Adobe stock (NASDAQ:ADBE) plunged after posting its Q1-2024 results last month. Investors cited a soft Q2-2024 outlook and mounting worries regarding advances in AI that could threaten Adobe’s business. Nevertheless, such concerns appear bloated, while Adobe’s momentum remains rock-solid. The creative software powerhouse posted double-digit top-line growth and even more impressive EPS growth in Q1, all while announcing a massive $25 billion buyback program. Accordingly, I remain bullish on ADBE stock.

Are AI Concerns Clouding Adobe’s Investment Case Valid?

The greatest concern among investors regarding Adobe’s investment case is generative AI. The jaw-dropping advancements we’ve witnessed lately have undoubtedly raised the question of whether this technology could eventually make Adobe software obsolete. Take Open AI’s Sora, for instance. The company’s latest demos show super detailed text-to-video results that bring to life one’s imagination with unprecedented ease.

While such concerns are valid, it’s worth mentioning that Sora, which is considered the most advanced AI in the field, is not commercially available yet. It’s not like any creator or creative enterprise can actually go and purchase Sora or anything similar and start producing videos, effectively replacing Adobe.

And sure, the video demos from Sora are impressive, but uncertainties remain when it comes to editing or post-producing these samples further. Will video editors need to communicate specific edits to Sora or similar AI software via text commands? If that’s the case, it actually sounds more complex compared to the linear editing process, where a human editor can envision in their head the desired outcome and take the shortest path of commands to achieve it.

So, while I’m confident that generative images and videos are here to stay, I don’t see them completely taking over manual, human-driven editing processes just yet. They’ll likely serve more as a complement to current standards rather than a full replacement. Besides, we don’t even know the potential problems that will arise from such AI software, like the possibility of copyright infringements. Thus, I believe that the market is making a large leap by presuming that AI will rapidly displace the prevailing industry status quo.

It’s also worth mentioning that Adobe is advancing itself in this field, showcasing remarkable results with its products like Firefly. Consequently, I think it would be unfair to overlook the growth opportunities AI presents for Adobe’s investment case and solely focus on the potential risks. Especially when software like Firefly is actually commercially available.

Growth Remains Robust, Signaling Continuous Strength

As I mentioned, despite AI posing a potential threat to Adobe’s businesses, the lack of any large-scale commercial availability of such software has not negatively impacted the company’s growth. In fact, Adobe’s growth remains robust, signaling continuous strength.

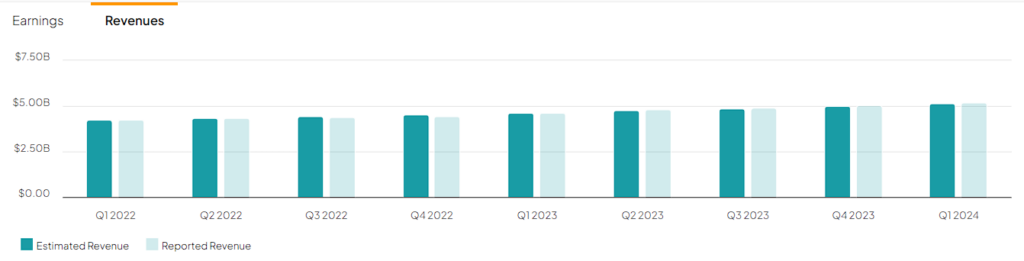

In Q1 2024, Adobe posted record quarterly revenues of $5.18 billion, representing 12% year-over-year growth in constant currency. Impressively, the company has posted positive year-over-year growth in each of the last 40 quarters. The fact that ADBE maintains double-digit growth after already dominating this space for decades now is absolutely incredible to me.

Simultaneously, Adobe achieved an adjusted operating margin of 47.6%, up from 45.8% last year. Further, the share buybacks in the four prior quarters led to adjusted EPS growth of 18% to $4.48. It was quite surprising to see the stock plunge following such numbers, which completely contrasts the pessimistic narrative prevailing in the market.

Post-Plunge Valuation Provides Attractive Entry Point

With Adobe’s profits continuing to rise, I believe the recent post-earnings share price dip offers an entry opportunity for investors, with shares trading at an attractive valuation.

Based on Adobe’s guidance, adjusted EPS is forecasted to reach $4.35 to $4.40 in Q2, leading Wall Street to forecast full-year adjusted EPS of $18.01. In turn, this translates to a forward P/E of 27.6x, which is on the low end of Adobe’s forward P/E range over the past five years. Given Adobe’s current superiority in the industry, its irreplaceable suite of creative software, and persistent double-digit growth, I see this valuation multiple as offering an attractive entry point for investors.

Another indicator that shares are attractively priced is the aforementioned $25 billion buyback program announced with its Q1 results. If management thought the stock was attractively priced prior to the plunge, evident by announcing such a massive program, they certainly think the same now that the stock is trading at notably lower levels.

Is ADBE Stock a Buy, According to Analysts?

Checking Wall Street’s view on the stock, Adobe has a Moderate Buy consensus rating based on 22 Buys, six Holds, and three Sells assigned in the past three months. At $617.79, the average Adobe stock price target suggests 24.3% upside potential over the next 12 months.

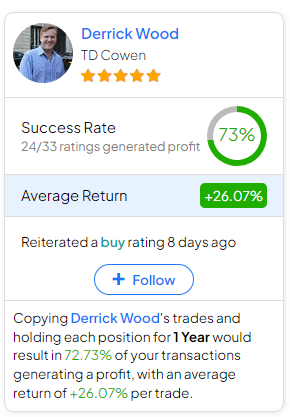

If you’re wondering which analyst you should follow if you want to buy and sell ADBE stock, the most profitable analyst covering the stock (on a one-year timeframe) is Derric Wood of TD Cowen, with an average return of 26.07% per rating and a 73% success rate. Click on the image below to learn more.

The Takeaway

To wrap this up, I agree that concerns over advancements in AI pose valid questions about Adobe’s future. However, such software is not yet commercially available on a large scale, and it is unlikely that it will entirely replace the way editing takes place today.

In the meantime, Adobe’s consistent double-digit growth, strong operating margins, and considerable buyback program form an attractive investment case. With shares trading at an attractive valuation now, the current dip presents a compelling entry point for investors who have been sitting on the sidelines.