Chinese technology giant Baidu, Inc. (BIDU) is slated to release its second quarter Fiscal 2022 results on August 30, before the market opens. Baidu specializes in Internet-related services and products, and artificial intelligence (AI). BIDU stock has lost 9.3% during the past six months, while gaining 11.9% in the last five days.

The Street expects Baidu to post adjusted earnings of $1.58 per share in Q2, much lower than the prior year period’s figure of $2.39 per share. Meanwhile, revenue is pegged at $4.24 billion, representing a year-over-year decline of 12.5%.

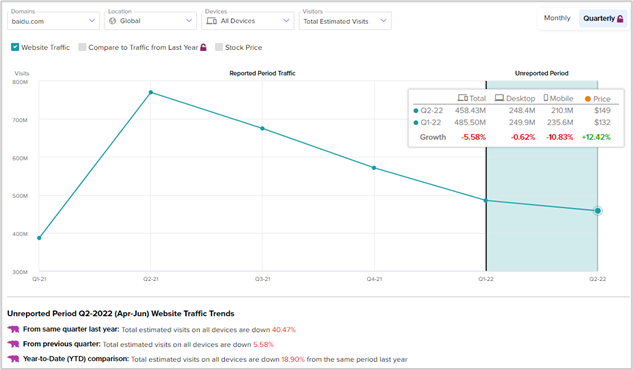

Baidu’s Q2 Website Traffic Trends are Weak

TipRanks Website Traffic Tool signals that Baidu is set to report weak Q2 results. As per the tool, in Q2, the total estimated visits to the baidu.com website declined by a whopping 40.47% compared to the same period of last year. The weakness in website visits continued in July as well, with a 21.16% year-over-year fall.

Furthermore, TipRanks Website Traffic Tool indicates that the year-to-date estimated visits fell 18.90% compared to the same period last year. These numbers hint that Baidu is set to post a disappointing second-quarter performance. There has also been a sequential fall of 5.58% in the second quarter’s total estimated visits.

Learn how Website Traffic can help you research your favorite stocks

Possible Catalysts Securing Long-Term Growth

Remarkably, Baidu received the first-ever permission in China to operate fully driverless robotaxis services commercially on public roads. Apollo Go, its autonomous ride-hailing service business, is allowed to operate its driverless robotaxis in Beijing, Chongqing, and Wuhan. Also, the company plans to expand its operations to 65 cities by 2025 and 100 cities by 2030.

Baidu boasts a robust AI Cloud business that is developing applications across different verticals. The segment’s revenue grew 45% in the first quarter, showcasing its strength in the market.

Also, on the regulatory front, the fears of delisting U.S.-listed Chinese stocks have been reduced. The U.S. and Chinese regulators signed a preliminary deal for audits of Chinese firms. As per reports, the deal will allow U.S. regulators to inspect the audit records of Chinese companies in Hong Kong. The procedure is expected to start as soon as next month.

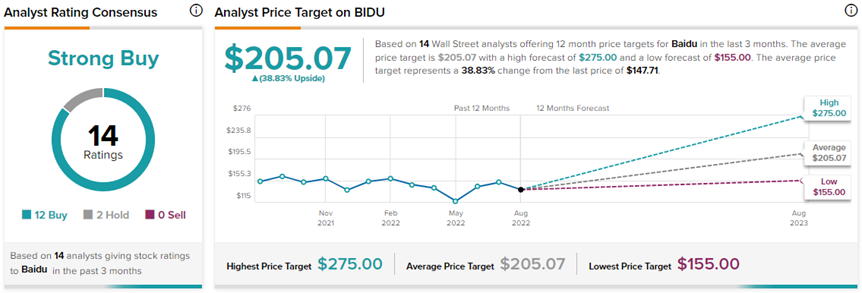

What is the Target Price for Baidu Stock?

On TipRanks, BIDU stock commands a Strong Buy consensus rating based on 12 Buys and two Holds. The average Baidu price target of $205.07 implies 38.8% upside potential to current levels. The highest price target for BIDU is $275 (86.2% upside), while the lowest is $155 (4.9% upside).

Ending Thoughts

While there are several catalysts for Baidu’s long-term growth trajectory, the near-term headwinds continue to drag down its performance. The current resurgence of COVID-19 in China and related lockdowns are affecting companies. Moreover, the inflationary pressures and economic slowdown have put a plug on advertising spending, which is one of the biggest revenue drivers for Baidu.

Nonetheless, Baidu continues to meaningfully diversify its operations into robotaxis and the AI Cloud business, and reduce its dependence on advertising streams. This is the probable reason for analysts’ highly optimistic view of BIDU stock as a potential long-term winner.