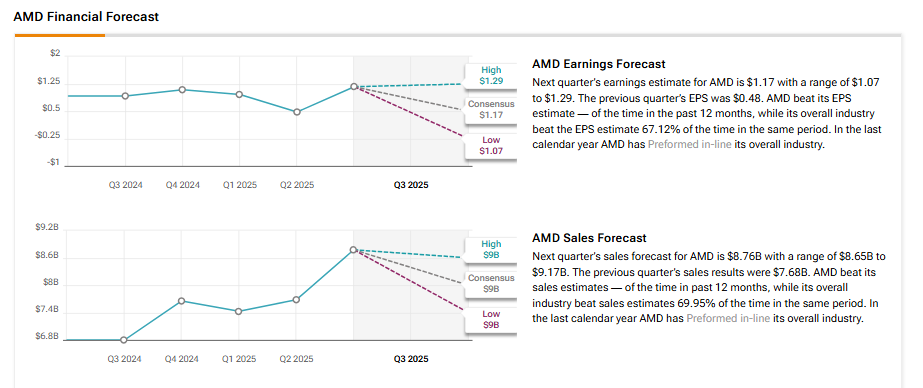

Advanced Micro Devices (AMD) is set to report its Q3 2025 earnings on Tuesday, November 4, after the market closes. AMD stock has gained 112% in 2025 so far, driven by strength in its data center business and steady expansion in major markets. Its new deals with OpenAI (PC:OPAIQ) and Oracle (ORCL) also show strong demand for AMD’s chips from leading AI players. Wall Street analysts expect the company to post revenues of $8.76 billion, up 28% from the year-ago quarter, according to data from the TipRanks Forecast page.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, earnings are expected to increase by about 27.2% from the year-ago quarter to $1.17 per share. Notably, AMD has an encouraging earnings surprise history. The company missed earnings estimates just twice out of the previous nine quarters.

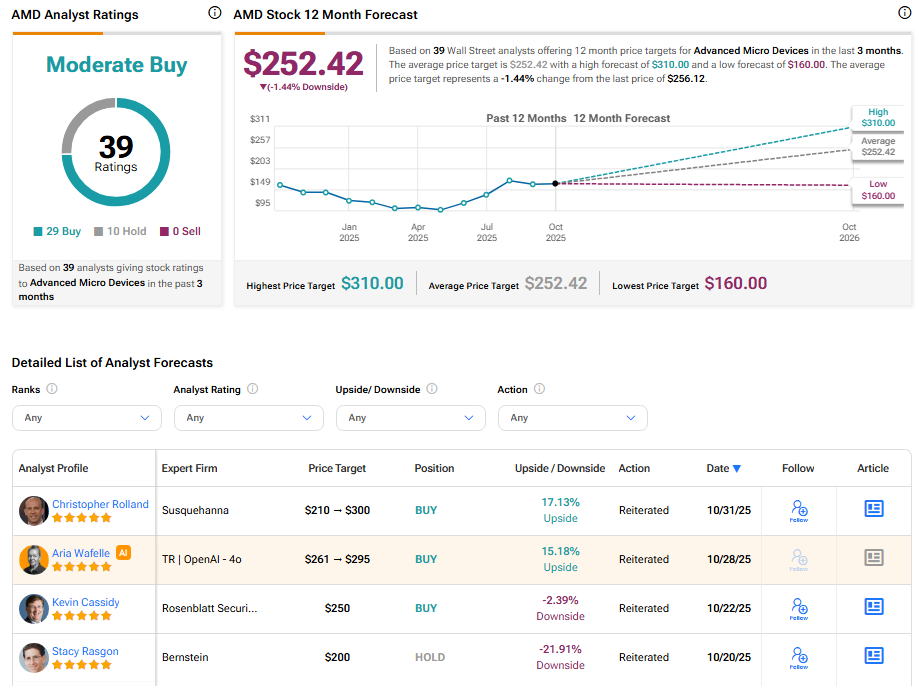

Analysts’ Views on AMD Ahead of Q3 Results

Ahead of the Q3 print, Susquehanna analyst Christopher Rolland raised his price target on AMD to $300 from $210 and kept a Buy rating on the stock. The firm expects slightly better numbers helped by stronger demand in its data center and PC units. Rolland said that production of the MI350 data center chips should rise sharply in the second half of the year.

Similarly, Top Rosenblatt Securities analyst Kevin Cassidy reiterated a Buy rating on the stock and kept a $250 price target. The analyst expects AMD to post a “modest beat-and-raise quarter,” helped by stronger demand for PC and server chips and ongoing market-share gains in both areas.

In addition, TipRanks’ AI Analyst Aria Wafelle (under the GPT-4o model) recently raised the price target on AMD stock to $295 from $261, while maintaining an Outperform (Buy) rating, noting strong financial performance and positive technical signals for the stock.

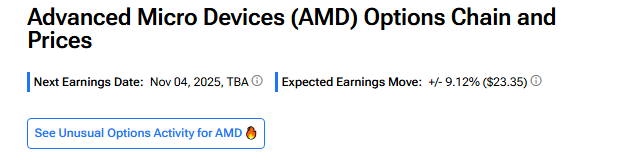

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 9.12% move in either direction.

Is AMD Stock a Buy or Sell?

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 29 Buys and 10 Holds. The average AMD stock price target of $252.42 indicates a possible downside of 1.44% from current levels.