Shares of Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL) were rocked following their respective quarterly earnings reports. And though the results weren’t as impressive as the likes of other “Magnificent Seven” members, I view the weak post-earnings action as more of a chance for contrarians to buy rather than a red flag that should spark a rush to the exits.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, if you’re looking for a reason to sell after recent earnings, the quarters of Apple and Alphabet gave you some reasons. However, if you were looking for positives, each quarter had that, too. Both companies delivered some pretty decent earnings.

That said, the market has set a high bar this time of year, with macro and rate risks atop everyone’s radar. Though Apple and Alphabet didn’t deliver spectacular results, I don’t think they were bad enough to spark a dip.

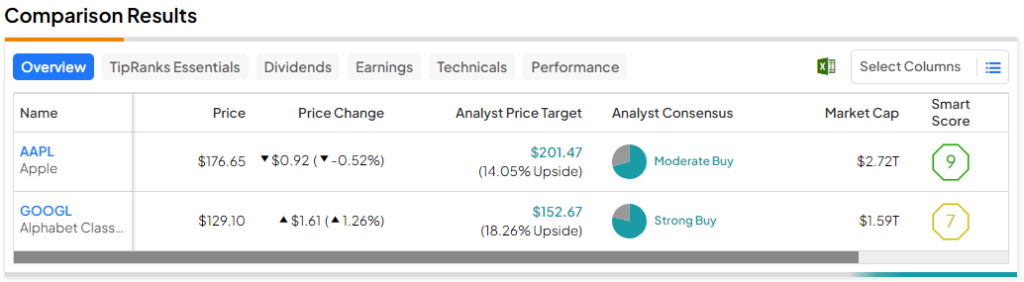

Therefore, let’s stack up the two tech titans using TipRanks’ Comparison Tool.

Apple: A Good Quarter Showcased to a Tough Crowd

After clocking in its fourth straight quarter of sagging sales while setting a low bar for the December quarter — CFO Luca Maestri is looking for revenue to be similar to last year — shares of Apple dipped over 3% in the after-hours session of trade, only to recover most of the lost ground the very next day.

Ultimately, though, Apple ended down just 0.5% following a quarter that I thought had quite a few positives (like record Services revenue). A flat-ish move post-earnings may not seem terrible until you consider the fact that it didn’t participate in what was a strong rally for broader markets on Friday that saw the S&P 500 rise almost a full percentage point.

Indeed, four straight quarters of sales in the red may be a horrific headline for some Apple skeptics. However, such stagnation is likely in the rear-view mirror as the consumer looks to heal and Apple looks to put the finishing touches on its Apple Vision Pro headset before it formally launches in a few months.

Neuburger Berman analyst Daniel Flax is just one of the bulls that sees Apple’s growth re-accelerating from here. If the upcoming Vision Pro mixed-reality headset is a hit and the iPhone 15 makes up for lost time in the new year, I think the stage could be set for an AAPL stock breakout.

And while Greater China numbers were also flat, thanks in part to competitive pressures from domestic smartphone maker Huawei, I think China concerns are overblown.

Competition is nothing new for Apple. And to think Apple will fail to stay up to speed against Huawei would be to heavily discount the Apple brand. There’s still a great deal of brand affinity for Apple and other American brands in China. As such, I view flat Chinese sales as a mere hiccup than the start of a troubling trend. China is still Apple’s third-largest market, and it’s one in which Apple has room to run.

Apart from the strong brand, I believe Apple’s hardware prowess will help it catch up to the likes of Huawei in China over the coming years. Apple Silicon is already building chips on the 3nm process with an intense focus on per-watt performance. My bet is that Apple will widen the per-watt performance gap from here.

Given the stock is trading at where it was two years ago, I don’t view Apple as ripe for a continuation of its correction; It already had one.

