No matter what your personal view is on celebrity endorsements, there’s no denying that their support can significantly boost the visibility of a product. That is the point after all in getting a well-known figure for some promotional activities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But what happens when the chosen celebrity happens to be the wrong fit? Well, Anheuser-Busch can tell you all about that. The Bud Light-owner decided to run a promotional push for the beer by bringing on board transgender ‘influencer’ Dylan Mulvaney, who counts over 10 million followers on TikTok. Mulvaney advertised Bud Light on her feed – and a backlash duly ensued.

Turns out the conservative crowd were unhappy with that choice and evidently there are a lot of conservative Bud Light fans. Calls for a campaign to boycott the drink/company did the job, and in April, Anheuser-Busch volumes fell by over 12% with Bud Light posting what Beer Business Daily has described as a ‘shocking deterioration’ of 21.4%.

Meanwhile, competitors have been reaping the rewards of the conservative ire. Rivals Molson Coors and Constellation notched respective growth of 7.6% and 3.8% during the same period.

So, until this controversy dies down and the next outrage kicks off, it might be worth leaning into the stocks that are already benefiting from the situation. We’ve turned to TipRanks, the world’s most comprehensive database of analysts and research, to get insights from Wall Street experts. Let’s take a closer look.

Constellation Brands (STZ)

In the wake of the Mulvaney fallout, Constellation Brands’ top brass must be rubbing their hands with glee. As the importer of the best-selling imported brands in the US – Modelo and Corona – the company is already reaping the rewards. Those brands aside, Constellation owns a diverse portfolio of well-known names, including Robert Mondavi, Kim Crawford, Casa Noble Tequila, Svedka Vodka and High West Whiskey, amongst plenty of others.

In recent years, the firm has focused on expanding its presence in the high-end beer market, particularly with the growth of the craft beer industry. Furthermore, in addition to its alcohol activities, the company has investments in cannabis and healthcare.

Investors did not seem too flustered by the company not being on point with all metrics in the most recent financial report – for fiscal 4Q23. Revenue fell by 4.8% year-over-year to $2 billion, while also falling $20 million short of the forecast. On the bottom-line, however, EPS of $1.98 trumped the $1.84 anticipated by the Street. For the coming year, Constellation expects EPS to come in the range between $11.70-$12.00, slightly higher than the consensus midpoint of $11.80. The company also said it would bump the quarterly dividend up by 11.3% to $0.89 from $0.80 per share. That currently generates a yield of 1.43%.

While Morgan Stanley analyst Dara Mohsenian concedes the latest financial statement had “puts and takes,” there are enough positive developments to fuel the bull-case.

“Taking a step back, there has been a lot of beer depletion volatility the last few quarters, but with solid trends ex California and assumed California weather normalization going forward, STZ’s positive topline tone and clarity now on margins, we see STZ’s 17.1 times CY24e P/E as way too low vs 7% corporate topline growth, and like the stock here,” Mohsenian explained. “Margins have been a big focus in recent quarters, but with greater clarity on FY24 and potential outsized FY25 expansion as lower spot costs flow through, we expect this debate to now recede.”

Putting these thoughts into ratings and numbers, Mohsenian considers STZ as Overweight (i.e., Buy), while his $277 price target makes room for 12-month returns of 23%. (To watch Mohsenian’s track record, click here)

Elsewhere on the Street, STZ receives an additional 11 Buys and 3 Holds, all coalescing to a Strong Buy consensus rating. (See STZ stock forecast)

Molson Coors (TAP)

The next “Mulvaney Gate” name we’ll look at has also seen its sales get a recent strong boost from the Bud Light palaver. Molson Coors is the maker of Coors Light (up 17.3% in April) and Miller Lite (up 19.1%). Those are just some of the well-known brands in the multinational brewing company’s portfolio – Carling, Molson Canadian, Blue Moon, Peroni Nastro Azzurro and Cobra are some of the others.

In addition to beer brands, Molson Coors also owns and markets a range of hard seltzers, such as Vizzy, Coors Seltzer, and Topo Chico Hard Seltzer, as well as ready-to-drink cocktails. The company also produces and markets a range of non-alcoholic beverages and a variety of craft beers through its Tenth and Blake division.

It’s a value proposition that served the company well in the recently reported Q1 earnings. Revenue increased by 6.3% year-over-year to $2.35 billion, coming in $120 million above the forecast. Adj. EPS of $0.54 beat the $0.26 expected by the analysts. For the 2023 outlook, the company reiterated its previous targets, including expectation of a low single-digit increase for net sales compared to 2022 (on a constant currency basis).

Roth MKM analyst William Kirk notes the guide might disappoint some investors, but he remains unperturbed.

“While some may consider an unchanged guidance worrisome, we believe the potential variance to the guide sits squarely on the positive side: U.S. April volumes are running +HSD, and with y/y cuts to marketing spend, the P&L leverage is likely to be outstanding,” Kirk explained. “Volume performance, even adjusted for an extra selling day, was much better than prior quarters. Importantly, this 1Q beat comes before U.S. demand shifted away from Bud Light and toward Miller Lite and Coors Light.”

So, what does this all mean for investors? Kirk maintained a Buy rating on Molson shares to go alongside a $75 price target. Should the figure be met, investors stand to pocket gains of 16% over the next year. (To watch Kirk’s track record, click here)

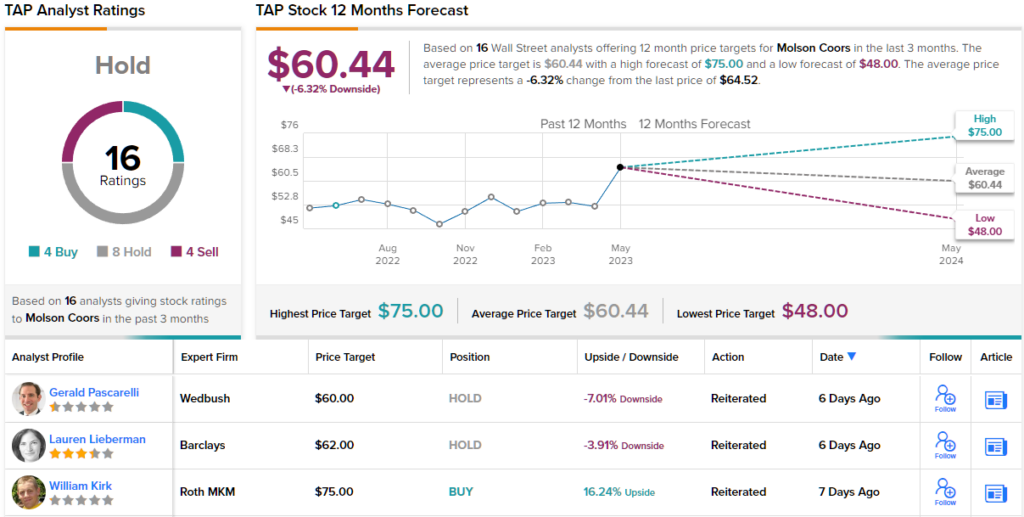

Not all on the Street, however, are quite as confident. The stock garners a Hold consensus rating based on 8 Holds and 4 Buys and Sells, each. (See Molson Coors stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.