American Airlines (NASDAQ:AAL) is scheduled to report fourth-quarter 2022 earnings on January 26, before the market opens. Earlier this month, the airline company raised expectations for the fourth quarter, citing strong demand as the key reason.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company expects to report adjusted EPS in the range of $1.12 to $1.17, up considerably from the prior guidance of $0.50 and $0.70.

Currently, the Street expects AAL to post earnings of $0.92 per share in Q4, compared with a loss of $1.42 in the prior-year period. Meanwhile, revenue expectations are pegged at $13 billion, representing a year-over-year jump of 38.3%.

Key Factors

The company’s topline is expected to have benefited from the rebound in travel demand, particularly in commercial travel. As per the International Air Transport Association (IATA), total air traffic increased considerably in the months of October and November.

According to TipRanks’ Website Traffic Tool, American Airlines’ website traffic increased about 3% year-over-year in Q4. The spike in global website visits hints at the fact that demand for the company’s services remains solid.

Nevertheless, volatile jet fuel costs due to high inflation might have impacted the company’s bottom line to some extent.

Is AAL a Good Stock?

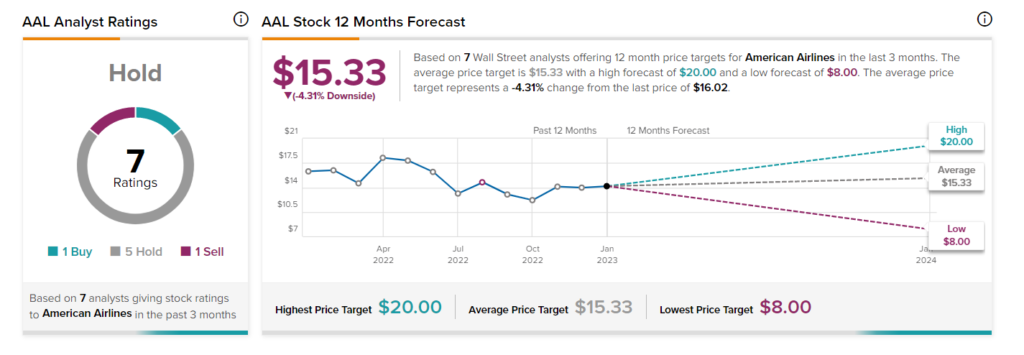

Overall, Wall Street is sidelined on the stock with a Hold consensus rating. This is based on one Buy, five Hold, and one Sell recommendations. The average stock price target of $15.33 implies 4.3% downside potential from the current level. Shares of the company are up 16.5% in the past six months.

Join our Webinar to learn how TipRanks promotes Wall Street transparency