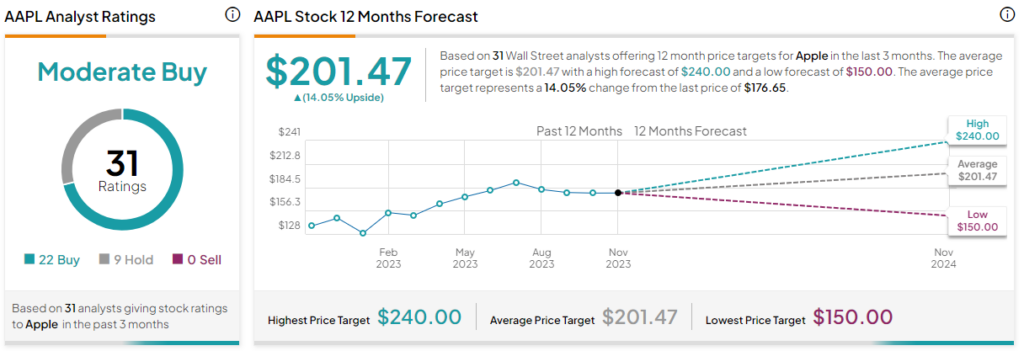

What is the Price Target for AAPL Stock?

Apple’s a Moderate Buy, according to analysts, with 22 Buys and nine Holds assigned in the past three months. The average AAPL stock price target of $201.47 implies 14.1% upside potential.

Alphabet: Weak Cloud Growth Clouding the AI Story

Alphabet stock was slapped with a brutal two-day plunge of around 12%, even as the firm clocked in better-than-expected earnings results. For the quarter, Alphabet reported third-quarter earnings per share of $1.55, comfortably ahead of the $1.46 estimate. Weakness in its Cloud division cast a dark shadow over the quarter, though, with cloud sales rising just 22%, down from 28% in the last two quarters.

Indeed, Microsoft’s (NASDAQ:MSFT) Azure may very well take share away from Google Cloud as it continues sprinkling in generative AI across its broad suite of products. AI plus Azure may be the perfect combo to take Microsoft’s cloud business to the next level. That said, don’t forget that Alphabet is an AI-savvy titan itself. Though Alphabet may be slower to effectively monetize AI versus Microsoft, I think Alphabet will make up ground once it’s ready to flex its own AI muscles.

For now, Google is hard at work pushing out new AI products, like Bard and Duet AI, which seems to mirror what Microsoft is doing with Bing and Copilot. The AI wars are not over yet — not by a long shot.

GOOGL trades at just 24.8 times trailing price-to-earnings (P/E), making it the cheapest of the Magnificent Seven stocks. I view Alphabet stock as a relative bargain while the distraction of the antitrust trial plays out in the background. Who says you need to pay a fat premium for top-of-the-line AI exposure?

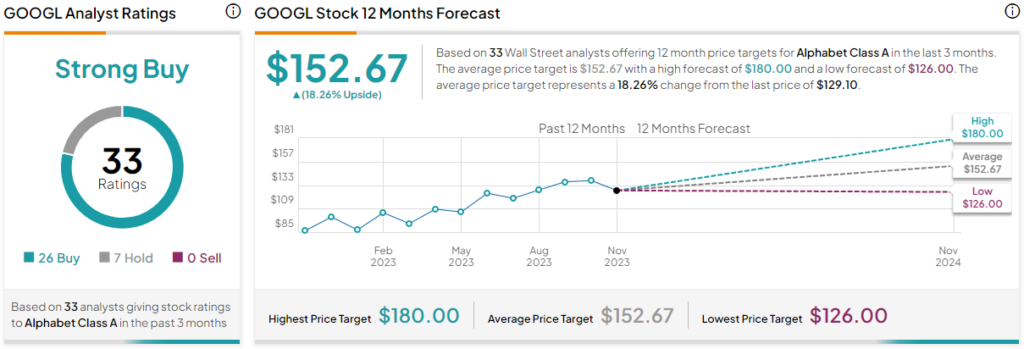

What is the Price Target for GOOGL Stock?

Alphabet is a Strong Buy, according to analysts, with 26 Buys and seven Holds assigned in the past three months. The average GOOGL stock price target of $152.67 implies 18.3% upside potential.

Conclusion

The so-called Santa Claus rally may be arriving earlier this year, but the real gift, I believe, is the recent weakness in Apple and Alphabet. I’m bullish on both companies, as most other investors overweigh the near-term negatives over the long-term positives.