Even if a recession strikes this year, consumer staples can survive, and beer stocks – especially if they’re approved by analysts – might outperform bubbly tech stocks and other pricey assets. So, I handpicked several stocks from TipRanks’ prime selection of beer and beverages stocks but only included businesses that are famous for selling beer.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

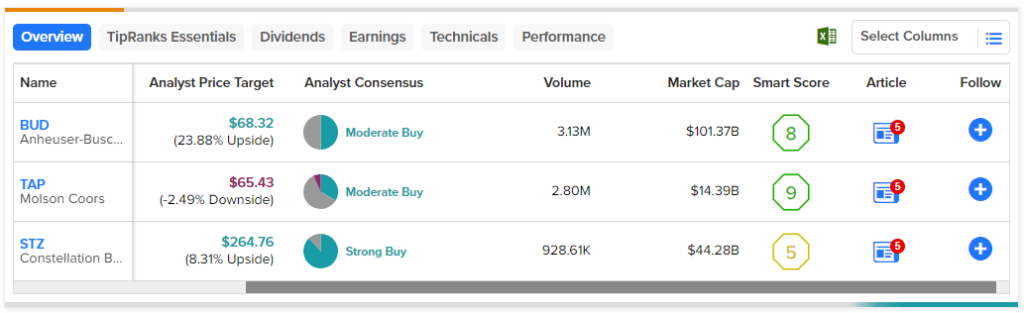

Furthermore, I’m only focusing on beer stocks that are generally favored by the analyst community, meaning that they have a Moderate Buy or Strong Buy rating. Consequently, I didn’t include Boston Beer (NYSE:SAM), which might be a good company, but it only has a Hold rating on Wall Street. Now, let’s take a sip of three highly-ranked beer stocks with potent profit potential in 2023.

Anheuser-Busch InBev (NYSE:BUD)

If you don’t mind courting controversy, Budweiser beer producer Anheuser-Busch InBev could present a dip-buying opportunity in your portfolio. BUD stock got hammered in the wake of Anheuser-Busch’s promotional campaign featuring transgender influencer Dylan Mulvaney.

It’s fine if you don’t want to invest in Anheuser-Busch, but there is a value proposition here for contrarian traders. JPMorgan (NYSE:JPM) analysts provided a grim forecast, calling for a 26% drop in Anheuser-Busch’s earnings before interest and tax (EBIT) as well as a 10% sales decline.

In other words, a worst-case scenario (or at least a less-than-ideal-case scenario) has already been priced into BUD stock. As a result, Anheuser-Busch’s valuation is quite reasonable now, with a GAAP trailing 12-month (TTM) price-to-earnings (P/E) ratio of 15x. This compares favorably to the sector median P/E ratio of 22.2x, so now might be the right time to put a six-pack of BUD stock in your summertime holdings.

What is the Price Target for BUD Stock?

Turning to Wall Street, BUD stock comes in as a Moderate Buy based on three Buys and two Hold ratings assigned in the past three months. The average BUD stock price target is $70.40, implying 27.7% upside potential.

Molson Coors (NYSE:TAP)

Maybe you’d prefer to sidestep Anheuser Busch’s controversy altogether. If so, then Molson Coors stock is worth a look, as Hedgeye analysts have identified Molson Coors as the “key beneficiary” of Anheuser-Busch’s “historic marketing fiasco of its own doing.” Indeed, Molson Coors appears to be in favor, as the brewer recently partnered with Philadelphia Union, making Coors Light the “Official and Exclusive Domestic Beer Partner of the Philadelphia Union and Subaru Park.”

Meanwhile, yield seekers should be glad to hear that Molson Coors offers an annual dividend yield of 2.33%, comparing favorably to the consumer defensive sector average yield of 2.125%. Furthermore, it’s probably a safe dividend since the payout ratio of 36.2% isn’t excessively high at all (my rule of thumb is that a payout ratio above 50% indicates that a company may be distributing too much of its earnings as dividend payments).

Overall, it looks like it’s “all systems go” for Molson Coors. TAP stock is on an unmistakable uptrend, hedge funds are buying it, and blogger sentiment is overwhelmingly bullish on Molson Coors. Hence, investors might consider hedging their BUD bets with a stake in TAP stock or just avoid BUD stock altogether and try Molson Coors stock instead.

What is the Price Target for TAP Stock?

Turning to Wall Street, TAP stock comes in as a Moderate Buy based on five Buys, nine Holds, and one Sell rating. The average Molson Coors stock price target is $65.43, implying 2.5% downside potential.

Constellation Brands (NYSE:STZ)

Out of the three beer stocks I’m featuring today, Constellation Brands has the highest rating on Wall Street – but we’ll get to that in a moment. First and foremost, Corona beer producer Constellation Brands is a consistently profitable company that beats analysts’ quarterly EPS forecasts more often than not.

Additionally, Constellation Brands has a track record of raising its dividend payments over time; currently, the company offers a decent 1.4% annual dividend yield. However, it might be difficult to fit STZ stock into small accounts, as the share price is nearly $250 – though some brokers may provide access to fractional shares, so you might want to look into that.

Since it’s a comparatively high-priced stock, STZ has a “steady Eddie” quality to it, which should suit cautious investors just fine. The news has been fairly quiet for Constellation Brands lately, but if you’re not interested in a headline-grabber like Anheuser-Busch, Constellation Brands offers a less controversial alternative for investors. However, don’t ignore the company’s upcoming quarterly earnings report, which is set to be released on Friday, June 30.

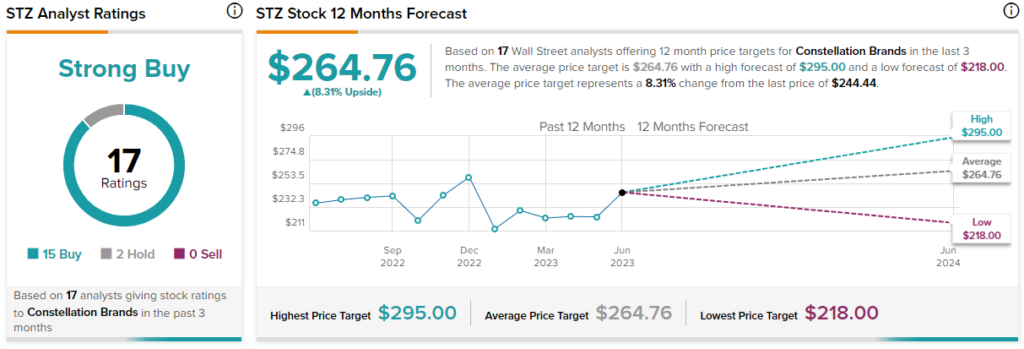

What is the Price Target for STZ Stock?

According to TipRanks’ analyst rating consensus, STZ is a Strong Buy based on 15 Buys and two Hold ratings. The average Constellation Brands stock price target is $264.76, implying 8.3% upside potential.

Conclusion: Should You Consider Beer Stocks?

BUD, TAP, and STZ stocks are similar in some ways but present investors with unique risks and potential returns. I’d say BUD stock is the riskiest, while STZ stock is the least risky of the trio. That said, it’s fair to assess all three stocks as reasonable holdings if you’d like to bolster your portfolio with assets that have recession-resistant track records but can also provide growth over the long run.