Worried about the prospect of a recession coming next year? Well, that sounds like a mild scenario, if Michael Burry’s prognosis is anything to go by.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The investor whose famous bet against the US housing market was documented in “The Big Short,” thinks a ‘multi-year recession’ is potentially in the cards – and one more severe than currently expected. This statement follows previous warnings regarding the economy, such as predicting last year that the ‘mother of all crashes’ is coming, while also suggesting recently that the bad times ahead could even top those of the Great Recession.

Ok, so it’s safe to say Burry is not overly optimistic about the state of the economy and where it is heading. That said, that hasn’t stopped Burry from loading up on stocks that he thinks are strong enough to withstand the looming recession.

We’ve tracked two of his recent purchases and used the TipRanks database to find out whether the Street’s analysts agree these names offer a safe harbor in troubled times. Here are the details.

The GEO Group (GEO)

Does Burry think the incoming recession will be a boon for private prisons and mental health facilities? The first Burry-endorsed name we’ll look at is GEO Group – the second-largest private prison company in the world.

The company’s specialty is secure facilities – prisons (maximum, medium and minimum), processing centers, as well as ‘community corrections’ centers and mental-health and residential-treatment facilities – all of these it owns, leases and operates. The company also provides industry-leading monitoring services, and rehabilitation and post-release reintegration services too.

As of the end of last year, GEO provided community supervision services to over 250,000 offenders and pretrial defendants, including over 150,000 people using a variety of technological tools like radio frequency, GPS, and alcohol monitoring devices.

In the latest financial statement, for Q3, the company generated revenue of $616.7 million, amounting to ~11% year-over-year increase and beating the Street’s call by $10.85 million. AFFO (adjusted funds from operations), reached $0.60, well ahead of the $0.33 forecast. For the outlook, the company raised its projection for annual revenues from the prior $2.35 billion to roughly $2.36 billion.

Looking at Burry’s activity, in the third-quarter he upped his stake in the company considerably – by over 300%. Burry purchased 1,517,790 shares, currently worth just under $18 million.

Burry is not the only one conveying confidence. Scanning the Q3 print, Noble analyst Joe Gomes hails the company’s performance.

“GEO Group continues to meet or exceed guidance on nearly all of the major financial measures,” Gomes wrote. “Continued strong performance by the business units resulted in one of the highest quarterly run rates for topline revenue and a new all-time high quarterly run rate for adjusted EBITDA. We believe this financial performance, in the face of contract terminations and an overall challenging operating environment, speaks to the strength of the Company’s diversified business segments.”

“We continue to believe GEO shares represent a favorable risk/reward situation,” Gomes summed up.

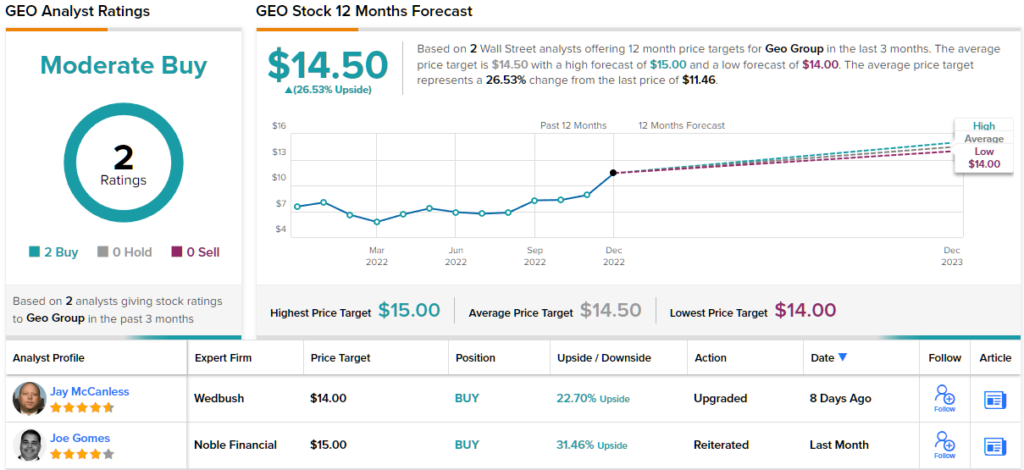

Bear market, you say? Not for this stock. The shares are up by 53% year-to-date. However, Gomes’ $15 price target makes room for additional gains of 26% in the year ahead. To this end, the analyst gives GEO shares an Outperform (i.e., Buy) rating. (To watch Gomes’s track record, click here)

