Amazon announced the rollout of a new online pharmacy service for the delivery of prescription medications in the US, as pandemic-led restrictions are fueling demand for digital services.

The e-commerce giant’s shares are up 2.5% in Tuesday’s pre-market session, while rival online pharmacy provider CVS dropped 7.5% and Walgreens plunged 10%.

Through Amazon (AMZN) Pharmacy, a new store on Amazon, customers can now buy medications on their desktop or mobile device through the Amazon App. Using a secure pharmacy profile, customers can add their insurance information, manage prescriptions, and choose payment options before checking out. Amazon Prime members get unlimited, free two-day delivery on orders from Amazon Pharmacy included with their membership.

With the aim of providing access to affordable medication, the new store allows customers to compare prices when buying drugs by choosing between their insurance co-pay, the price without insurance, or available savings for new Prime subscribers. Prime subscribers can get up to 80% off generic and up to 40% off brand medications if they pay without insurance.

“As more and more people look to complete everyday errands from home, pharmacy is an important and needed addition to the Amazon online store,” commented Amazon’s Doug Herrington.

Companies like Amazon are weathering the Covid-19 crisis relatively well as the pandemic has led to an unprecedented wave of orders and delivery services as well as to a change in consumer shopping preferences and needs. As the e-commerce giant sees the online growth trend continuing post-pandemic, the company has also been looking to increase its reach and boost market share.

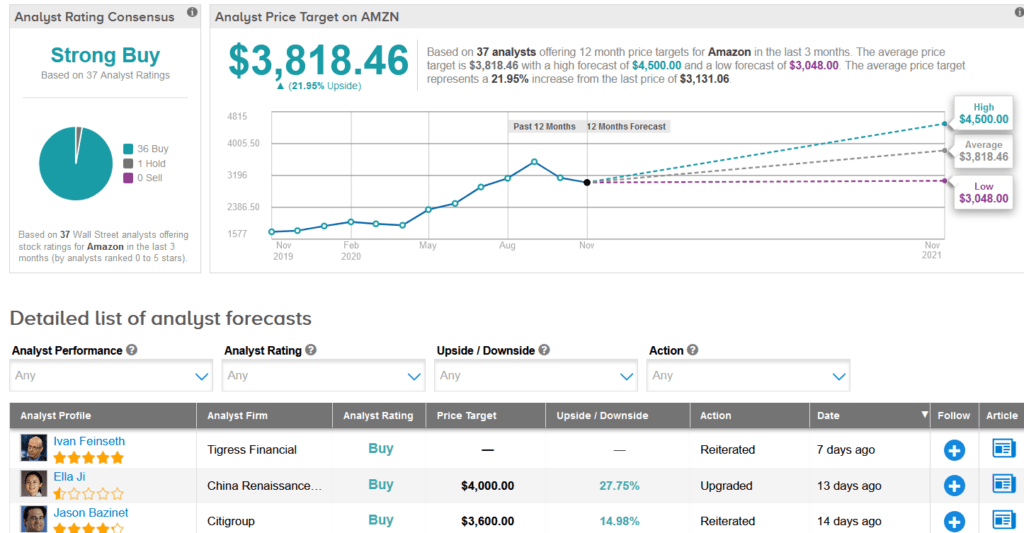

As a result, shares of Amazon have been on a steady gaining streak, jumping a stellar 70% so far this year, with the average analyst price target of $3,818.46 implying an additional 22% upside potential lies ahead in the coming 12 months.

Tigress Financial analyst Ivan Feinseth last week reiterated a Buy rating on the stock, saying that COVID-19 shifts in consumer shopping and enterprise computing trends continue to drive AMZN’s leading position in e-commerce and cloud services.

“AMZN continues to expand its presence in all retail and technology areas, including innovating its delivery capabilities,” Feinseth wrote in a note to investors. “AMZN’s strong underlying technological advantage, including its AWS (Amazon Web Services) platform and Alexa smart speakers, will continue to drive growth opportunities.”

“We believe significant upside exists from current levels and continue to recommend purchase,” the analyst concluded.

Overall, AMZN scores a Strong Buy analyst consensus with 36 Buy ratings vs. only 1 Hold rating. (See Amazon stock analysis on TipRanks).

Related News:

Qualys Inks Container Security Deal With Google Cloud; Street Sees 26% Upside

Cisco’s Quarterly Sales Beat The Street; Shares Rise 8%

Rockwell Slips On 4Q Sales Miss; Analyst Stays Bullish