Chinese stocks have been in a world of pain well before the S&P 500 (SPX) plunged into a bear market in 2022. Indeed, many investors and talking heads have slapped the unenviable title of “uninvestable” on Chinese stocks, given how difficult it is to gauge their inherent risks. Indeed, delisting concerns and other issues based on exogenous events make it hard to value even the “cheapest” Chinese internet ADRs (American Depository Receipts). Despite the added risks of investing in Chinese stocks, many Wall Street analysts continue to view names like Alibaba (NASDAQ:BABA), JD.com (NASDAQ:JD), and Pinduoduo (NASDAQ:PDD) favorably.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There’s no doubt that U.S. investors have been burned by Chinese names in recent years. With swollen regulatory risk discounts and considerable growth to be had over the long run, China’s top internet plays may still be worth considering while they’re miles away from their peaks.

Let’s check in on three Strong-Buy-rated Chinese tech titans that Wall Street expects great things from in 2023.

Alibaba (BABA)

Alibaba is probably the first firm that comes to mind to American investors looking for Chinese tech exposure. It’s been a slow, painful descent for one of China’s most FAANG-like stocks. After plunging by around 80% from peak to trough, BABA stock has shown signs of life in recent weeks, rallying by around 52% off the October trough.

Whether the recent rally lasts remains to be seen. Regardless, it’s hard for value-conscious investors to overlook the absurdly-low 1.9 times price-to-sales (P/S) multiple.

At these depths, even the slightest positive news could have a significant impact on the stock. With Chinese stocks bouncing due to easing COVID-19 restrictions, Alibaba and the broader basket may, once again, be unignorable as consumer spending looks to heal. Arguably, Alibaba has the most to gain as China reopens its economy and the worst recession fears come to pass.

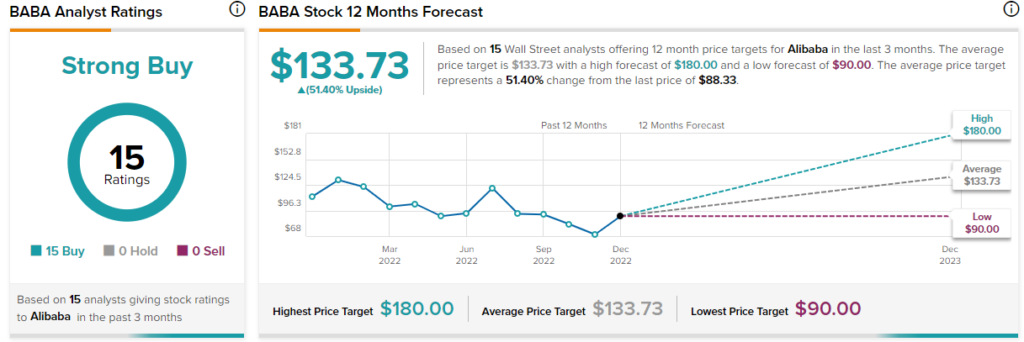

What is the Price Target for BABA Stock?

Wall Street is sticking with its “Strong Buy” rating on Alibaba stock, with 15 unanimous Buy recommendations. The average BABA stock price target of $133.73 implies a solid 51.4% gain from here.

JD.com (JD)

JD.com is an e-commerce player that rallied sharply in recent weeks after enduring a nearly two-year-long 64% plunge. Driven by easing COVID-19 restrictions and a huge third-quarter beat that saw per-share earnings crush estimates ($0.90 EPS vs. $0.70 consensus), JD stock now seems to have the most technical strength behind it.

At just 0.6 times sales, JD stock has some low expectations in mind ahead of what’s likely to be a global recession. As China looks to loosen its strict zero-COVID policy, JD could be one of the bigger beneficiaries.

In a rising-rate world, U.S. investors can appreciate JD’s latest profitability surge. The company is well-positioned to continue driving margins higher as it looks to take a page out of the playbook of an early Amazon (NASDAQ:AMZN).

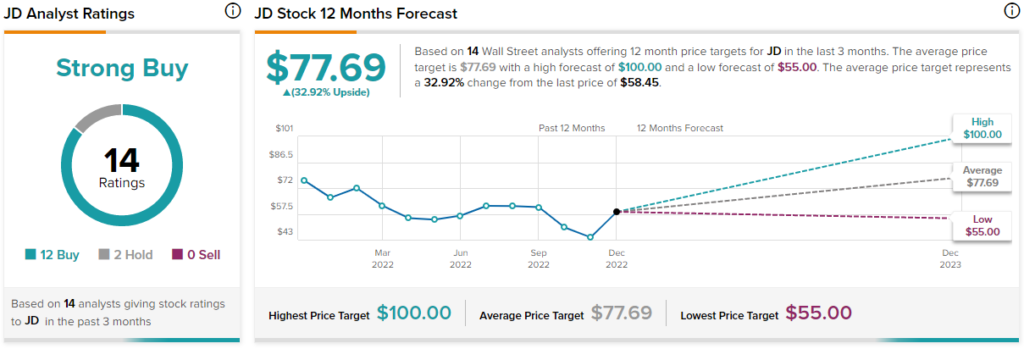

What is the Price Target for JD Stock?

Wall Street loves JD stock, with a “Strong Buy” consensus rating. The average JD stock price target of $77.69 implies 32.92% gains from current levels.

Pinduoduo (PDD)

Pinduoduo is a Chinese e-commerce play that’s suffered the biggest hit to the chin amid China’s horrific tech sell-off. From peak to trough, shares shed more than 83% of their value. Since bottoming earlier this year, though, PDD stock has been really heating up, rewarding dip-buyers who gave the digital retail play the benefit of the doubt. Shares are now up around 265% from their 2022 lows.

Indeed, Pinduoduo is the spiciest Chinese internet stock, but one that could deliver the biggest gains in a turnaround scenario. The recent third-quarter beat was a blowout ($1.23 EPS vs. $0.69 consensus). As the company continues to impress despite the dire macro conditions, growth-savvy investors willing to stomach the risks may be enticed to get back into the name.

At 6.4 times sales and 30 times trailing earnings, PDD stock is one of the pricier Chinese e-commerce firms. After six straight sizeable bottom-line beats, though, I view the name as compelling.

What is the Price Target for PDD Stock?

Wall Street continues to pound the table on Pinduoduo. The average PDD stock price target of $99.51 implies 15.95% gains from here.

Conclusion: Wall Street is Most Bullish on BABA

Indeed, recent momentum in Chinese stocks may reignite enthusiasm. A sustained rally into 2023 may even cause pundits to shed their “uninvestable” status. Of the three names in this piece, Wall Street expects the biggest gains from Alibaba stock.