So does the only other analyst currently tracking this company’s progress. Combined, the stock claims a Moderate Buy consensus rating, backed by an average target of $14.50. This figure implies one-year share appreciation of ~26%. (See GEO stock forecast on TipRanks)

CoreCivic Inc. (CXW)

Looks like there’s a pattern emerging for what Burry thinks represents sound investment choices to protect against a heavy recession. CoreCivic is another company operating in the private prison and detention center business.

Seeing out 2021, CoreCivic acted as the owner and manager of 46 correctional and detention facilities, 26 residential reentry centers, and owned 10 properties for lease to third parties. Not unfamiliar with the controversies surrounding the private prison industry (taking on substandard staff, overdoing it on the lobbying front), formerly known as the Corrections Corporation of America (CCA), the company rebranded to CoreCivic in October 2016.

CoreCivic released its Q3 results at the start of November. The top-line showed $464.2 million, which represented a modest 1.5% decline from the same period last year. The company’s adjusted FFO of $0.29 per share also fell short of the consensus estimates for $0.32 per share.

Nevertheless, Burry must be impressed with the company. He purchased 724,895 CXW shares in Q3, amounting to a new position. These are now worth over $9.3 million.

Echoing Burry’s sentiment, Wedbush’s Jay McCanless is a CXW fan and explains why he thinks the Q3 print came in a tad soft. McCanless also lays out the bullish thesis for the company.

“The labor market remains tight for CXW, and the company has had to payout higher than normal levels of bonus and incentive payments in order to retain staff,” McCanless wrote. “However, we believe that some of this incremental expense is temporary in nature, and that the labor market should ease up over time, especially if we were to head into a more pronounced recession. We anticipate that this upfront expense will eventually be offset by increased revenues as occupancy rates trend towards pre-pandemic levels over time. The company reduced its overall net debt balance by $109.1 million in the quarter, which included opportunistic open market repurchases given distressed bond markets.”

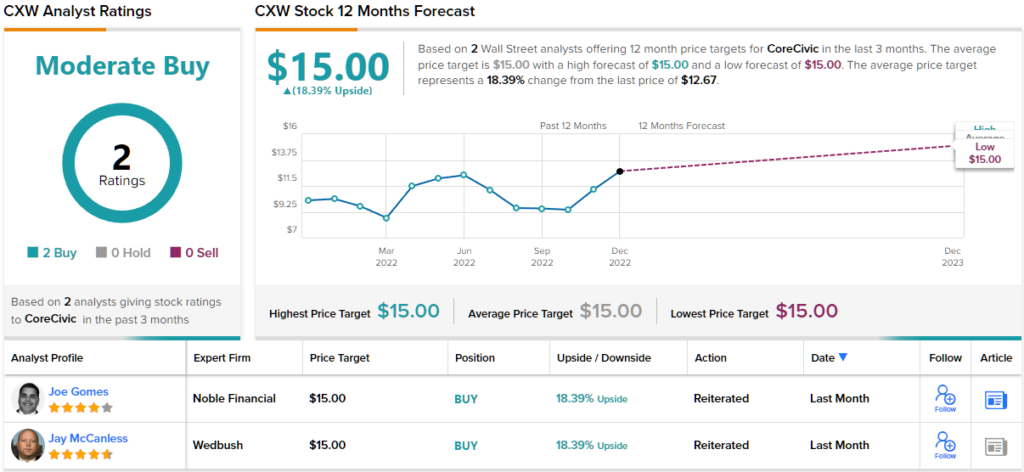

To this end, McCanless rates CXW shares an Outperform (i.e. Buy) while his $15 price target suggests the shares will climb ~18% higher over the coming months. (To watch McCanless’s track record, click here)

Only one other analyst has waded in recently with a CXW review and they are also positive, providing the stock with a Moderate Buy consensus rating. (See CXW stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.