, the company produced 1,550 vehicles, agreed to join Tesla’s (NASDAQ:TSLA) NACS (North American charging Standard) standard, and entered into an arrangement to supply EV powertrain, battery systems, and software to Aston Martin (LSE:AML). Further, the Gravity SUV is expected to go into production in late 2024.

Still, the company’s shares took a beating after it lowered its production outlook for the full year to 8,000 to 8,500 vehicles from the prior target of 10,000. At the time, CFO Sherry House noted, “I want to make clear that production is not our bottleneck, but rather we are taking a prudent approach to inventory management and working capital to better align with deliveries.”

In the present macroeconomic environment, U.S. EV makers are seeing a rise in inventories as consumers adopt a cautious spending approach and Wall Street has not been exactly upbeat about Lucid’s shares either.

What Is the Target Price for Lucid?

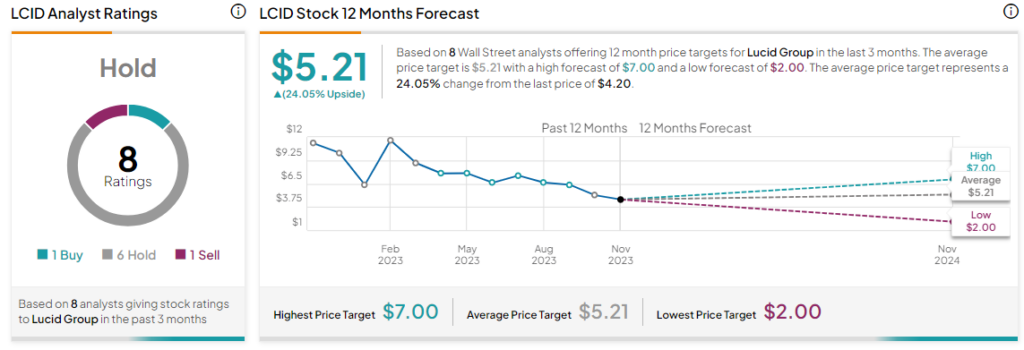

Baird’s Ben Kallo has reiterated a Hold rating on Lucid but lowered the price target on the stock to $6 from $7. Needham’s Chris Pierce too lowered the price target on the stock to $5 from $9 while maintaining a Buy rating.

The overall consensus rating for Lucid shares remains a Hold, and the average LCID price target of $5.21 implies a 24% potential upside in the stock. But that’s after a nearly 59% correction in the company’s share price over the past year.

Additionally, Lucid has been consistently churning out losses since going public in 2020 and it could be quite some time before it starts seeing gains from amped-up production targets (it aims for a 150,000 annual unit capacity in Saudi Arabia) and hit profitability.

Read full Disclosure