The sky-high inflation level and elevated gas prices continue to squeeze many businesses. However, there are industries that could benefit from the crisis now and in the long-term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Although many opportunities exist out there, the current chaotic markets make it difficult for investors to choose the right stocks to add to their portfolio.

To help investors identify stocks with the potential to pay off, TipRanks brings to you its Insiders’ Hot Stocks tool. The tool helps you to identify stocks that insiders are buying and the sentiment of corporate insiders.

Let’s take a look at two stocks that TipRanks’ Insiders’ Hot Stocks tool shows are favorites of those in the know.

Groupon (GRPN)

The Chicago-headquartered Groupon was founded in 2008. It operates a digital platform that connects consumers to merchants and focuses on serving up deals that can fuel sales for local businesses while saving shoppers money. Groupon anticipates 2022 full-year revenue in the band of $670 million to $700 million.

The Street has a Hold rating with an average Groupon price forecast of $18.42, which implies 19% upside potential to current levels. Shares have declined about 42% year-to-date.

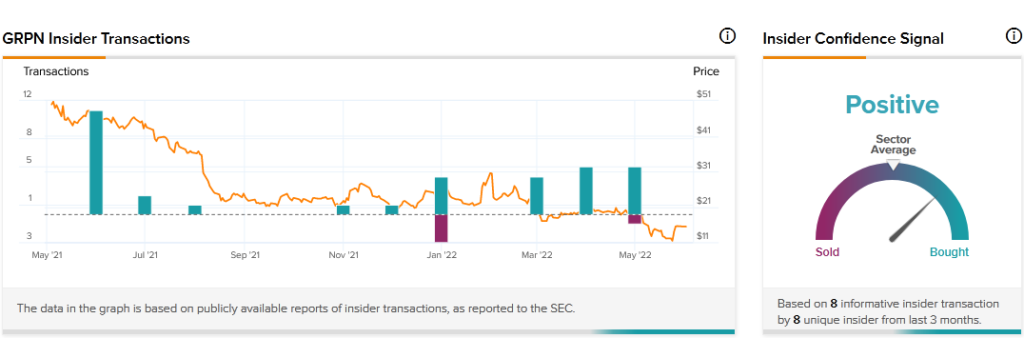

TipRanks’ Insider Trading Activity tool shows that Insider Confidence Signal is currently Positive for Groupon. Corporate insiders have bought $57.8 million worth of the company’s shares in the last three months.

Transocean (RIG)

Switzerland-based Transocean provides offshore contract drilling services to oil and gas companies. It has clients around the world. As of April 2022, the company had a $6.1 billion contract backlog.

According to Transocean CEO Jeremy Thigpen, although the world is gradually shifting to renewable energy, oil will continue to be an important energy source for the foreseeable future.

Street has a Hold rating with an average Transocean price target of $4.72, which implies 14.3% upside potential to current levels. Shares have gained about 32% year-to-date.

TipRanks’ Insider Trading Activity tool shows that Insider Confidence Signal is currently Very Positive for Transocean. Corporate insiders have bought $15 million worth of the company’s shares in the last three months.

Final Thought

Wall Street looks cautiously optimistic on Groupon and Transocean, but insider interest in the stocks is a sign they are worth watching closely.

Read full Disclosure