The economic recovery in the U.S. has led to fresh demand for utilities over the past year. Moreover, the ongoing war between Russia and Ukraine has led to a rise in energy and gas prices, which has further boosted the shares of utilities companies despite fanning the already raging inflation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Moreover, the growing inflation and economic uncertainties related to exorbitant prices in real estate, falling gold prices, and the like, are expected to create a demand pullback, causing a recession. However, this is expected to have minimal impact on the utilities sector because of its essential value. People are more likely to cut back on non-essential spending, such as eating out, travelling, and shopping, rather than to stop using electricity or gas. This makes this sector one of the safer investing options for investors at this point.

An Unusual Rally

Usually, inflation and rising interest rates are disadvantageous for utility stocks that are trading at rich premiums. This is because the exorbitant debt burdens on utilities companies dent their profitability with rising interest rates on the debt. Also, dividend yields from utilities companies become less appealing to investors in the face of higher treasury yields, as interest rates rise.

However, interestingly, this time around it has been different. U.S. utilities have been among the top best-performing sectors so far this year, trading at almost 20 times forward 12-month earnings. Historically, the utilities sector has traded slightly cheaper than the S&P 500 over the past 10 years, in contrast to the current premium of 15 percentage points over the index.

Fundamentally, companies in the utilities sector, including electricity, water, and energy producers and suppliers, are taking systematic strides toward environmental cleanliness. Investments in renewable energy sources which will reduce carbon emissions are expected to be a long-term growth driver.

Investors are also being attracted to utilities stocks, and are focusing on the growing income stream which will come steadily every month amid such a tense economic environment. Doors seem to be closing for investors from all directions that have been typically considered to be ‘safe havens’ of investment. In such a precarious situation, utilities can seem to be very attractive for some time before starting to seem too expensive. Here are two stocks that stand to benefit best from this bull run.

Xcel Energy (NASDAQ: XEL)

Xcel is impressively focused on expanding its capabilities in renewable power generation. Furthermore, its base of electric and natural gas customers is steadily expanding. More importantly, the company is working toward attaining carbon neutrality by 2050.

Another positive point to consider is its regularity in enhancing shareholder value by paying consistent quarterly dividends that increase every year. Xcel tries to hike its dividend rate by 5-7%, annually, subject to approval from its board, supported by strong cash flow generating capabilities.

Recently, Evercore ISI analyst Durgesh Chopra maintained a Buy rating on XEL, and raised his price target to $79 from $75.

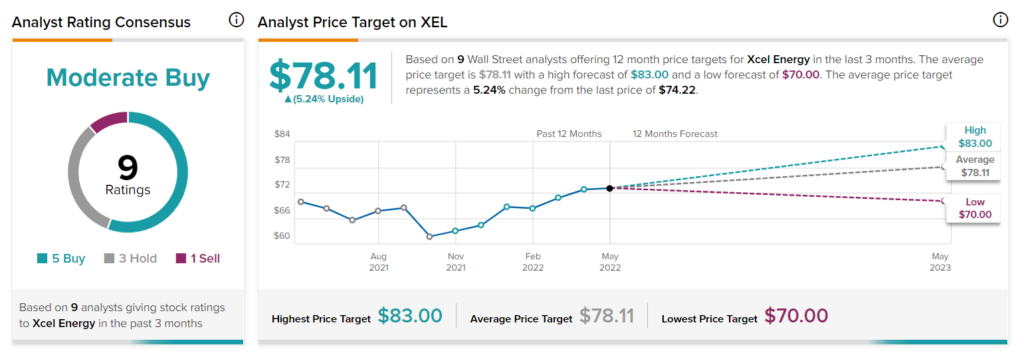

Moreover, Wall Street is fairly optimistic on the stock, with a Moderate Buy rating, based on five Buys, three Holds, and one Sell. The XEL stock price projection points at an average price target of $78.11, which indicates a 4.86% upside from early Monday’s price level.

ONE Gas (NYSE: OGS)

Natural gas distributor ONE Gas is benefiting from solid demand from residential customers. The company’s net income has consistently grown with the support of its expanding customer base and steady demand environment.

Moreover, the base rate hikes approved by regulators have also been acting as tailwind for the company. ONE Gas expects this rate to increase by 7%-8% through 2025, boosting its bottom-line. Management also expects its earnings per share to grow between 6% and 8% over the coming four years.

Last month, Morgan Stanley analyst Stephen Byrd reiterated a Hold rating on the stock, but raised the price target to $90 from $89.

Wall Street is cautiously optimistic on ONE Gas with a Moderate Buy rating, based on two Buys and two Holds. The average OGS price target stands at $92.25 presently, indicating an upside of 7.95% from early Monday’s price level.

Parting Thoughts

XEL and OGS are two stocks that seem to be poised to cash in heavily from the current streak of luck for the utilities sector before the bubble bursts and stock prices ease. Nonetheless, keeping that risk aside, the utilities sector is one that is essential for survival, meaning, demand will remain steady in the long run despite hiccups here and there.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.