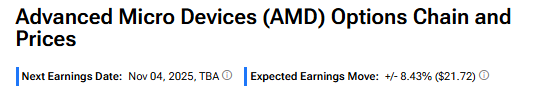

Advanced Micro Devices (AMD) is set to report its third-quarter earnings after the bell on Tuesday, November 4. Following the release, the options market is bracing for a potential 8.41% move in either direction. That is much higher than AMD’s long-term average post-earnings move of -1.94%, which reflects a modest decline. This suggests higher investor expectations and uncertainty, as the chipmaker accelerates its AI push.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Currently, Wall Street is expecting AMD to report earnings of $1.17 per share, up 27.2% from the same period last year. Also, analysts project revenues of $8.76 billion, up from $6.82 billion in the year-ago quarter.

It must be noted that the company had guided Q3 revenue of $8.7 billion, reflecting nearly 28% year-over-year growth.

What Are Investors Looking for in AMD’s Earnings

In the upcoming Q3 earnings report, investors are eager to see whether AMD’s AI strategy is paying off. The company has gained momentum due to the increased adoption and ramp of its Instinct MI350 series GPUs among hyperscalers and enterprise customers such as Oracle (ORCL) and Google (GOOGL).

Moreover, a key area of focus will be AMD’s Data Center revenue, where traders are watching the scale of AI-related sales. Attention is also on the Client and Gaming segments, which continue to benefit from a rebound in the PC and gaming markets.

Finally, an improved gross margin could be a bullish signal, especially if AMD’s premium AI chips help drive profitability, pointing to stronger earnings ahead.

Beyond Q3 numbers, investors also want updates on AI demand, the upcoming MI400 chips for 2026, and the impact of new partnerships with OpenAI (PC:OPAIQ) and the U.S. Department of Energy.

Is AMD a Buy or Sell Now?

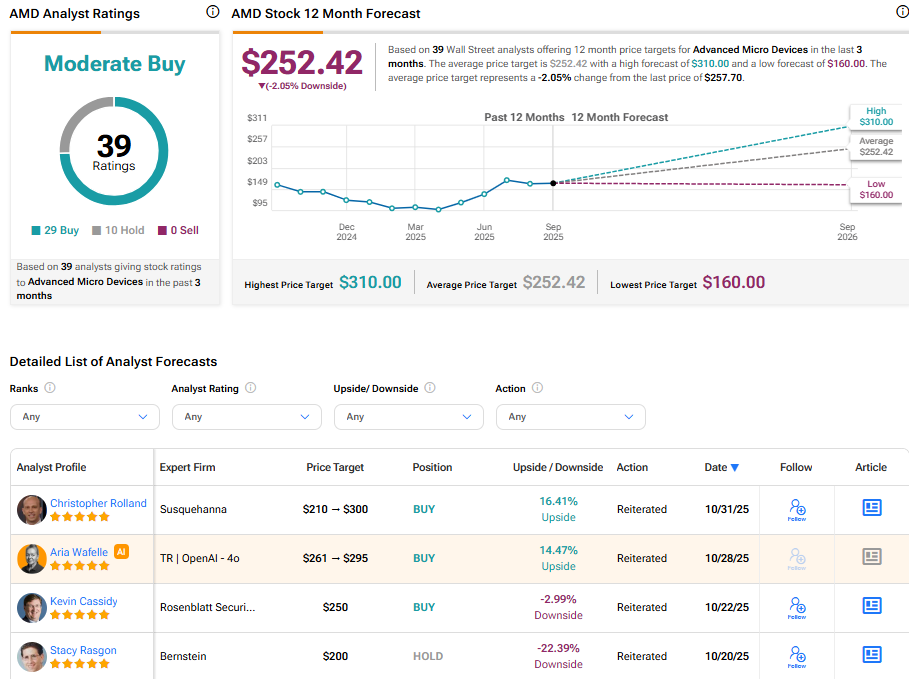

Turning to Wall Street, AMD stock has a Moderate Buy consensus rating based on 29 Buys and 10 Holds assigned in the last three months. At $252.42, the average AMD price target implies a 2.05% downside risk.