Just because a recession is waiting around the corner doesn’t mean investors should take significant action with their portfolios. Liquidating holdings or recklessly reaching to catch falling knives may not help investors score better returns. Instead, investors should tread cautiously and look to sectors that offer defensive exposure to effectively ride out a recession. Let’s use TipRanks’ Comparison Tool to check out three compelling healthcare stocks that Wall Street remains upbeat on.

Zoetis (NYSE:ZTS)

Zoetis is an animal health company down around 36% from its December 2021 all-time high. Though the firm has been a choppy ride, I view it as an enticing defensive that could make it easier to ride out a recession year. Despite plunging more than the S&P 500, shares of ZTS sport a 0.72 beta, meaning the stock is less likely to be flustered by hawkish surprises or exogenous shocks.

Third quarter results came up short ($1.21 EPS vs. $1.24 consensus), thanks partly to supply shortages and regulatory delays surrounding canine osteoarthritis drug Librela. Such issues seem transitory and likely to fade in the new year, even as new economic headwinds move in.

Undoubtedly, the pet health industry looks more recession-resilient than many investors may give it credit for. The humanization of pets trend likely makes pet health firms just as defensive as other well-run biopharmaceutical companies.

As such a dominant force in pet health, Zoetis stands to face fewer competitive pressures. Though the company faces less surprise upside from breakthrough blockbuster drugs, investors should be comforted by the smooth upward trajectory of shares over the long term.

At 35.2 times trailing earnings and 8.97 times sales, ZTS stock still isn’t cheap. With such high-quality defensive assets, it doesn’t deserve to be cheap.

What is the Price Target for ZTS Stock?

Wall Street has a “Strong Buy” consensus rating on Zoetis, based on six Buys assigned in the past three months. The average ZTS stock price target of $208.83 implies over 33% upside potential.

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is the best-known robotic surgery company on the public markets today. The da Vinci surgical system is a true marvel on the frontier of minimally-invasive procedures.

It’s been a choppy ride over the past year, with shares getting cut in half before bouncing back 48% in razor-sharp fashion following a remarkable third-quarter earnings beat ($1.19 EPS vs. $1.14 consensus). Management also soothed investors, raising its full-year procedure forecast to 17-18%.

Though another COVID surge could delay surgeries and demand for Intuitive’s offerings while introducing more volatility into the name, I think many such nearer-term risks are clouding a powerful long-term story.

Intuitive is on the cutting edge of innovation in the robot-aided surgery scene. The firm’s push into robot-assisted bronchoscopy is intriguing and could be just one of many areas that could help the firm raise the bar on its growth.

Even as a 2023 recession weighs down the consumer, Intuitive will be busy fine-tuning its robots to make them more capable. The long-term growth story is still intact. Intuitive stock’s hefty valuation (14.9 times sales) and choppiness (1.37 beta) are two potential knocks against the stock in a market that could continue to discount the top growth companies.

What is the Price Target for ISRG Stock?

Wall Street loves Intuitive Surgical, with a “Strong Buy” consensus rating. Despite upbeat recommendations, ISRG stock sports a $252.75 price target, which implies a negative 7.92% return from current levels. Indeed, Intuitive’s recent rally will likely cause price target hikes over the coming weeks. JPMorgan recently hiked its target on the name to $280 from $250.

Eli Lilly (NYSE:LLY)

Eli Lilly is a $352 billion pharmaceutical behemoth that boasts one of the most cherished smart-beta stocks (low 0.36 beta, high returns) in the health space. Shares are up more than 38% year-to-date, leaving the S&P 500 in the dust. I think more of the same could be in store as the economy sinks into a recession.

Powering the latest leg of the robust rally is the third-quarter beat ($1.98 EPS vs. $1.91 consensus) and optimism surrounding the firm’s drug pipeline. Such drugs, including Alzheimer’s medication Donanemab, could bolster growth in one of the hottest big-pharma names in the market. With so much blockbuster potential, it’s not a mystery why LLY stock is trading at such a lofty valuation.

The stock trades at 55.7 times trailing earnings and 12.03 times sales, making it one of the priciest plays in the mega-cap healthcare space.

What is the Price Target for LLY Stock?

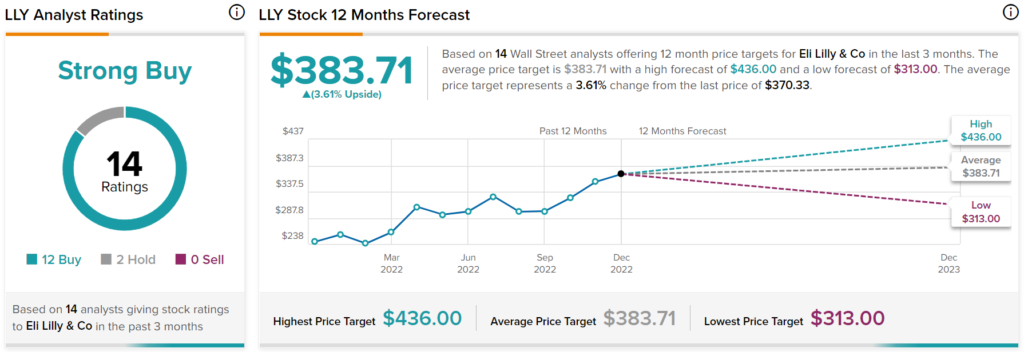

Wall Street thinks Lily is worth paying up for with a Strong Buy consensus rating based on 12 Buys and two Holds assigned in the past three months. The stock sports a $383.71 price target, implying 3.61% gains from here.

Conclusion: Analysts Expect the Most from ZTS Stock

Wall Street is most upbeat on ZTS stock going into a recession year. Though, each firm gets high marks from analysts.