Buy now, pay later provider Affirm (AFRM) is expanding its partnership with New York Life Insurance. As part of the new deal, New York Life will buy up to $750 million worth of Affirm’s installment loans through 2026. This funding will help Affirm support about $1.75 billion in annual loan volume without keeping the loans on its own balance sheet. Notably, the two companies first partnered in 2023, when New York Life started investing in Affirm’s loan-backed securities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So far, New York Life has invested nearly $2 billion into Affirm’s loan pools. Interestingly, this is part of a growing trend in which insurers and private-credit firms are investing more in consumer finance, as higher interest rates make these loans more profitable. For instance, Klarna (KLAR) has collaborated with Nelnet (NNI) and Pagaya (PGY), while PayPal (PYPL) signed a $7 billion deal with Blue Owl Capital (OWL).

However, this new deal with New York Life comes at a time when the lending environment is uncertain. While consumer spending remains steady and late payments are easing, investors are still cautious after recent bankruptcies in subprime auto and consumer credit. Nevertheless, the continued support from major financial partners suggests that many still believe in Affirm’s long-term potential, as it has financed over $100 billion in purchases and says that more than 90% of its borrowers return for repeat loans.

Is AFRM Stock a Good Buy?

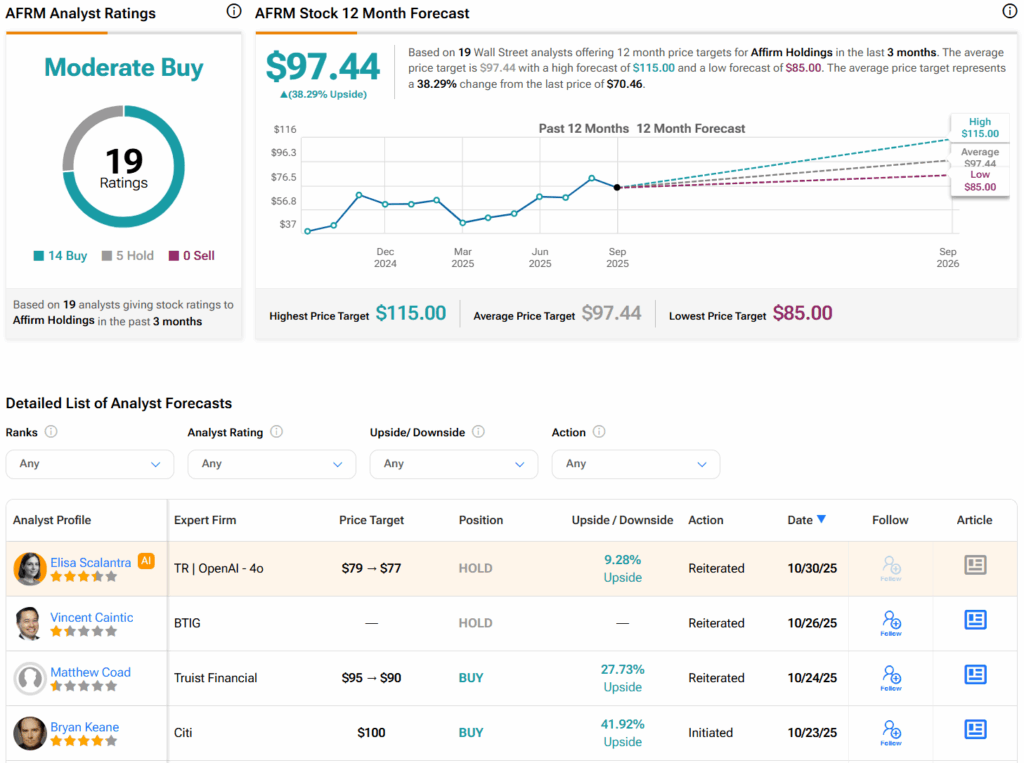

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Affirm stock based on 14 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Affirm price target of $384 per share implies 17% upside potential.