One of the biggest names around when it comes to streaming infrastructure has to be Roku (NASDAQ:ROKU). Those little boxes definitely punch above their weight in providing streaming value. However, a new report that retail giant Walmart (NYSE:WMT) may be poised to shake up the field by buying smart TV maker Vizio (NYSE:VZIO) is leaving some very concerned. With the market about to close for the day, Roku itself is up a little over 1.5%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The deal in question suggests that Walmart might end up buying Vizio. That’s a move that could have serious implications for Roku, but both positive and negative possibilities exist, according to word from KeyBanc analyst Justin Patterson. Roku is very much a big part of Walmart’s ecosystem of low-priced televisions. However, so is Vizio. And if Walmart gets control of Vizio, Patterson notes, there could be a strain on Roku’s device sales and overall customer count. Still, Walmart in control of Vizio might prove a welcome boost for Roku, offering “some valuation support for Roku’s installed base.”

Opinions Vary All Over

Not all analysts looked for positive outcomes, though; Matt Farrell with Piper Sandler was looking for Roku to lose ground in such a move. Meanwhile, other reports suggested that there would be little for Roku to worry about here, as Vizio was a “fringe platform player” at best, and the whole thing sounded a bit too familiar considering Walmart’s acquisition of Vudu back in 2010. Finally, the fact that Roku has already fended off the likes of Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) makes it pretty clear that it can likely handle Walmart, too.

What Is a Good Price for Roku Stock?

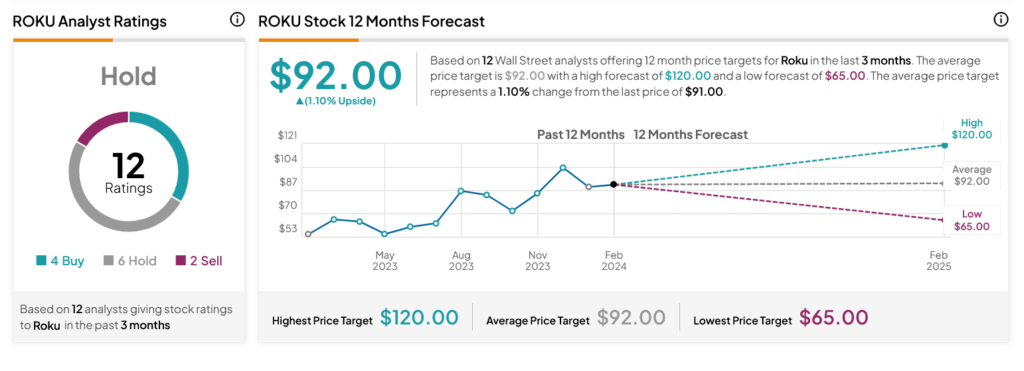

Turning to Wall Street, analysts have a Hold consensus rating on ROKU stock based on four Buys, six Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 0.59% rally in its share price over the past year, the average ROKU price target of $92 per share implies 1.1% upside potential.