American Express (NYSE:AXP) stock is riding hot after clocking in a quarterly beat that impressed Wall Street. Undoubtedly, no payments play can smooth a recession as consumers feel the force of headwinds and inflation. Despite macro headwinds, American Express stands out as a payments firm that could feel the least pinch as recession-related headwinds continue moving in. Even after the post-quarter stock surge, I remain bullish.

The latest January round of inflation data has hit the broader markets pretty hard. As inflation continues to linger, the Fed may have no choice but to keep the rate hikes coming. Further, a pivot to rate cuts may be pushed out further into the future than investors expect, given just how stubborn inflation can be.

As investors re-adjust expectations to the downside after a strong rally to start the year, I think they may be in a spot to pivot slightly back in favor of the defensives or, at the very least, companies that are more insulated from the hit of a recession.

Exposure to Creditworthy Wealthy Customers Insulates AXP

As consumer spending looks to cool off further through the year, credit card firms are likely to feel a bit more of a pinch. That said, American Express stands out as a firm that’s better able to weather a mild recession in 2023. That’s because the credit card company (which I view as more of a full-service financial service firm) is best known for its exposure to wealthier and more creditworthy consumers.

When times get just a bit tougher, such affluent and high-credit consumers are less likely to miss payments. Further, wealthier consumers are more likely to continue spending to rack up the rewards and justify hefty annual fees. Indeed, American Express has a lower magnitude of credit risk versus its peers and is at a lower risk of spending declines as the economy contracts.

Further, higher fees on American Express credit cards are worth paying up for if it means a merchant gains access to an army of wealthy customers who are ready and willing to spend. In tougher times, when sales and demand are weighed down, access to customers is a must.

Indeed, targeting wealthier consumers, American Express has a unique business model that helps separate itself from the pack. It’s not a mystery as to why Warren Buffett has a much bigger stake in Amex than its credit card peers.

American Express’ Strong Quarter Could be Just the Start

American Express clocked in some impressive fourth-quarter numbers. Revenues rose 17% to $14.2 billion. Though adjusted EPS missed the mark ($2.07 vs. $2.23 consensus), it was encouraging that higher-end credit cards received a lot of interest, with average fees per card rising to $85 from $76 a year earlier.

Even after a strong post-earnings reaction, American Express stock seems to have legs despite the market rally running out of steam. Further, Morgan Stanley (NYSE:MS) recently upgraded AXP, thanks in part to its relative credit strength and its positive operating leverage.

At 17.6 times trailing earnings, AXP stock still trades at a hefty discount to the big-two credit card firms. With a 1.2% dividend yield, which I view as a fine bonus, American Express seems like one of the safest ways to play the resilience of the consumer.

Only time will tell if the latest quarter is the start of a trend. Regardless, I think it’s hard to ignore the strength revealed in the latest quarter and the wave of upgrades it could induce over the coming weeks.

Is American Express Stock a Buy, According to Analysts?

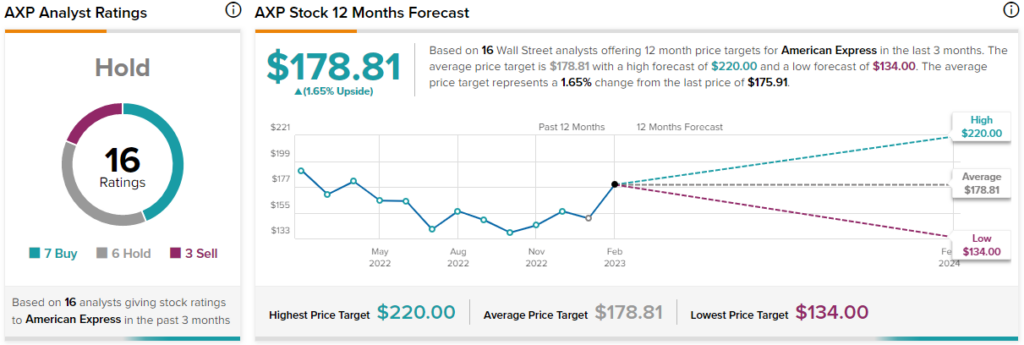

Turning to Wall Street, AXP stock comes in as a Hold. Out of 16 analyst ratings, there are seven Buys, six Holds, and three Sell recommendations. The average American Express stock price target is $178.81, implying upside potential of just 1.65%. Analyst price targets range from a low of $134.00 per share to a high of $220.00 per share.

The Takeaway

American Express stock is down just north of 10% from its highs. As the travel recovery continues into the spring and summer seasons, I think American Express could make a run for new highs.

Wall Street analysts are still quite muted on the name after its post-earnings pop. In any case, I do think Morgan Stanley raises good points that could inspire others to upgrade the name as well.