American food delivery company DoorDash (DASH) has launched its new fulfillment service for third-party sellers, with CVS Pharmacy (CVS) and Party City as its first customers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move signals the company’s effort to expand beyond last-mile delivery. However, DASH stock was down about half a percentage point to about $271 per share as of 11:36 a.m. EDT.

The fulfillment services mean that DoorDash will handle end-to-end logistics for its customers, from managing inventory to picking, packaging, and delivering products. The company aims to accomplish this with its DashMarts, delivery-only convenience stores that stock and ship everyday essentials directly to customers.

Through the service, merchants and retailers can sell their products on DoorDash or their own channels, while avoiding the costs associated with end-to-end logistics, DoorDash said. It added that Kroger (KR), the second-largest grocery chain in the U.S., will also be onboarded to the service later on as a customer.

Already, DoorDash and Kroger have joined forces to provide customers with full access to Kroger’s grocery selection through the DoorDash app. From next month, both companies are expected to deploy Kroger’s delivery network to deliver on-demand groceries to more households.

DoorDash Deepens Retail Reach

Meanwhile, the new service is the latest growth-seeking move by DoorDash, which is in the process of taking over British food company Deliveroo (GB:ROO) in a $3.9 billion deal. The California-based company has also recently teamed up with Ace Hardware, which operates more than 4,000 hardware stores in the U.S., to provide on-demand delivery of do-it-yourself repair and home improvement supplies.

However, DoorDash is entering a fulfillment market dominated by e-commerce giant Amazon (AMZN), with other e-commerce companies such as Walmart (WMT) also ramping up their investments in e-commerce fulfillment services. Last year, the fulfillment market was worth about $22.4 billion, according to Grand View Research.

Is DoorDash Stock Worth Buying?

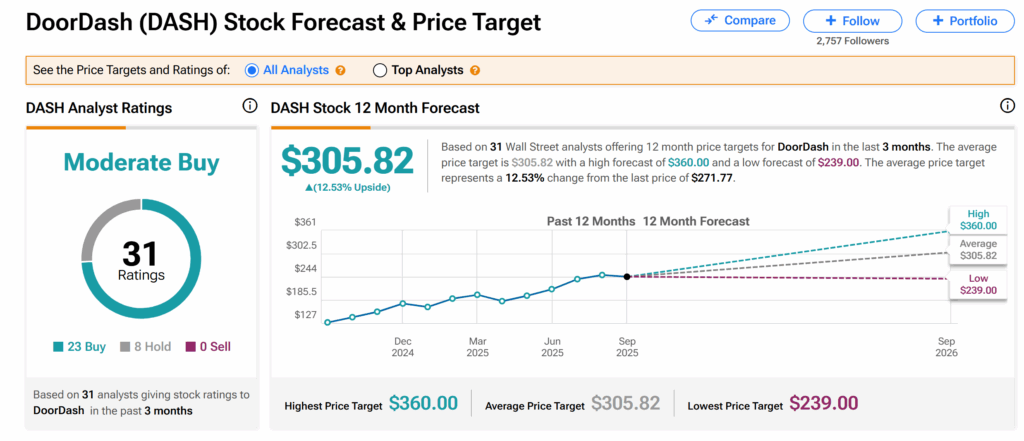

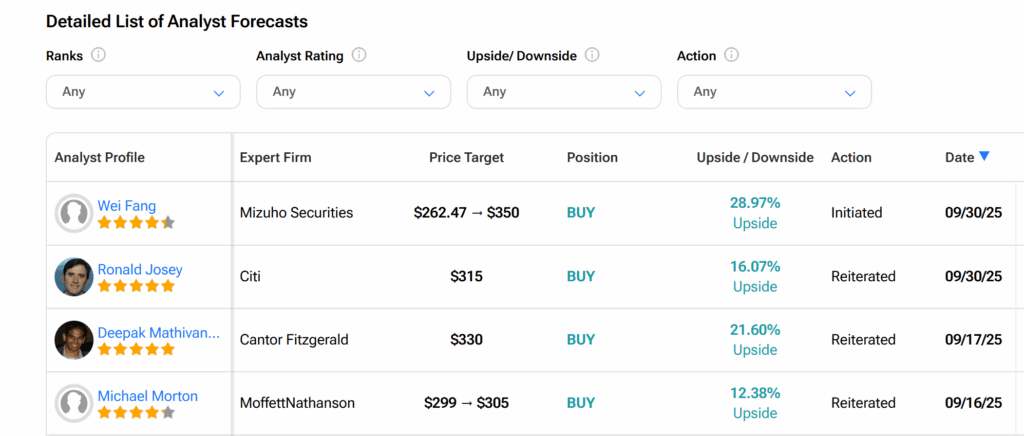

Across Wall Street, DoorDash’s shares have a Moderate Buy consensus rating based on 23 Buys and eight Holds assigned by 31 Wall Street analysts over the past three months. However, the average DASH price target of $305.82 suggests a 12.43% upside potential.