After the earnings report that streaming video hardware provider Roku (NASDAQ:ROKU) just posted, you’d think it’d be on top of the world. Or at least on top of the market. But that’s not what happened, and Roku is down nearly 23% in Friday morning’s trading thanks to new word from analysts. And the word of the day, almost unfathomably, is “caution.”

Roku’s earnings not only featured a beat for earnings and revenue, but the beat apparently wasn’t as broad as investors were hoping for. And a small decline in average revenue per user didn’t help matters, even as Roku’s overall active account growth grew nearly three times as much as average revenue declined, which meant more users spending slightly less, for a net gain. And that was when the analysts got involved. Some are cheerleading frantically, insisting that the double-digit declines are overblown and now is a perfect time to “load up the truck.” Meanwhile, others like Oppenheimer’s Jason Helfstein noted that the stock is “…range-bound until the company sustainably delivers high-teens Platform revenue growth…”

A Rebound From an Unlikely Quarter?

One point many of the analysts didn’t seem to reference immediately was the seeming return of online video advertisers. We’ve seen it before making the rounds of social media, and with the ad-supported tiers of Netflix (NASDAQ:NFLX) and Amazon (NASDAQ:AMZN) apparently doing well, it’s not a surprise to hear that Roku is benefiting similarly from this return to the field. Roku pointed out that its advertiser rates are also perking up. While it’s clear that Roku does need to continue its growth patterns in order to truly prove its value in the face of its competitors, it’s already done a lot of the legwork.

What is a Good Price for Roku Stock?

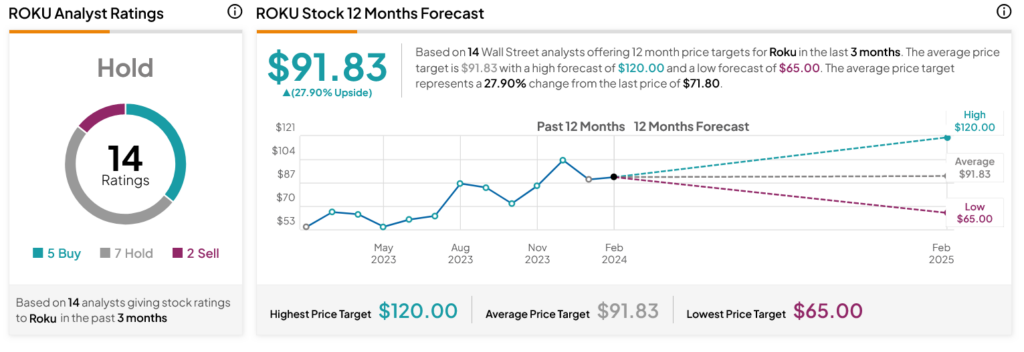

Turning to Wall Street, analysts have a Hold consensus rating on ROKU stock based on five Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 1.26% rally in its share price over the past year, the average ROKU price target of $91.83 per share implies 27.9% upside potential.