L Brands (LB) is one of the many stocks that went through the roof this year and delivered exceptional returns. The easing of pandemic-led restrictions and government stimulus payments aided L Brands’ sales and led to a strong recovery in its stock. Furthermore, improved guidance and initiatives to drive shareholders’ value through share buybacks and dividend reinstatement added a spark to its stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

With a market capitalization of $19.7 billion, the share price of this specialty apparel, personal and beauty care, fragrance, and body care products retailer more than doubled on a year-to-date basis. (See L Brands stock chart on TipRanks)

The company operates through three retail brands: Victoria’s Secret, PINK, and Bath & Body Works. It owns 2,684 specialty stores in North America and Greater China and operates more than 700 franchised locations worldwide.

As L Brands stock gained quite a lot this year, let’s dig deeper into its growth catalysts.

What’s Behind the Rally?

Like other companies in the retail industry, L Brands scrambled to remain afloat amid the pandemic. However, an improving macroeconomic environment, large stimulus payments, and the relaxation of COVID-19 related restrictions led to improved sales and earnings trends and pushed its stock higher.

Furthermore, its initiatives to improve sales at its business segments, plus efforts to cut costs and reduce leverage, led to improved profitability. In the Bath & Body Works segment, the company more than doubled its U.S. direct business in the past year and launched 16 localized e-commerce sites globally that drove traffic and led to strong sales volumes. Meanwhile, the Victoria’s Secret business benefitted from the improving product assortment, solid inventory mix, and targeted marketing.

The company also announced the repayment of $1.04 billion of debt and reinstated its annual dividend, giving a significant boost to investors’ sentiment. TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on L Brands stock, with 9.7% of investors increasing their exposure in the past 30 days.

Business Split at L Brands

L Brands said its board approved the separation of its Victoria’s Secret business into an independent publicly traded company. L Brands stated that “The new company, named Victoria’s Secret & Co. (“Victoria’s Secret”), will include Victoria’s Secret Lingerie, PINK and Victoria’s Secret Beauty,” and start trading on the New York Stock Exchange with ‘VSCO’ symbol.

Per the terms of separation, L Brands stockholders will get one share of Victoria’s Secret & Co. for every three shares of L Brands. Furthermore, L Brands changed its corporate name to Bath & Body Works, Inc., and will change its stock symbol to ‘BBWI’ from ‘LB.’ The two separate companies will start trading on the exchange from Aug. 3.

2021 Turning Out to be a Profitable Year for L Brands

After delivering solid Q1 performance, L Brands announced solid quarter-to-date net sales numbers for Q2 on July 13. It reported net sales of $2.35 billion for the nine weeks ended July 3, compared to $1.37 billion in the comparable prior-year period. Strong performance across both its business segments supported the overall sales.

Furthermore, it expects to report Q2 EPS between $1.20 and $1.30, which is significantly higher than its earlier guidance of $0.80 to $1.00.

Following the Q2 financial update, Robert W. Baird analyst Mark Altschwager said, “Net, fundamental momentum remains strong, and we’re raising our FQ2 estimates to reflect the sales and earnings update.” Altschwager has a Hold rating on the stock with a price target of $75.

With improved financial performance and business restructuring initiatives, will the uptrend in L Brands stock sustain?

Analysts Weigh In on L Brands

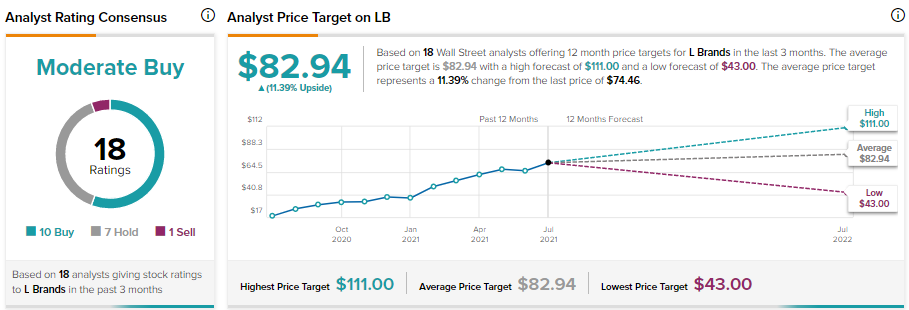

Despite the rally in L Brands stock, UBS analyst Jay Sole maintained a Buy rating and increased the price target to $111. This represents a 49.1% upside potential from current levels. Another analyst, Omar Saad of Evercore ISI, assigned a Buy rating on the stock with a price target of $100 (34.3% upside potential).

Overall, L Brands stock has a Moderate Buy consensus rating based on 10 Buys and 7 Holds. The average L Brands price target of $82.94 implies 11.4% upside potential from current levels. L Brands has an ‘Outperform’ Smart Score of 8 out of 10.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.