Technology bigwig Amazon.com, Inc. (AMZN), despite its current lows, is poised for robust growth potential as the macroeconomic headwinds gradually fade away. Inflation and supply chain constraints were the biggest two challenges hampering Amazon’s performance considering its well-diversified business model.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

AMZN stock is currently trading at a Price/Sales multiple of 2.69x, which is less than its five-year average of 3.82x. Notably, Amazon stock hit a yearly low of $101.26 after the stock split. Additionally, the stock is trading at a steep discount of 32.6% from its 52-week high of $188.11 in November 2021. This makes Amazon stock look quite attractive.

Amazon’s Diversified Offerings

Notably, Amazon boasts of five successful businesses. Its Amazon Web Services (AWS) provides cloud computing services and is contributing handsomely to its top-line growth. In Q2FY22, AWS generated $19.74 billion in revenue, growing 33% year-over-year and representing about 16% of total revenue.

Next is Amazon Marketplace, its e-commerce website that allows third-party sellers to sell their offerings online along with Amazon’s range of products. Undoubtedly, Amazon’s marketplace continued to strengthen its stronghold even during the pandemic and after. Amazon’s online stores contributed $50.86 billion in revenue in Q2, declining slightly by 4.3% compared to Q2FY21.

Amazon Prime, its paid subscription service, enables premium services to customers across the globe. It has over 200 million subscribers worldwide. Revenue from Prime is included in Amazon’s subscription services revenue, which contributed $8.72 billion in Q2, jumping 10.1% year-over-year.

Next up is the Amazon Advertising service, which works similarly to pay-per-click ads on Google (GOOGL) (GOOG) and is one of the top advertising services available online. In Q2, Amazon earned $8.76 billion in revenue from advertising services, growing 17.6% compared to the prior-year period.

And lastly, Amazon Logistics provides last-mile shipping and delivery services. Amazon boasts one of the largest fulfillment and distribution centers in the world from where it delivers packages to customers. Logistics revenue is included in Amazon’s third-party seller services, the biggest revenue contributor. In Q2, this segment generated $27.38 billion in revenue, growing 9.2% year-over-year.

Is Amazon a Buy, Sell or Hold?

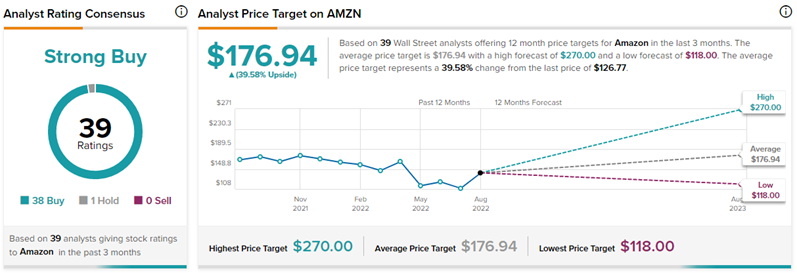

Wall Street analysts are highly optimistic about AMZN stock’s trajectory. On TipRanks, AMZN stock commands a Strong Buy consensus rating based on 38 Buys and one Hold. The average Amazon.com price target of $176.94 implies 39.6% upside potential to current levels. Meanwhile, its stock has lost 25.6% so far this year.

In a recent internet sector study, Robert W. Baird analyst Colin Sebastian stated that he expects domestic e-commerce in the United States to grow by 10% year on year. This means that the second half of 2022 is poised for 12%–13% year-over-year growth and double-digit growth for e-commerce stocks, including AMZN.

The analyst projects domestic e-commerce to hit $1 trillion in 2022 and $1.5 trillion by 2025. Sebastian has a Buy rating on AMZN stock with a price target of $150, implying 18.3% upside potential.

Takeaway- Amazon Poised for Substantial Growth

With the passing of the Inflation Reduction Act (IRA), Amazon may see its bottom line shrink to a certain extent. One of the components of the IRA is to set the minimum corporate tax rate at 15%. As a result of this ruling, Amazon’s income taxes may increase and may impact its bottom line.

Nonetheless, over the years, Amazon has emerged as one of the biggest tech giants worldwide. With a broad moat and an extremely well-diversified business model, the company is poised for substantial growth ahead. With the demand for e-commerce and cloud services expected to boost considerably in the coming years, Amazon should perform well. Moreover, analysts are also highly bullish on the trajectory of the stock, making for an attractive investment case.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue