As earnings season winds down, investors will have a chance to digest the results before the next round hits. Undoubtedly, this season saw varying results, but given the trajectory of the S&P 500 (SPX), I think it’s safe to say that the numbers lived up to the hype, at least in certain corners of the tech scene. Not all tech companies with skin in the artificial intelligence (AI) scene swung a grand slam, though. There were some notable stumbles, a few fumbles, and even a couple tumbles.

Though the AI scene is still evolving before our eyes, I wouldn’t overreact to some of the tech duds that flopped this earnings season. At the same time, I wouldn’t get too excited about the AI kings (think the AI chip plays) that blew away the numbers despite the heightened expectations.

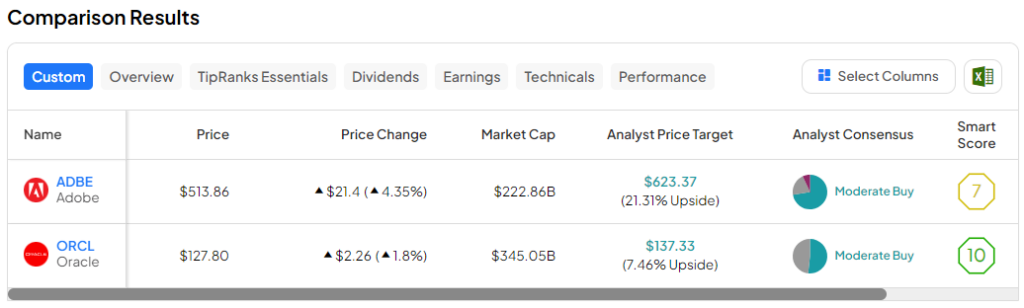

In this piece, we’ll use TipRanks’ Comparison Tool to weigh in on two AI-leveraging tech juggernauts (ADBE and ORCL) that recently reported earnings. We’ll see where analysts stand on the names and what to expect after their first showing of 2024.

Adobe (NASDAQ:ADBE)

First, let’s start with the earnings dud of this piece. Adobe stock clocked in results last Thursday after market close, and the results were somewhat decent, with a slight beat on the bottom line (earnings per share of $4.48 vs. $4.38 estimate). However, the soft Q2 guidance left some investors feeling a strong sense of disappointment. Specifically, annual recurring revenue (ARR) projections for the next quarter came up short of the estimates ($440 million vs. $468 million expectation).

Undoubtedly, the slight earnings beat with a side of soft guidance seems to be the formula for an instant correction (the stock fell 13.7% last Friday), at least these days. Despite the unimpressive showing, I remain bullish, as its generative AI efforts, I believe, will pay off in due time. For now, though, investors have the right to be concerned, as generative AI products like OpenAI Sora, text-to-video AI models, and Microsoft’s (NASDAQ:MSFT) revamped Paint application (now with some subtle AI features) begin to capture the hearts of creatives.

Sora, a profound technology that looks like a credible threat to workers in the film industry, hasn’t been released yet, and some bugs and glitches still need to be ironed out. However, neither the technology nor the company behind it (OpenAI) can be taken lightly. Fortunately, Adobe has been harnessing AI powers itself. And though more rivals are bound to come after its creative suite, I believe competition will only push Adobe to become the best version of itself.

Generative AI will transform Adobe, likely for the better. And though its coming quarter could be relatively muted, I’d consider Adobe one of the potential AI top dogs to own through the next three years.

The company made it clear that the sales impact of AI won’t hit immediately. However, Adobe looks relatively undervalued in the AI tech scene as it puts its foot on the AI gas pedal as Firefly works its magic over the firm’s creative suite. CEO Shantanu Narayen says the adoption of Firefly in existing creative platforms has been “pretty good.” Investors should take the man’s word for it.

Is ADBE Stock a Buy, According to Analysts?

Adobe stock is a Moderate Buy, according to analysts, with 21 Buys, six Holds, and two Sells assigned in the past three months. The average ADBE stock price target of $623.37 implies 21.3% upside potential.

Oracle (NASDAQ:ORCL)

Next up, we have Oracle, one of this earnings season’s biggest winners, which blasted off following its solid third quarter with a side of upbeat guidance. Indeed, the bottom-line beat was not huge, with earnings per share coming in at an adjusted $1.41 vs. the $1.38 estimate and revenues coming in more or less in line, though missing estimates by a hair. That said, the biggest takeaway was Oracle guiding for something big as generative AI continues to take off.

Even after the latest post-earnings surge, I find it hard to be anything but bullish on ORCL stock right here as it grabs the AI bull by the horns. The company is readying its data centers to account for the booming demand for AI infrastructure. With plans to build 100 new cloud data centers, it’s clear that Oracle is not sparing expenses as it looks to continue adding to its AI-driven rally, one that caught many investors off-guard through most of last year.

With shares hovering at all-time highs and a stock that’s going for just 33.2 times trailing price-to-earnings, considerably less than the 41.7 times of the infrastructure software industry average, I’d not be afraid to be a buyer as shares make higher highs.

Oracle is back, and I don’t think it’s wise to bet against Larry Ellison’s empire as it braces for the AI age. At this pace, perhaps Oracle is looking to catch up to Microsoft’s AI dominance.

Is ORCL Stock a Buy, According to Analysts?

Oracle stock is a Moderate Buy, according to analysts, with 15 Buys and 14 Holds assigned in the past three months. The average Oracle stock price target of $137.33 implies 7.5% upside potential.

The Bottom Line

I’m a fan of Adobe and Oracle after their recent results. If I had to choose one, it’d have to be Oracle. It may have a lower implied upside potential (7.5% vs. 21.3% for ADBE stock), but the AI tailwind at its back could prove sustainable. Only time will tell if investors are still underestimating Oracle’s ability to capitalize on AI’s rise. Regardless, shares still don’t appear remotely expensive, given the opportunity at hand.