Persistent macro challenges and growing fears of a potential recession have hammered growth stocks, especially the ones trading at sky-high valuations. While a continued rise in interest rates to tame inflation might put pressure over the near term, the long-term prospects for certain growth stocks seem attractive. Bearing that in mind, we used TipRanks’ Stock Comparison Tool to place PayPal (NASDAQ:PYPL), Shopify (NYSE:SHOP), and Roku (NASDAQ:ROKU) against each other to pick the best growth stock amid a steep pullback.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

PayPal Holdings (PYPL) Stock

Fintech giant PayPal delivered market-beating third-quarter results despite a slowdown in consumer spending and e-commerce growth. The company also raised its full-year earnings guidance, thanks to its productivity initiatives. PayPal ended the quarter with total active accounts of 432 million, up 4% from the prior-year quarter.

However, investors are concerned about the slowdown in PayPal’s growth rates in a challenging macro backdrop. The company has guided revenue growth of 7% in Q4, reflecting a deceleration compared to 11% growth in Q3.

Meanwhile, PayPal remains focused on improving its efficiency while investing in vital growth areas. It aims to generate cost savings of over $900 million this year and at least $1.3 billion next year.

Is PayPal a Buy, Sell, or Hold?

Following the print, BMO Capital analyst James Fotheringham lowered his price target for PayPal stock to $109 from $137 but maintained a Buy rating. The analyst remains positive about PayPal over the long-term given share gains of industry-wide e-commerce volumes, with “sustained frequency of use by active accounts and margin expansion from increased cost discipline.”

Overall, Wall Street’s Moderate Buy rating for PayPal stock is based on 21 Buys and eight Holds. The average PYPL stock price target of $106.58 implies upside potential of 46.7%. Shares have plunged 61.5% year-to-date.

Shopify (SHOP) Stock

E-commerce platform Shopify gained immensely from pandemic-induced tailwinds. Nevertheless, the company has been under pressure as e-commerce growth has normalized since the reopening of the economy.

Shopify’s Q3 revenue grew 22% to $1.4 billion. While the company slipped into an adjusted net loss of $0.02 per share from an adjusted EPS of $0.08 in the prior-year quarter, it fared better than analysts’ adjusted loss expectation of $0.07.

The 11% growth in Q3 gross merchandise value and increased adoption of the company’s merchant solutions seem encouraging. That said, investors are worried about the impact of persistent macro challenges on Shopify’s business. Meanwhile, Shopify continues to expand its geographical reach by launching products like Shopify Payments, Shopify Capital, and Shopify Shipping in additional countries.

What is the Prediction for Shopify Stock?

Recently, Wolfe Research analyst Deepak Mathivanan downgraded Shopify stock to a Hold from Buy (in line with his downgrade for the overall e-commerce sector) without assigning a specific price target. Mathivanan believes that given the high penetration, e-commerce growth could be very sensitive to retail sales and consumer spending trends amid a potential economic slowdown next year. The analyst also feels that consensus estimates “are still elevated in many cases.”

Analysts have a Moderate Buy consensus rating for Shopify stock backed by 10 Buys, 12 Holds, and one Sell rating. At $40.89, the average Shopify price target suggests 6.9% upside potential. SHOP stock has tanked over 72% this year.

Roku Inc. (ROKU) Stock

Leading TV streaming platform Roku generates revenue through the sale of content distribution services and advertising on its platform, as well as from sales of streaming players and other products. This pandemic winner has been crushed by the decline in consumer spending due to high inflation and recessionary fears.

Roku’s Q3 revenue increased 12% to $761 million and beat expectations. However, the company slipped into a loss of $0.88 from EPS of $0.48 in the prior-year quarter due to higher operating expenses. The company expects Q4 revenue of about $800 million, reflecting a year-over-year decline of 7.5%. Roku expects the macro environment to further impact consumer discretionary spending and advertising budgets.

Is ROKU Stock a Buy?

Roku stock was downgraded by several analysts last month, including KeyBanc analyst Justin Patterson. Patterson downgraded Roku stock to a Hold from Buy as he feels that the company’s problems go beyond macro weakness.

Patterson feels that the factors that made him bullish earlier, including the company’s growth in connected TV advertising and its platform being preferred by media partners, haven’t yielded the desired results. While the analyst acknowledges the impact of macro challenges on Roku and its peers, he feels that the company is growing significantly slower than its rivals and losing market share.

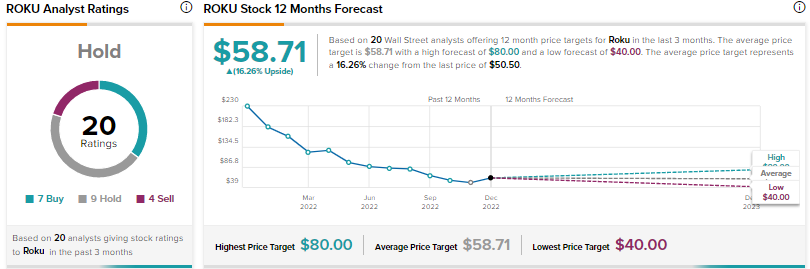

Overall, Wall Street is sidelined on Roku Stock, with a Hold consensus rating based on seven Buys, nine Holds, and four Sells. The average ROKU stock price target of $58.71 implies 16.3% upside potential. Shares have declined nearly 78% year-to-date.

Conclusion

Wall Street analysts are more optimistic about PayPal than Shopify and Roku and expect PYPL stock to generate higher returns. Despite the growing competition in the fintech space and near-term headwinds, analysts expect PayPal to grow further amid the increased adoption of digital payments.

As per TipRanks’ Smart Score System, Paypal scores a “Perfect 10,” which indicates that the stock could outperform the broader market over the long term. Furthermore, the Hedge Fund Confidence Signal is Very Positive for PayPal, with hedge funds increasing their holdings of PayPal stock by 6.9 million shares last quarter.