California-based Affirm (AFRM) provides short-term consumer loans at the point of purchase in a segment that has come to be known as buy-now-pay-later (BNPL). The company reports its fiscal Q4 2022 earnings after markets close on August 25, for the three months ended June 30. Significantly, TipRanks’ website traffic tool hints at upbeat earnings results from the BNPL provider, meaning that AFRM stock could rise.

Affirm’s Website Traffic Soars

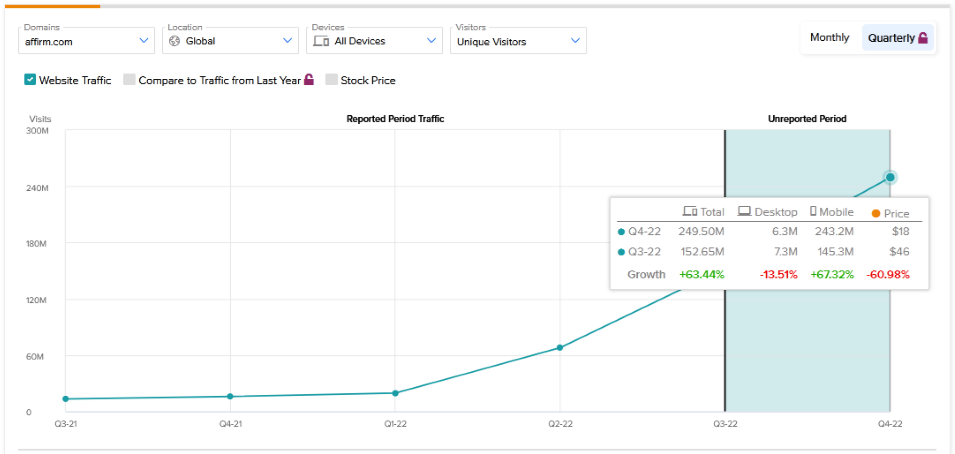

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers a peek into Affirm’s performance this quarter.

The tool shows that the Affirm website recorded a 63.4% rise in global visits in Q4 compared to Q3. Furthermore, Affirm’s website traffic has increased more than 1,053% year-to-date.

The TipRanks Website Traffic Tool helps investors gauge customers’ interest in a company’s products for clues on the financial performance. A rise in website traffic trend can signal increased demand for the products, which can in turn suggest favorable earnings. Conversely, a drop website traffic trend can imply weak demand and point to downbeat earnings results.

Learn how Website Traffic can help you research your favorite stocks.

Wall Street’s Expectations of Affirm’s Q4 Earnings

Analysts expect Affirm to report a loss per share of $0.58 on revenue of $355 million. Affirm issued internal guidance for revenue in the range of $345 million to $355 million. The company did not issue its internal EPS estimate. In the year-ago quarter, Affirm delivered a loss per share of $0.48 on revenue of $261.8 million, which exceeded Wall Street expectation of $255 million.

Affirm is set to report earnings at a time when questions have begun to arise over the future of BNPL stocks. Aside from Affirm, another major BNPL lender is Block (SQ) through its Afterpay unit. Investors are wondering whether BNPL lenders can survive the anticipated recession considering the risk of high loan defaults.

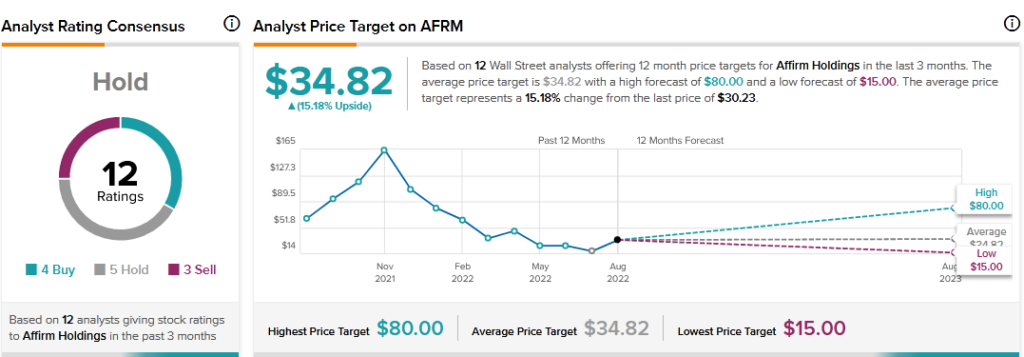

What Is the Price Target for Affirm Stock?

Affirm’s stock has gained more than 30% over the past three months, but it has declined about 68% year-to-date. According to TipRanks’ analyst rating consensus, AFRM stock is a Hold based on four Buys, five Holds, and three Sells. The average AFRM price target of $34.82 implies 15% upside potential.

Final Thoughts

The upcoming earnings report will be a major test of faith for Affirm stock. If Affirm posts upbeat earnings as the website traffic trends suggest, it would be seen as the company proving its critics wrong. That may calm down anxious investors worried about recession’s realty check for BNPL stocks. On the other hand, downbeat earnings would only heighten investors’ anxiety.

Read full Disclosure.