In the current uncertain market scenario, investors might want to invest in stocks that offer a steady income – dividend-paying stocks. Using TipRanks’ Stock Screener tool, we zeroed in on companies offering a dividend yield higher than 2.5% and have received Buy recommendations from the top Wall Street analysts. Also, strong fundamentals and robust cash flows add to the appeal of these stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s take a look at three such stocks with impressive dividend histories, Philip Morris (NYSE:PM), MetLife (NYSE:MET), and American Tower (NYSE:AMT).

Philip Morris International, Inc.

Philip Morris has a glorious record of raising dividends for 14 straight years. The tobacco company offers a dividend yield of 5.3% along with a dividend payout ratio of 89.96%. The company’s high-margin business and rising cash flows justify its considerably high payout ratio.

Further, the growing demand for Philip Morris’ smoke-free product, especially among young adults, is expected to support revenue growth. On top of that, the company’s $2 billion cost-efficiency program might drive its bottom-line performance.

Is PM a Buy or Sell?

Earlier this month, UBS analyst Nik Oliver raised his price target for Philip Morris to $116 from $106 and upgraded the rating to Buy.

The analyst is upbeat about growing heated tobacco unit (HTU) shipment volumes in developed markets. Further, Oliver believes that the company may benefit from new product launches in terms of volume and market share growth.

Top Wall Street analysts are optimistic about the prospects of PM stock. It has a Strong Buy consensus rating based on six Buys and one Hold. Also, the average price target of $116.29, signals a 22.7% upside potential from its current level.

MetLife, Inc.

MetLife has increased its dividend amounts for the past several years. Also, it rewards shareholders with share repurchases. At present, MET stock has a dividend yield of 3.6%.

The global financial services company offers insurance, annuities, employee benefits, and asset management solutions. MetLife’s recently announced acquisition of Raven Capital Management, a privately-owned alternative investment company, should support the expansion of product offerings.

Is MET a Good Stock to Buy?

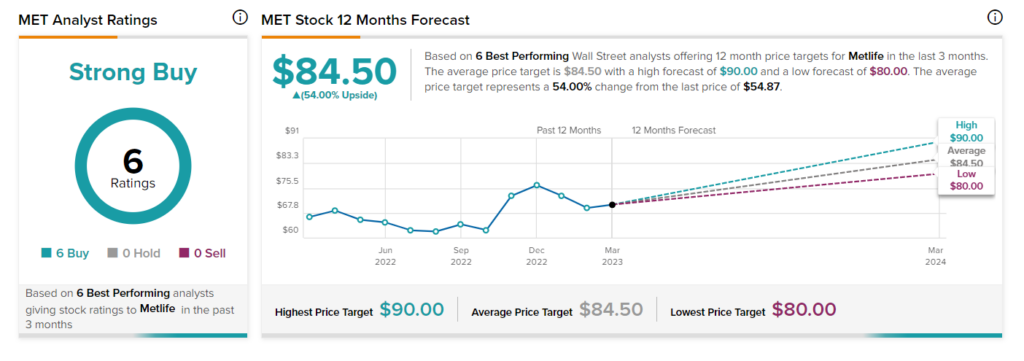

MET stock has a Strong Buy consensus rating on TipRanks. This is based on six unanimous Buy recommendations from the top Wall Street analysts. The average stock price target of $84.50 implies 54% upside potential.

American Tower Corp.

Investing in real estate investment trusts (REITs) is one of the best ways to earn a regular income. These companies generally pay out a large chunk of their earnings as dividends. American Tower owns and operates wireless and broadcast communications infrastructure. It has an attractive dividend yield of 3%. The company has raised dividends for ten consecutive years. It is worth highlighting that it rewards shareholders with multiple hikes per year.

The company’s efforts to expand its presence with strategic acquisitions are encouraging. Also, American Tower is deepening its reach in the growing cloud computing and digital infrastructure businesses. This is expected to support its long-term growth.

Is AMT a Good Stock to Buy?

Following the release of fourth-quarter results last month, one of RBC Capital’s top analysts Jonathan Atkin reiterated a Buy rating on American Tower but lowered the price target to $230 from $240.

Atkin believes that the company delivered a strong quarterly performance. Overall, AMT stock has a Strong Buy consensus rating based on seven Buys and two Holds. Meanwhile, top analysts’ average price target of $246.86 implies 22.6% upside potential.

Ending Thoughts

Investors looking to generate steady passive income may consider adding these stocks to their portfolios. Interestingly, top analysts expect these stocks to register gains in the next 12 months.