Admiral Group’s (GB:ADM) shares have been through a tough time in 2022: after hitting a high spot in September 2021, the share prices have been on a downward trajectory and have fallen by 22% YTD.

Could this be the time to buy?

The company’s direct competitor in the UK market, Direct Line Insurance (GB:DLG) stock is also trading down by 20% in this year so far.

Direct Line even issued a profit warning in July 2022, as it struggles with rising claim costs triggered by inflation.

What does Admiral Group do?

Admiral Group is a financial services company, known mainly for its insurance services, and is famously one of the leading car insurance companies in the UK.

The group comprises many other businesses such as Admiral Law for legal services, Admiral Money for personal finance, and Admiral Pioneer for investing in start-ups.

First-half results 2022

The company posted a profit before tax of £251.3 million in the six months ended on 30 June 2022. Even though this was around 48% lower than the previous year, it was still 19% higher than the first half of 2019. The UK motor business performed well and contributed the most to the profits.

On a positive note, the group’s turnover increased by 6% to £1.85 billion. Also, it added 1.09 million new customers during this period, a 14% growth from last year.

The differentiation

The higher costs of car claims are affecting the whole car insurance industry. However, Admiral is following a long-term approach in pricing to navigate through this situation.

It is able to manage its margins effectively in the UK market with a disciplined pricing strategy. The company is known for higher prices in the market and has further increased them by 16% this year.

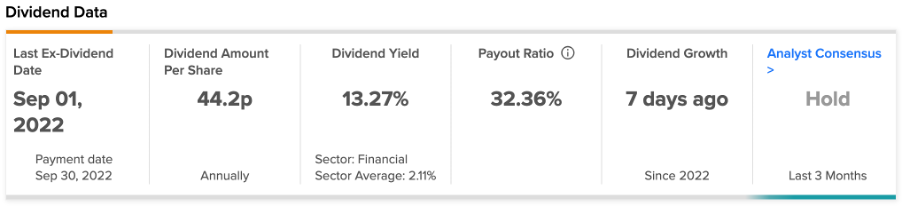

A dividend gem

Admiral is an ideal stock for income investors. The company has an attractive dividend yield of 13.27%, way ahead of the sector average of 2.1%.

Along with the results, the company announced an interim dividend of 60p per share and a special dividend of 45p per share.

Admiral share price forecast

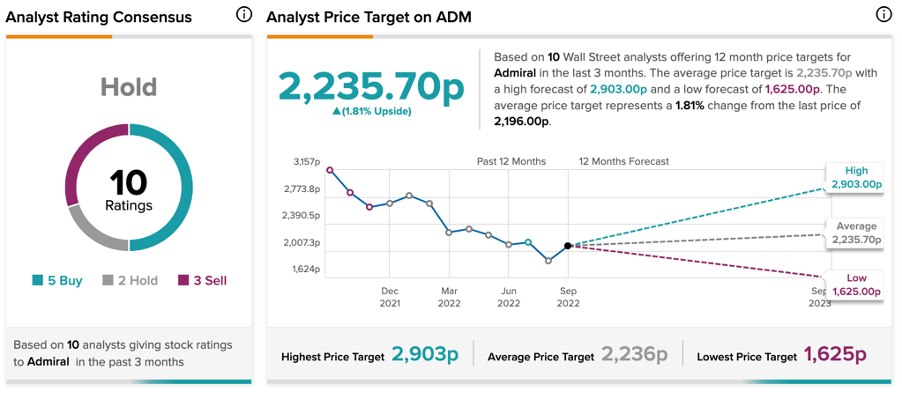

According to TipRanks’ analyst rating consensus, Admiral stock has a Hold rating. The stock has a wide analyst coverage with a total of 10 ratings, including five Buy, two Hold, and three Sell recommendations.

The ADM target price is 2,235.70p, with a high and a low forecast of 2,903p and 1,625p, respectively. The price target implies a slight change of 1.8% from the current price level.

Barclays analyst Ivan Bokhmat is highly bullish on the stock and has recently reiterated his Buy rating. He has also raised his target price from 2,583p to 2,698p.

Barclays said Admiral had “weathered the challenging H1 22 well.”

Conclusion

Admiral Group, as an insurance company, has the benefit of stable business operations in this uncertain environment.

The stock has a very good passive income opportunity. Even though the analyst is predicting a lower dividend yield in 2023, it will still remain higher than most of its competition as well as the market average.