Shares of Cisco Systems jumped 7.7% in Thursday’s extended market trading after the software company reported better-than-expected 1Q results and issued 2Q guidance that topped Street’s estimates.

Cisco’s (CSCO) 1Q revenues of $11.9 billion declined 9% year-over-year but beat the Street consensus of $11.85 billion. Its adjusted EPS decreased 10% to $0.76 year-on-year but were above analysts’ expectations of $0.70.

“Cisco is off to a solid start in fiscal 2021 and we are encouraged by the signs of improvement in our business as we continue to navigate the pandemic and other macro uncertainties,” said Cisco CEO Chuck Robbins. “Our focus is on winning with a differentiated innovative portfolio, long-term growth and being a trusted technology partner offering choice and flexibility to our customers.” (See CSCO stock analysis on TipRanks).

For 2Q, Cisco expects revenues to be flat to down 2%, which is slightly better than the Wall Street forecast for a 3% decline. The company projects adjusted EPS between $0.74 and $0.76 compared to analysts’ expectations of of $0.74.

In a Nov. 9 report, Robert W. Baird analyst Jonathan Ruykhaver reiterated a Hold rating on the stock and a price target of $46 (19% upside potential) after completing a survey of Cisco partners for 1Q. Ruykhaver commented “we did see solid improvement relative to our prior survey around overall CY20 growth expectations, and a first look at CY21 was positive. Overall, we would characterize survey results as mixed, and we remain fundamentally Hold-rated on CSCO given concerns over longer-term headwind to the business.”

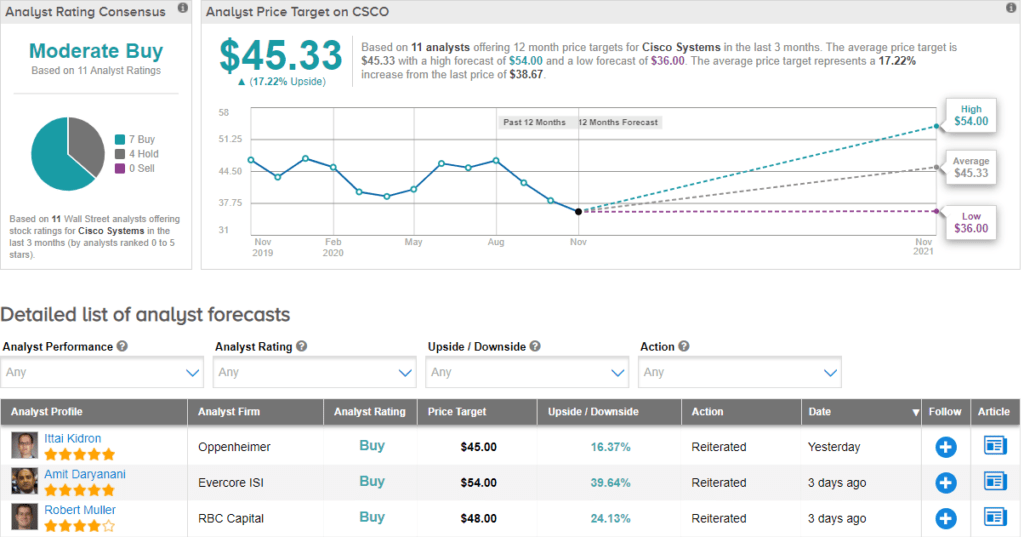

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 11 Buys and 9 Holds. The average price target stands at $45.33 implying upside potential of about 17.2% to current levels. Shares are down nearly 19.4% year-to-date.

Related News:

Rockwell Slips On 4Q Sales Miss; Analyst Stays Bullish

CyberArk’s 4Q Outlook Disappoints; Shares Drop 9%

GameStop To Redeem $125M In Notes Early; Street Sees 38% Downside