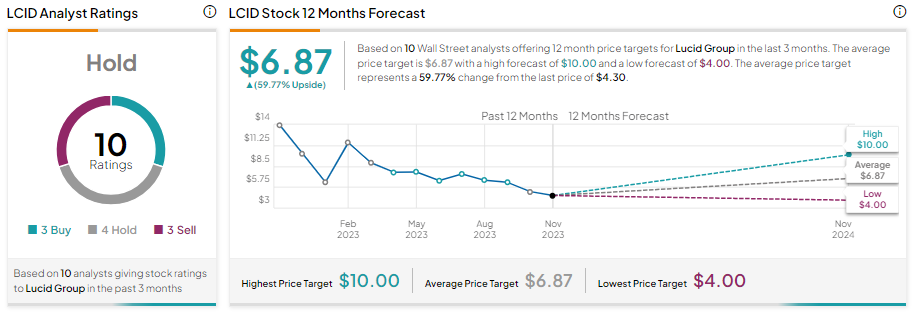

Shares of the luxury EV (electric vehicle) maker Lucid (NASDAQ:LCID) are down over 68% in one year. Moreover, LCID stock fell about 4% in Tuesday’s after-hours of trading as its Q3 performance and full-year production outlook disappointed investors. Despite the significant correction in its share price, Wall Street analysts remain sidelined on Lucid stock, indicating a Hold.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, it’s worth noting that the recommendations and price targets for Lucid stock were issued before the company lowered its full-year production guidance. Consequently, investors can expect a potential downward revision in the price targets for LCID stock.

With this background, let’s delve into Lucid’s full-year production outlook.

Lucid Lowered 2023 Production Target

Lucid’s CFO, Sherry House, said during the Q3 conference call that the company is adjusting its 2023 production outlook to a range of 8,000 to 8,500, down from its earlier guidance of over 10,000. House added, “I want to make clear that production is not our bottleneck. But rather we’re taking a prudent approach to inventory management and working capital to better align with deliveries.”

However, this is unlikely to go down well with the investors. For instance, Lucid’s peer Rivian (NASDAQ:RIVN) raised the production guidance for the year to 54,000 units during the Q3 earnings call. Moreover, Tesla (NASDAQ:TSLA), a bigger rival, continues to ramp up production, which enables it to lower costs per vehicle and deliver superior margins.

Will Lucid Stock Go Back Up?

Per analysts’ average price target, Lucid stock is expected to go up. Lucid has received three Buy, four Hold, and three Sell recommendations for a Hold consensus rating. The average LCID stock price target of $6.87 implies 59.77% upside potential from current levels.

However, as we stated earlier, the analysts’ price targets were provided ahead of its Q3 result announcement. Thus, considering the downward revision in production, investors can expect a cut in the average price target.

Bottom Line

Lucid may face challenges due to the reduction in its full-year production forecast, increased competition, and adverse macroeconomic conditions impacting vehicle sales. These problems are reflected in the “Hold” consensus rating.