Advanced Micro Devices (AMD) stock rallied 35% on Monday, as of writing, following the announcement of a deal with OpenAI (PC:OPAIQ), under which the ChatGPT maker will deploy up to 6 gigawatts of AMD’s graphics processing units (GPUs) over multiple years. Interestingly, the deal also includes a warrant, which, if exercised, will give OpenAI about a 10% stake in AMD, based on the current number of shares outstanding.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The deal follows a massive $100 billion investment agreement between OpenAI and Nvidia (NVDA) to power the AI startup’s next-generation AI models. NVDA stock was down about 1% as of writing.

The OpenAI-AMD partnership underscores the growing circular nature of deals in the AI space, with a handful of tech companies collaborating to develop and power next-generation technology.

More on the Strategic Deal Between AMD and OpenAI

The deal marks a key milestone for AMD, validating the demand for its next-generation Instinct products. It will help address concerns about AMD lagging behind Nvidia in the AI chip race. Under the partnership, OpenAI will purchase 6 gigawatts worth of AMD’s GPUs, with the deployment of the first 1 gigawatt of AMD Instinct MI450 GPUs set to commence in the second half of 2026.

Furthermore, OpenAI will be AMD’s core strategic compute partner to drive large-scale deployments of the semiconductor company’s technology, starting with the AMD Instinct MI450 series and rack-scale AI solutions and extending to next-gen offerings.

Importantly, AMD has issued OpenAI a warrant for up to 160 million shares of its common stock, which will vest as specific milestones are achieved. Notably, the first tranche vests with the initial 1 gigawatt deployment, with additional tranches vesting as purchases ramp up to 6 gigawatts.

“This agreement creates significant strategic alignment and shareholder value for both AMD and OpenAI and is expected to be highly accretive to AMD’s non-GAAP earnings-per-share,” said Jean Hu, CFO of AMD.

“AMD’s leadership in high-performance chips will enable us to accelerate progress and bring the benefits of advanced AI to everyone faster,” said Sam Altman, co-founder and CEO of OpenAI.

Is AMD Stock a Buy, Sell, or Hold?

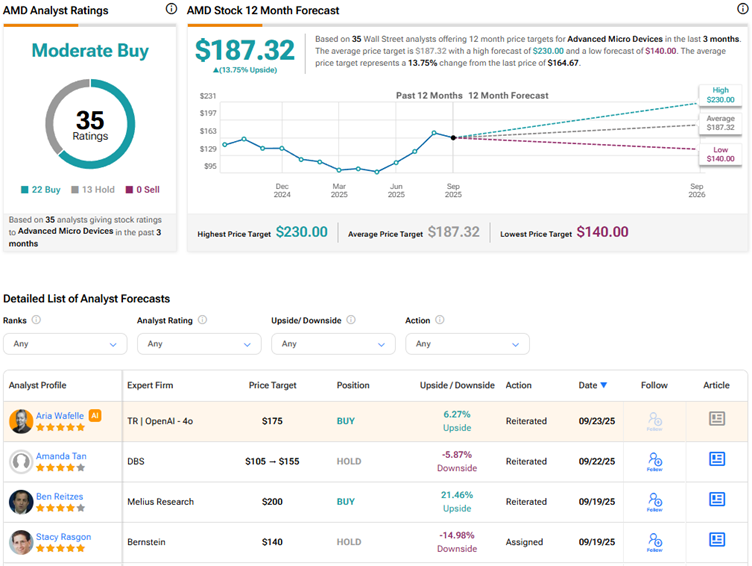

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 22 Buys and 13 Holds. The average AMD stock price target of $187.32 indicates about 14% upside potential.

However, analysts’ ratings and price targets are expected to be revised based on today’s game-changing partnership with OpenAI.