It was a good day for semiconductor equipment maker Applied Materials (NASDAQ:AMAT), as it posted its earnings report late yesterday and came back with a win in Friday afternoon’s trading session. Applied Materials gained almost 3% on the strength of that earnings report, backed up by solid guidance and the underlying conditions that got it there.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The earnings report brought in terrific results. Applied Materials posted third quarter earnings of $1.90 against analyst projections that looked for $1.75 per share. Revenue, meanwhile, came in at $6.43 billion. While that was down 1.4% against the third quarter of 2022, it was enough to beat analyst projections that looked for $6.18 billion. Better yet, Applied Materials’ guidance for the fourth quarter turned out to be a winner as well. Applied Materials looks to bring in between $6.11 billion and $6.91 billion in revenue. Even the lowest point on that range handily blows away analyst projections calling for $5.87 billion. As for earnings, the $1.82 to $2.18 expected will also swamp consensus calling for $1.60.

Joseph Moore, analyst with Morgan Stanley, notes that rising spending in DRAM gave Applied Materials a boost, along with its growth in trailing edge logic. The DRAM spending may not be sustainable, but Applied Materials’ gains should be able to hold out. Moore noted that Applied Materials’ results last year were somewhat hampered by supply chain issues, but Applied Materials itself is still performing well and should likely continue to do so.

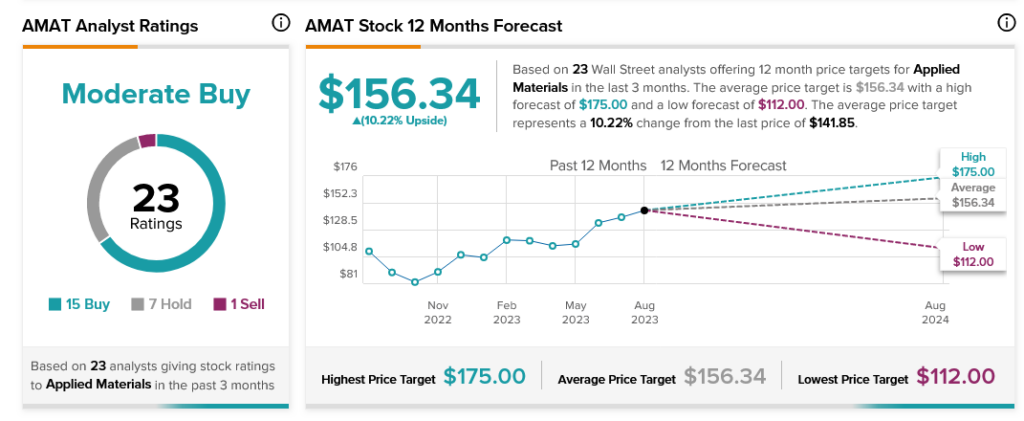

Meanwhile, analysts echo Moore’s sentiment, for the most part. With 15 Buy ratings, seven Hold and one Sell, Applied Materials stock is considered a Moderate Buy. Further, Applied Materials stock offers investors an upside potential of 10.26%, thanks to its average price target of $156.34.