The brewing titan, Anheuser Busch InBev (NYSE:BUD), is currently grappling with a severe drop in sales due to a backlash from consumers against several of its well-known brands. According to Nielsen, the sales volume of Bud Light, Michelob Ultra, Budweiser, and Natural Light have all nosedived. The controversy surrounding the brands has hit Busch Light particularly hard, with a notably stark deceleration in sales. Amidst this turmoil, rival brand Coors Light is making strides, recording an upswing in sales figures.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The root cause of the sales slump is a marketing campaign that involved transgender influencer Dylan Mulvaney promoting Bud Light. Analysts from JPMorgan predict a significant blow to Anheuser-Busch InBev’s profits in the U.S. this year due to this controversy. They expect a 26% plunge in earnings before interest and tax (EBIT), coupled with a 12% fall in volume and a 10% drop in sales.

JPMorgan’s analysts went further, saying, “We believe there is a subset of American consumers who will not drink a Bud Light for the foreseeable future.” Despite the grim forecast, they anticipate an improvement in margins as costs per liter decline, and shareholders could see returns boosted as the company manages its balance sheet. While a sales recovery is not anticipated in Fiscal Year 2024, analysts believe the risk-reward ratio is now favorable.

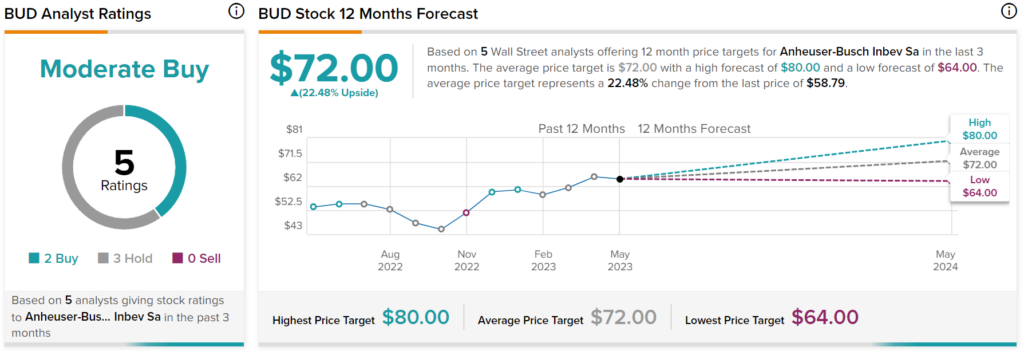

Overall, Wall Street analysts have a Moderate Buy rating on BUD stock based on two Buys and three Holds assigned in the past three months. In addition, analysts expect over 20% upside potential from current levels.