Although Americans generally stay optimistic even against challenging circumstances, when it comes to money, investors must approach obstacles with sobriety. For all the feel-good sentiments out there, several pieces of hard data indicate at least the possibility of a recession. Therefore, it makes sense to consider downturn-resistant stocks to buy, particularly the tickers D and MCY.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last week, the benchmark S&P 500 (SPX) index enjoyed a solid outing. With a key inflation report coming in lower than expected, the anticipation among investors centered on a less-aggressive monetary policy.

However, subsequent sessions steadily went off the rails. First, as TipRanks reporter Vince Condarcuri mentioned, the Fed raised the benchmark interest rate by 50 basis points. Although expected by the market, the move still signaled policymakers’ commitment to tackling inflation by hiking borrowing costs.

The following day, consumer spending data revealed what TipRanks articles have been mentioning for quite some time: people are hurting and therefore have tightened their belts. Naturally, the combination of less-than-favorable monetary policy and poor consumer sentiment sent many stocks to buy on a downward spiral.

Adding to the dilemma for investors seeking shelter, high-profile experts such as Michael Burry of “The Big Short” fame warned about a looming recession. Burry’s stocks to buy to protect himself present controversies, to say the least, choosing to bet on private prisons.

Fortunately, those that are understandably squeamish about the sector have other options. Below are two stocks that concerned investors should consider.

Dominion Energy (NYSE:D)

A North American power and energy company headquartered in Richmond, Virginia, Dominion Energy enjoys exceptional relevance. Unlike other stocks to buy, Dominion Energy essentially features no lower-cost alternatives regarding the trade-down effect. Stated differently, unless a household wanted to go off the grid, it must pay its utility bills. Plus, in a digitalized economy, not owning access to power represents a catastrophic dilemma.

Further, Dominion benefits from millennial migration trends. For instance, the company provides power services to Virginia, North Carolina, and South Carolina. Even before the COVID-19 crisis, several cities in Virginia captured strong millennial influxes. In addition, the Carolinas have always been popular with young people. With the global health crisis imposing sharp increases in costs of living, many more will likely see the wisdom in moving to lower-cost regions of the U.S.

Finally, Dominion offers attractive financials. For one thing, the market prices D stock at 13.9 times forward earnings. This sits below the sector median of 16.3 times. In addition, the company’s gross margin stands at 46.5%, beating out over 80% of its peers. Also, with such a high gross margin, Dominion enjoys pricing flexibility, a factor that may help absorb recessionary pressures.

Is Dominion Energy Stock a Buy, According to Analysts?

Turning to Wall Street, Dominion Energy stock has a Hold consensus rating based on two Buys, 11 Holds, and one Sell rating. The average Dominion Energy price target is $70.64, implying 16.8% upside potential.

Mercury General (NYSE:MCY)

Headquartered in Los Angeles, California, Mercury General is a multiple-line insurance organization offering personal automobile, homeowners, renters, and business insurance. Fundamentally, Mercury General enjoys inelastic demand at the baseline of consumption. Stated differently, people need to buy a certain amount of financial protection irrespective of economic conditions. Moreover, the post-pandemic new normal will likely spark a significant uptick in MCY.

For one thing, COVID-19 proved that the world is much smaller than most people in advanced societies would prefer. With the interconnectedness of the global community, an exotic, foreign outbreak can quickly spiral into a domestic crisis. Therefore, the realization that anything can happen may drive demand for insurance policies.

Second, post-pandemic circumstances impose new dangers for everyday individuals. Auto-related fatalities surged during the pandemic, and risky driving, in general, has increased in frequency since the unfortunate rise of COVID.

On a financial note, MCY presents a higher-risk, higher-reward profile because of its poor technical performance in 2022, along with concerns about profitability margins. However, the market also prices MCY at 0.53 times sales, lower than the sector median of 0.99 times. Therefore, MCY makes for a potentially undervalued example of stocks to buy.

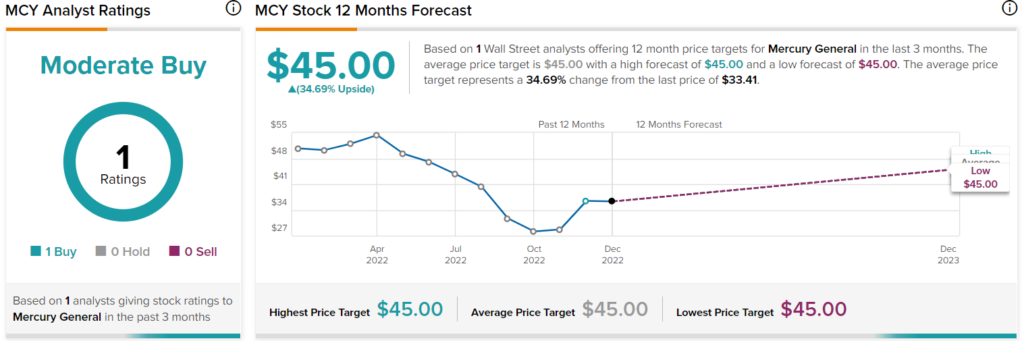

Is MCY Stock a Buy, According to Analysts?

Turning to Wall Street, MCY stock has a Moderate Buy consensus rating based on one Buy, zero Holds, and zero Sell ratings. The average MCY price target is $45.00, implying 34.7% upside potential.

Focus on Fundamentally-Relevant Stocks to Buy

To be fair, it’s not a certainty that a recession will materialize in 2023. However, with so much data pointing in that direction, it would be imprudent not to prepare for the possibility. Fortunately, certain stocks to buy may benefit because of their relevant and indelible businesses.