The new earnings cycle is underway, and American Express (NYSE:AXP) is in the news today after releasing its Q1 earnings report. If customers are resilient, then American Express can profit handsomely, but that’s far from assured in a high-interest-rate environment. Yet, after viewing the just-released data, I am bullish on AXP stock and am preparing for higher share prices throughout the year.

American Express is a well-known American credit card issuer, but there may be a perception that the company caters to older shoppers. The billion-dollar question, then, is whether American Express can appeal to younger customers, such as Millennials and people classified as being in Generation Z (a.k.a. Gen Z or Zoomers).

More generally, with inflation ticking back up in March, there’s a question of whether American Express can gain new clients and turn a profit at all. Those questions were just put to rest, though, with American Express’s quarterly data points demonstrating that, for better or for worse, many Americans are still vigorously shopping and spending.

Warming Up with American Express’s Encouraging Loan Data

As a warm-up to American Express’s fresh batch of quarterly financial data, it’s worthwhile to take a look at the company’s recently released loan delinquency and write-off stats. This information covers American Express’s U.S. Consumer and Small Business Card Member lending portfolios for the first three months of 2024.

With bond yields surging during the past few weeks, you might imagine that high interest rates are making it impossible for most borrowers to repay their loans to American Express. Yet, that’s actually not the case at all.

Here’s the rundown for 2024’s first quarter. American Express reported $109.9 billion in total loans, and believe it or not, the company’s loan-delinquency rates were only around 1.4% to 1.5%. Furthermore, American Express’s write-off rates only stood at around 2.3%.

This doesn’t automatically mean American Express won’t encounter challenges if the Federal Reserve decides to keep interest rates higher for longer than expected. Nevertheless, the low rate of loan delinquencies and write-offs suggests that American Express’s borrowers have at least been able to make the minimum payments for the time being. It’s an encouraging sign, even if it doesn’t mean that American Express is completely out of the woods, so to speak.

American Express Stock Jumps as Younger Customers Get on Board

Now, we can circle back to the question of whether younger Millennial and Gen Z customers are aware of American Express during a time when new, flashy fintech firms are competing for their attention. The answer may surprise you, and it certainly adds to the bullish argument for American Express stock.

Amazingly, more than 60% of American Express’s newly acquired global customers in 2023 were Millennials or Zoomers. So clearly, American Express is finding ways to appeal to these age demographics.

Of course, this doesn’t mean that all Zoomers can afford to use an American Express credit card. American Express Chief Financial Officer (CFO) Christophe Le Caillec explained, “These are not your average Gen Z customers. These are typically young professionals that are living in big cities.”

Thus, perhaps American Express can continue to gain traction among elite, young metropolitan spenders. Did American Express perform well overall in this year’s first quarter, though?

AXP stock is up over 5% today, so you can probably surmise that American Express had a great quarter generally. As it turns out, the company’s revenue grew 11% year-over-year to $15.8 billion, narrowly surpassing the consensus estimate of $15.77 billion.

It gets even better when we examine American Express’s bottom-line results for Q1 of 2024. Impressively, the company reported $2.437 billion in net income, up 34% year-over-year. That translates to earnings of $3.33 per share, while Wall Street’s consensus estimate only called for $2.96 per share.

Is American Express Stock a Buy, According to Analysts?

On TipRanks, AXP comes in as a Moderate Buy based on eight Buys, eight Holds, and three Sell ratings assigned by analysts in the past three months. The average American Express stock price target is $222, implying 3.1% downside potential.

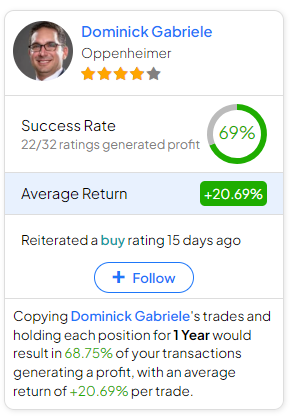

If you’re wondering which analyst you should follow if you want to buy and sell AXP stock, the most profitable analyst covering the stock (on a one-year timeframe) is Dominick Gabriele of Oppenheimer, with an average return of 20.69% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider American Express Stock?

American Express, like all other U.S.-based credit card issuers, had to deal with elevated interest rates in this year’s first three months. Yet, instead of making excuses, American Express stepped up its game and delivered Street-beating first-quarter results.

There’s another story happening here, though. American Express is successfully demonstrating that it can evolve from an old credit-card company that appeals mainly to high-net-worth older clients to a modern fintech firm that can cater to younger shoppers.

So, even though AXP stock jumped today, I believe it’s still not too late to get on board as an investor. Given the aforementioned positive data points and the company’s growth potential in 2024, I am bullish on AXP stock and will definitely consider a share position.