When analysts throw their opinions on stocks into the ring, there’s no telling where things will go. Large sectors of the chip stock sector, for example, did quite well today, but some lagged behind. And it’s all thanks to just a couple new analyst reports that took aim at some specific firms and left the rest a bit uncertain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

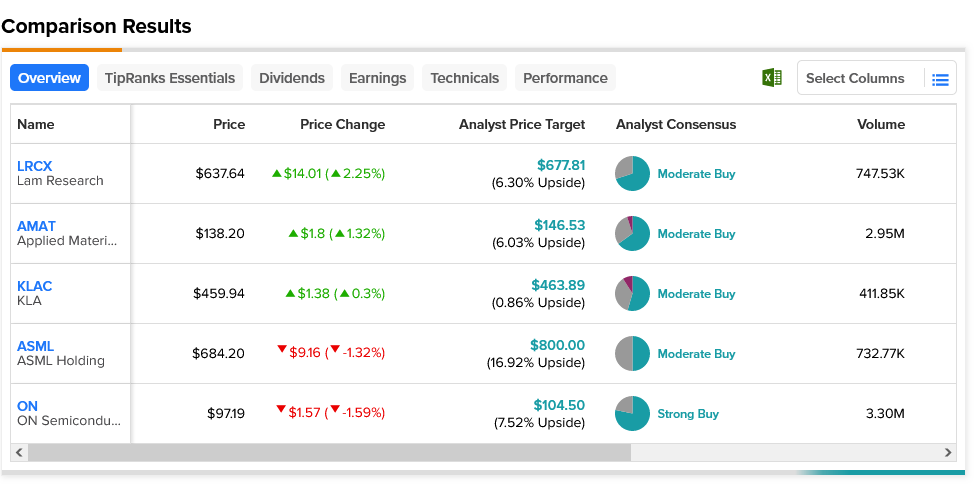

For Lam Research (NASDAQ:LRCX), a word from Stifel—via analyst Brian Chin—goosed the stock up 2.25% in Monday afternoon’s trading. Chin not only upgraded Lam’s rating from Hold to Buy, but also pumped up the price target from $505 per share to $725 per share. Why the sudden uptick? Turns out that dynamic random access memory (DRAM) might be the key to getting more out of artificial intelligence. Since that’s Lam Research’s focus, it helps out significantly. Meanwhile, Applied Materials (NASDAQ:AMAT) added 1.32% and KLA (NASDAQ:KLAC) added 0.3%.

However, it wasn’t all good news, as Rosenblatt Securities’ Kevin Cassidy spelled trouble for ON Semiconductor (NASDAQ:ON). Cassidy dropped his rating from Buy to “neutral,” citing that automotive demand might pose some troubles for ON later on. That was enough to sink ON over 1.5% in Monday’s trading. And even as ASML (NASDAQ:ASML) reported its results last week and hiked its outlook for the full year, it still wasn’t enough to keep shares from dropping 1.32% at one point.

Of these five chip stocks, only one—ON Semiconductor—rates as a Strong Buy with analysts. Yet its upside potential is neither the smallest nor the largest. The smallest goes to Moderate Buy KLA, whose $463.89 average price target gives it just 0.86% upside potential. Meanwhile, ASML Holdings, another Moderate Buy, offers a 16.92% upside potential on its average price target of $800 per share.