Shares in U.S. private equity giant Apollo Global Management (APO) rose today on hopes that it could be set to buy a 50% stake in a U.K. offshore wind farm project from troubled Danish developer Orsted (DOGEF).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wind Blows

As reported by the Financial Times, Orsted is negotiating the sale of the stake valued at $5.6 billion in its wind power project Hornsea 3. It will be the world’s single largest offshore wind farm with a capacity of 2,955 MW when it begins operating in 2027.

It launched the sales process at the end of last year and in August, it announced that it had selected a preferred bidder – however it did not name the company at the time.

Hornsea 3 is one of eight offshore wind farms that Ørsted is working to complete worldwide, but the company has faced rising costs, supply chain challenges, and in the U.S. political decisions impacting its progress.

Indeed, President Trump’s preference for ‘Drill, baby, drill’ fossil fuels such as oil and gas over renewable energy has led to action such as a stop-work order on Orsted’s Rhode Island Revolution Wind offshore wind project in August. That order has since been lifted.

Orsted is currently trying to raise around $9.4 billion in a rights issue. It was needed after U.S. President Donald Trump’s anti-offshore wind strategies left it unable to sell a stake in its 924MW New York Sunrise offshore wind farm.

Government Subsidies

The U.K. offers a friendlier environment for renewable energy developers, including government investment and other forms of financial support.

The potential move underscores Apollo’s strategic pivot toward renewable energy and also highlights a broader trend of PE firms capitalizing on the global energy transition.

Apollo has committed $40 billion to climate-related investments since 2020, with recent partnerships like its $3 billion collaboration with bank Standard Chartered to finance global infrastructure and clean energy projects.

It has also established a new joint venture with energy firm RWE to help fund grid infrastructure expansion in Germany.

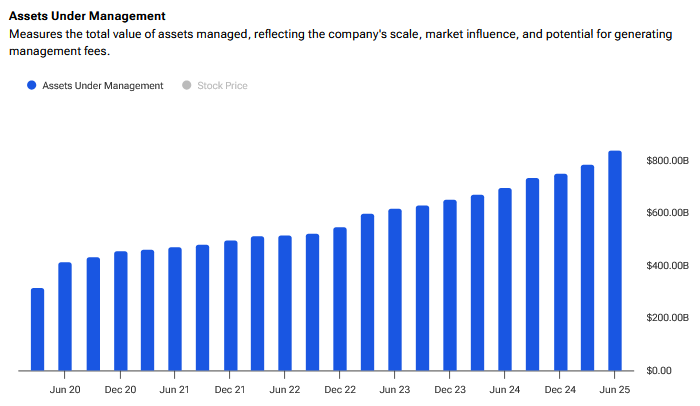

A deal would be a further boost to its improving assets under management numbers – see below:

There may also be opportunities for M&A in the U.S. energy sector as Trump’s policies drive consolidation. Clean energy deals surged to 63 with a combined value of around $34 billion in the first half of 2025, according to KPMG, versus roughly 57 deals worth about $7 billion in the second half of 2024.

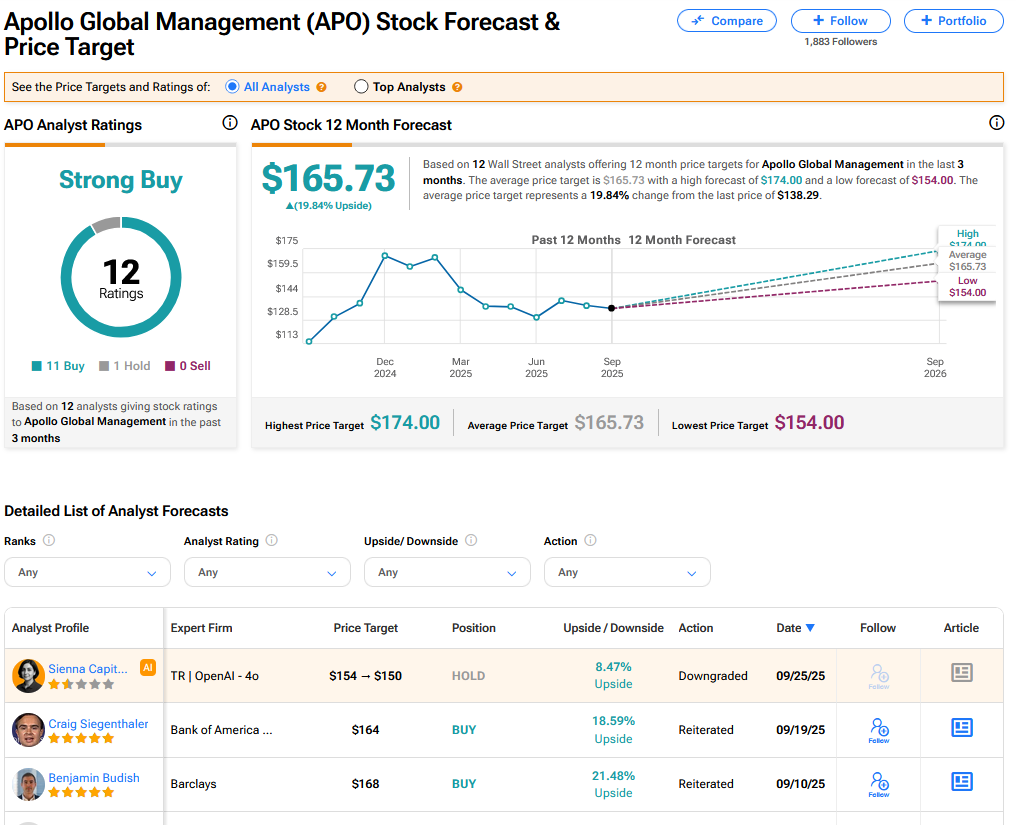

Is APO a Good Stock to Buy Now?

On TipRanks, APO has a Strong Buy consensus based on 11 Buy and 1 Hold ratings. Its highest price target is $174. APO stock’s consensus price target is $165.73, implying a 19.84% upside.