AGF Management (TSE: AGF.B) released its financial results for the fourth quarter and year ended November 30, 2021, on Wednesday.

Q4 and FY 2021 Financial Results

The investment management firm reported assets under management and fee-based assets totaling C$42.6 billion, compared to C$43.4 billion as of August 31, 2021, and C$38.3 billion as of November 30, 2020.

AGF’s mutual fund gross sales totaled C$914 million in Q4 2021, compared to C$679 million in Q4 2020, representing a 35% improvement over the previous year. Year-over-year, gross retail mutual fund sales improved 39%, compared to 18% industry-wide.

AGF’s mutual fund net sales improved by C$264 million year-over-year, with net sales totaling C$352 million for the fourth quarter of 2021, compared to C$88 million for the fourth quarter of 2020.

Mutual fund sales growth continued in the first quarter of 2022, as net sales reached C$115 million as of January 21, 2022, compared to net sales of C$104 million for the same period last year. Mutual fund gross sales increased 3% year-over-year.

Net income, for the three months and year ended November 30, 2021, was C$13.8 million (diluted EPS of C$0.19) and C$39.3 million (diluted EPS of C$0.55), compared to C$110.4 million (diluted EPS of C$1.43) and C$173.9 million (diluted EPS of C$2.22) for the corresponding periods in 2020. Adjusted diluted EPS was C$0.19 and C$0.42 in the comparative prior year periods.

Management Commentary

AGF CEO and CIO Kevin McCreadie said, “As we marked our second fiscal year-end of the pandemic, we have continued to work effectively and execute against our long-term strategy and stated goals, including the growth of our private alternatives business and securing key hires intended to help us accelerate our growth. Over the course of the year we built terrific sales momentum and delivered risk-adjusted performance, while providing our clients with an essential service.”

Wall Street’s Take

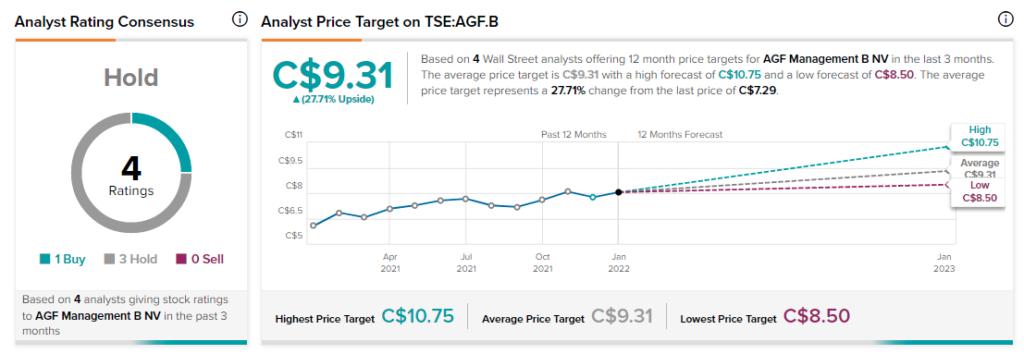

On January 25, Scotiabank analyst Phil Hardie kept a Hold Rating on AGF.B and lowered its price target to C$9.50 (from C$10.50). This implies 30.3% upside potential.

The rest of the Street is neutral on AGF.B with a Hold consensus rating based on one Buy and three Holds. The average AGF management price target of C$9.31 implies 27.7% upside potential to current levels.

Download the TipRanks mobile app now

Related News:

Manulife: Canadians’ Stress Has Increased

RBC Launches RBC Global Choices Portfolios