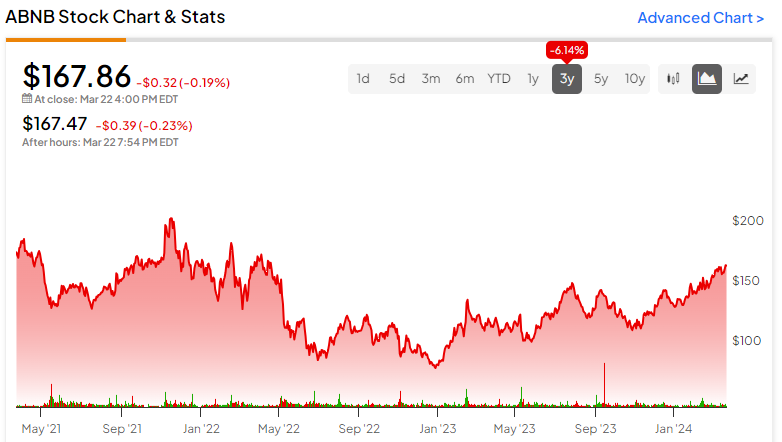

Airbnb stock (NASDAQ:ABNB) has transformed into a cash-printing machine backed by strong revenue growth and its lucrative, high-margin business model. As one of the leading booking platforms favored by travelers seeking unique accommodations, as well as one-of-a-kind experiences, Airbnb maintains its momentum, steadily broadening its brand reach. Last year’s results illustrated this theme, while consensus estimates point to this trend lasting for years to come. Thus, I remain invested and bullish on ABNB stock.

Travel Industry Momentum Drives Top and Bottom-line Gains

Fiscal 2023 was a strong year for Airbnb, with the travel industry’s strong momentum driving robust top and bottom-line gains. One would think that following 2021-2022’s revenge travel post-pandemic period, the travel industry would take a breather. However, the post-pandemic recovery momentum remained strong last year, extending industry gains.

Specifically, according to Eurostat, in 2023, the number of nights booked in Europe grew by 171 million or 6.3% compared with 2022, driven by notable growth in both international and domestic travelers. In fact, the approximate number of nights spent at tourist accommodations during the year reached 2.92 billion in the continent. This surpassed the pre-pandemic 2019 level of 2.87 billion by 1.6%, setting a new record year. Globally, Statista reported that the size of the global tourism market grew by nearly 14% last year.

Being the world’s second-most visited accommodation and hotel platform, only behind Booking Holdings (NASDAQ:BKNG) Booking, Airbnb enjoyed an organic tailwind from the travel industry’s strong traction. This led to Airbnb recording significant growth across its key metrics and overall financials.

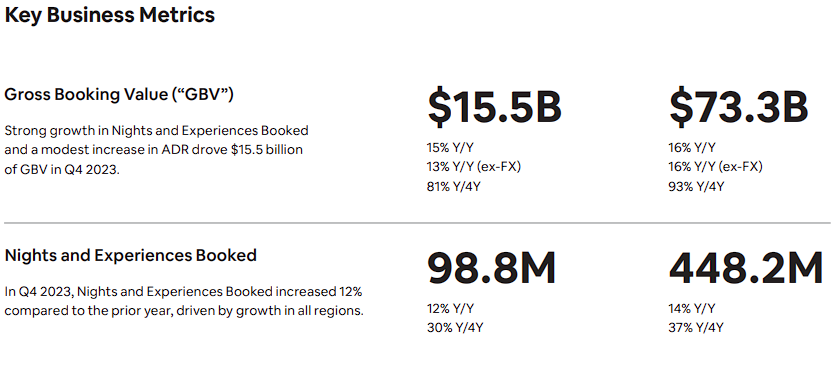

In particular, nights and experiences booked grew by 14% to 448.2 million for the year, driven by growth in all regions. This growth, combined with higher average prices on nights and experiences, led to Airbnb posting gross booking value (GBV) growth of 16% to $73.3 billion.

Airbnb’s take rate on this amount was relatively stable year-over-year (14.3% in Q4, for context), so the growth in GBV and a soft but favorable currency translation led to total revenues growing by 18% for the year to $9.9 billion.

What I love about Airbnb’s business model is that it’s incredibly lean and capital-light, meaning that the company can achieve tremendous margins. The more Airbnb scales its revenues, the higher its margins go, especially given management has focused intently on controlling expenses in recent quarters.

Indeed, adjusted EBITDA in 2023 landed at $3.7 billion, implying an adjusted EBITDA margin of ~37%, up from last year’s ~35%. Airbnb’s adjusted net income (which excludes some notable gains recorded in 2023 that inflated GAAP net income) also had a strong margin of about 29%.

Nevertheless, note that the whole booking/reservations business model is very much a cash-flow business model. For this reason, I believe that Airbnb can be better assessed by looking at its free cash flow. This is where the business truly shined, posting a record free cash flow of $3.8 billion, up from $3.4 billion last year, implying a massive free cash flow margin of 39%.

Double-Digit Growth to Persist For Years To Come

Airbnb’s double-digit growth appears poised to persist for years to come. In my view, this will sustain the stock’s bullish sentiment.

As far as this year goes, management stated that 2024 started strong and expects revenues in Q1 to land between $2.03 billion and $2.07 billion, implying year-over-year growth of 12% to 14%. Based on this and the travel industry’s ongoing momentum, consensus estimates point toward Fiscal 2024 revenues of $11.08 billion, suggesting a year-over-year increase of 11.8%.

Impressively, Airbnb’s consensus revenue estimates forecast double-digit revenue annually throughout 2033. Sure, after a few years, projecting revenues becomes highly speculative. Still, this reveals the current sentiment, which should give you an idea of how the market feels about the company’s growth prospects.

Furthermore, free cash flow growth is expected to follow suit and land at $4.04 billion and $4.62 billion in 2024 and 2025, charting a similar trajectory. Therefore, the company appears set to keep growing rapidly and printing cash for years to come.

Is ABNB Stock a Buy, According to Analysts?

Regarding Wall Street’s view, Airbnb has gathered mixed feelings. The stock features a Hold consensus rating based on five Buys, 19 Holds, and four Sells assigned in the past three months. At $144.80, the average Airbnb stock price target implies 13.7% downside potential.

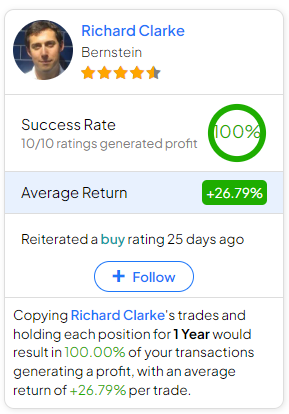

If you’re unsure which analyst you should follow if you want to trade ABNB stock, the most accurate analyst covering the stock (on a one-year timeframe) is Richard Clarke from Bernstein. He boasts an average return of 26.79% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

To sum up, I believe that Airbnb’s rise as a cash-generating machine is undeniable. With a business model that thrives organically on the back of the travel industry’s growth combined with juicy margins, Airbnb’s free cash flow generation prospects are truly fascinating.

Further, Wall Street predicts double-digit revenue and free cash flow growth extending far into the future, suggesting that the stock’s investment outlook remains promising. In light of this, I’m feeling confident about sticking with Airbnb stock for the future and staying optimistic about its long-term story.