FAANG stocks (Meta Platforms (NASDAQ:META), previously called Facebook, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Google’s parent company Alphabet (NASDAQ:GOOGL, GOOG)) shed significant value last year. However, except for Netflix, the remaining four stocks have fared better than the S&P 500 (SPX) year-to-date, with META shares posting the highest gain. We used TipRanks’ Stock Comparison Tool to place Amazon, Apple, and Netflix against each other to pick Wall Street’s favorite FAANG stock at current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amazon (NASDAQ:AMZN)

The impact of macro pressures on consumer spending and the reopening of physical stores impacted Amazon’s retail business. Additionally, moderation in IT spending due to fears of an impending recession slowed down the growth rate of the company’s cloud computing Amazon Web Services (AWS) business.

Amazon is improving its cost structure to navigate a tough environment. The company recently announced 9,000 additional job cuts following an earlier round of 18,000 layoffs. The latest round impacted AWS, advertising, human resources, and Twitch units. Overall, Amazon is taking initiatives to make its structure leaner and more profitable.

Is Amazon a Buy, Hold, or Sell?

Reacting to Amazon’s cost-cutting measures, William Blair analyst Dylan Carden said, “Assuming the Street is close on its revenue assumptions, which we believe are relatively conservative, we find that there is combined upside to total company operating income of close to 40% over the next two years as cost items move back toward relatively consistent historical patterns.”

Further, Carden is bullish about the company’s Prime offering and AWS business. He believes that AMZN stock offers compelling value ahead of a possible “reacceleration” in AWS coupled with the “ultimate profitability” of its retail business. The analyst projects acceleration in the AWS business later this year, driven by new customer adoption.

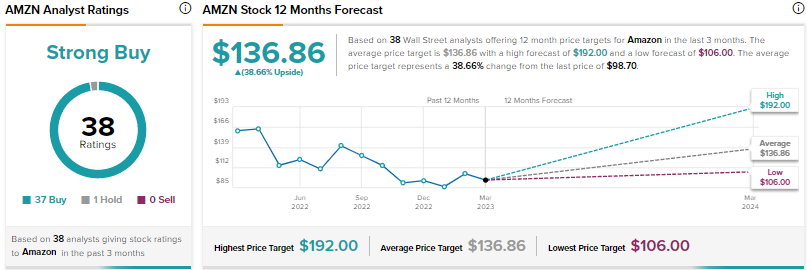

Wall Street’s Strong Buy consensus rating for Amazon is backed by 37 Buys and one Hold. The average price target of $136.86 suggests about 39% upside potential. Shares have advanced over 17% since the start of the year.

Apple (NASDAQ:AAPL)

Often considered one of the most innovative companies in the world, Apple has delivered significant returns for shareholders over the past decade. Last month, the company reported a decline in its December quarter revenue, citing production disruptions in China, currency headwinds, and macroeconomic challenges.

Apple expects its March quarter revenue performance to be similar to the December quarter. While the impact of near-term pressures can’t be ignored, Apple’s strong fundamentals, its solid product portfolio, and growing services business continue to make it an attractive stock for several analysts.

Is Apple Stock a Buy?

Earlier this month, Wedbush analyst Daniel Ives raised the price target for Apple stock to $190 from $180 and reiterated a Buy rating, as checks by his firm revealed that the demand for iPhones in China has been growing.

Ives stated that iPhone supply was steady in January and February, in contrast to the December quarter, which was impacted by supply constraints stemming from China’s zero COVID policy. Additionally, early indications in March indicate that conditions continue to improve.

Ives added that Apple is winning market share in China and demand in the U.S. and Europe is also faring well. Also, he believes that the new iPhone users added to the company’s ecosystem over the past year will result in a reacceleration of Apple’s services business in the upcoming quarters.

Overall, Apple’s Moderate Buy consensus rating is based on 24 Buys, six Holds, and one Sell. At $170.18, the average AAPL stock price target implies nearly 8% upside. Shares have risen more than 21% year-to-date.

Netflix (NASDAQ:NFLX)

After losing subscribers in the first two quarters of 2022, streaming giant Netflix bounced back well in the second half of 2022. The company reported 7.66 million paid net subscriber additions for the fourth quarter of 2022, smashing Wall Street’s expectations of 4.58 million subscribers.

The company is trying to boost its revenue through various initiatives, including better content, an ad-supported subscription plan, and a paid sharing plan. That said, the path ahead is not easy, given the intense competition from not just other streaming players but also other channels of entertainment like YouTube and short-form entertainment like TikTok.

What is the Price Target for NFLX Stock?

Last week, Oppenheimer analyst Jason Helfstein reiterated a Buy rating on Netflix stock with a price target of $415. Helfstein noted that NFLX shares initially advanced following the Q4 2022 results but then started to decline due to fears that the company’s crackdown on password sharing might lead to a higher churn. Shares were also impacted by the slower launch of the ad-supported tier by the company and macro troubles.

“We believe nothing has changed from our original thesis: advertising increases the total addressable market, content competition is easing, and paid account sharing will be a long-term tailwind,” said Helfstein.

The Street’s Moderate Buy consensus rating for Netflix is based on 17 Buys, 16 Holds, and two Sells. The average price target of $356.20 indicates upside potential of 21.2%. Shares are flat on a year-to-date basis.

Conclusion

Macro pressures are expected to impact the near-term performance of Amazon, Apple, and Netflix. Wall Street is more bullish about Amazon and is confident about its long-term potential, thanks to its e-commerce leadership, the dominant position of AWS in cloud computing, and the growing advertising business.

As per TipRanks’ Smart Score System, Amazon earns a nine out of 10, which implies that the stock is capable of generating market-beating returns over the long term.