With the lights put out on the technology sector, value hunters may be looking for high-upside tech stocks to buy, such as TMUS, CRWD, and INTU. As interest rates continue moving higher, it’s really tough to jump in right now against the momentum of sellers. Things have been bad for tech, but they could get worse.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In any case, the tech layoffs have mounted in recent months. Most have been met with investor enthusiasm despite any longer-term impact on growth and innovation. In a high-rate world, investors want to see corporations be pickier when it comes to spending.

Further, investors want to see spending result in some sort of predictable payoff. Money no longer comes easy for innovative startups. These days, they need more than just a story to raise funds to finance high-stakes projects that may or may not have an acceptable return on investment.

Nonetheless, let’s have a look at the three Strong-Buy rated tech stocks mentioned above.

T-Mobile (NASDAQ:TMUS)

T-Mobile isn’t a tech stock in a traditional sense; it’s a telecom. However, the company’s rolling out some infrastructure on the cutting edge of wireless tech. While 5G wireless has been around for some time, it’s still not as widely available or speedy as many consumers would have thought. T-Mobile is playing a major role in bringing 5G to the masses, and there’s still a way to go as consumers continue moving on from LTE.

Undoubtedly, T-Mobile has beaten its rivals in the wireless scene. While its peers struggle, TMUS stock has steadily made higher highs through the past year. In 2023, recession headwinds will move in, but don’t count on T-Mobile to slow down or give up ground to rivals. If anything, T-Mobile is expected to continue cutting into the turf of its competitors.

T-Mobile has no dividend, and it doesn’t need one. The company is in growth mode, and as it looks to win more subscribers, continuing its momentum from 2022, I expect the stock to rise further.

Wall Street seems to think there’s more upside ahead for T-Mobile despite the hefty 122.4 times trailing earnings multiple.

What is the Price Target for TMUS Stock?

TMUS stock earns a Strong Buy consensus rating on Wall Street based on 14 Buys and one Hold rating assigned in the past three months. The average TMUS stock price target of $182.62 suggests 21.8% upside potential from here.

CrowdStrike (NASDAQ:CRWD)

CrowdStrike is a cybersecurity kingpin that’s felt the pain of analyst price target downgrades of late. One of the latest and hardest-hitting came courtesy of Jefferies, which slashed its CRWD target from $175 to $120. The recommendation also went from “Buy” to “Hold.”

Undoubtedly, CrowdStrike faces headwinds as IT budgets face pressure. As an endpoint security leader, though, it’s a bad idea for corporate firms to slash their cybersecurity spending. Indeed, cyber threats don’t care how bad the economy is. Attackers will always be out there, and proper defenses are a must!

In any case, I expect CrowdStrike to overcome headwinds. The company has the means to keep bringing on new users while upselling existing customers. Though there are competitors in the cybersecurity space, I expect CrowdStrike will continue to hold its own, as loyal customers appreciate the powerful platform for the protection it provides.

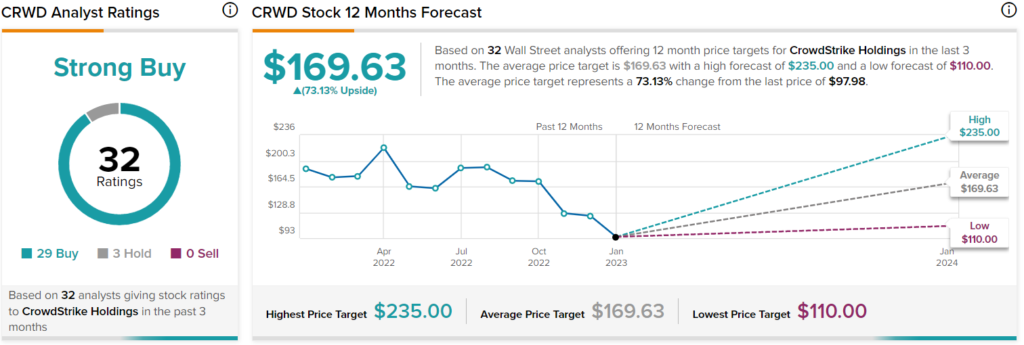

What is the Price Target for CRWD Stock?

At 11 times sales, I no longer view CRWD as a pricy play. Wall Street’s average CRWD stock price target of $169.33 implies 73.1% upside potential from here.

Intuit (NASDAQ:INTU)

Intuit is a tech firm behind popular accounting software QuickBooks aimed at smaller firms. The company completed its Credit Karma acquisition around two years ago (Credit Karma is a personal finance company). Looking back, I think it’s safe to say Intuit could have gotten a better price had it waited, given the tech collapse of 2022.

For now, Credit Karma is a sore spot that could be in for negative growth. Looking past Credit Karma, Intuit has other segments in the Intuit ecosystem that could do some heavier lifting as recession headwinds mount.

Looking further out, expect Intuit to continue leveraging technologies to help its clients get accounting and tax work done easier and more accurately. Specifically, AI could be a major source of innovation.

At 60.2 times trailing earnings and 8.2 times sales, INTU stock isn’t cheap. Still, Wall Street’s upbeat!

What is the Price Target for INTU Stock?

The average INTU stock price target of $491.68 implies a 23.9% gain in the next 12 months. The stock has a Strong Buy consensus rating based on 19 Buys and one Hold rating assigned in the past three months.

The Takeaway

While it may be too soon to reach for the innovators that are most appealing to fearless investors, I’d argue that more mature tech companies that can replace sales growth with profit margin improvements are less risky and potentially more rewarding for tech-focused dip-buyers. Of the three names listed, I’m the biggest fan of T-Mobile. It’s a proven leader of the pack. With that, I expect it to extend its lead in 2023.