Retail pharmacy chain operator CVS Health (CVS) is set to release its third-quarter fiscal year 2025 financial results tomorrow. Investors will be paying close attention to the report as its beleaguered subsidiary, Omnicare, recently entered Chapter 11 bankruptcy protection in Texas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Does Wall Street Expect from CVS Health?

Wall Street expects the company to report $1.37 per share, rising about 26% from $1.09 in the same period last year. Analysts also anticipate CVS Health’s revenue will increase by about 4% year-over-year to $98.81 billion, up from $95.41 billion.

However, the expected revenue is below the $98.9 billion CVS reported during the second quarter. The figure grew by 8% YoY during that period, with strong performance from the healthcare company’s Pharmacy and Consumer Wellness segment. This segment, which focuses on pharmacy operations, is where Omnicare is housed.

Omnicare Faces Fraud Controversy

Omnicare provides pharmaceutical care and consulting to skilled nursing, assisted living, and chronic care institutions. The business was acquired by CVS Health in 2015 for over $10 billion.

The CVS subsidiary was recently slammed with $949 million in restitution and penalty payments by a U.S. district court to settle a case accusing the company of fraudulently billing the U.S. government for wrongfully dispensed prescription medications.

CVS Boosts Business amid Omnicare Bankruptcy

The challenge comes even as e-commerce giant Amazon (AMZN) recently rolled out in-office prescription kiosks at select locations hosting its One Medical clinics in Los Angeles. This puts pressure on traditional pharmacy chains such as CVS and Walgreens by offering convenience and tech-driven service.

However, CVS Health has also made moves to strengthen its business. It recently signed up alongside party supply retailer Party City as one of the first partners to deploy California-based food delivery business DoorDash’s (DASH) new fulfillment services for third-party sellers.

At the same time, the healthcare company also expanded its presence in the U.S. by taking over 63 former Rite Aid and Bartell Drugs stores in Idaho, Oregon, and Washington. The expansion means the company will be able to serve more than nine million former patients of both pharmacies.

Is CVS a Good Stock to Buy Now?

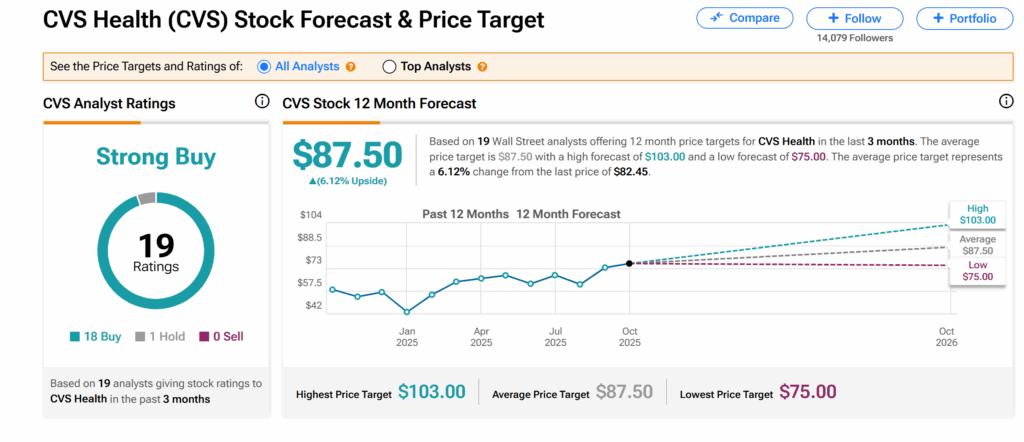

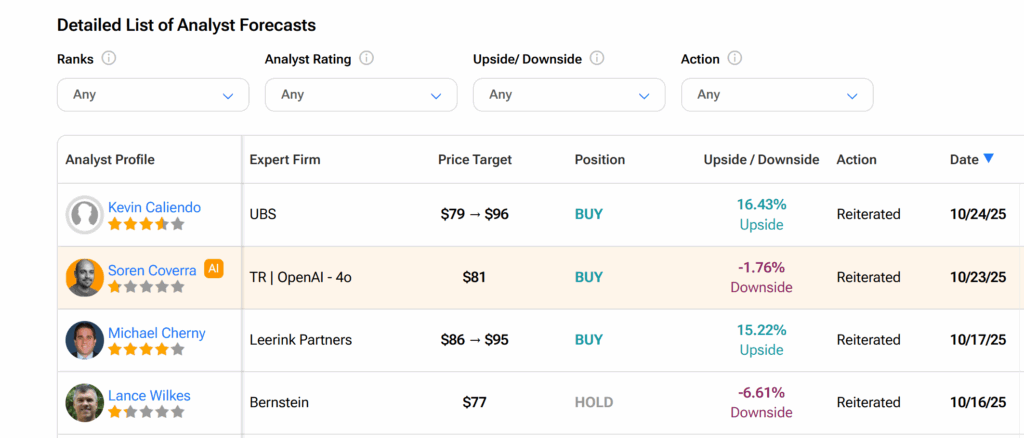

On Wall Street, CVS Health’s shares currently boast a Strong Buy rating from analysts, as seen on TipRanks. This is based on 18 Buys and one Hold issued by analysts over the past three months.

In addition, the average CVS price target of $87.50 indicates about 6% upside potential from the current level. Since the start of the year, CVS stock has soared nearly 92%, hitting $84 per share during early trading on Tuesday.