Abrdn (GB:ABDN) reported a pre-tax loss of £320 million for the first half of 2022 as compared to a profit of £113 million last year – due to the falling value of its major investment companies, such as HDFC Asset Management, HDFC Life, and Phoenix Group.

The company’s fee-based revenue was also reduced by 8% to £696 million due to market volatility.

This came as a jolt to the company’s already falling share prices, and they fell by a further 6.3% on Tuesday. The company’s stock is down by 37% in the past year.

Fighting a tough environment

Losses from the investment division were supported by better performances of the company’s adviser and personal business segments. The adviser segment saw its fee-based revenue increase by 6% and the personal segment’s fee-based revenue increased by £13 million.

The company expanded its personal business segment, following the completion of its acquisition of Interactive Investor in May 2022. With this acquisition, Abrdn hopes to expand its reach in the UK’s personal wealth market and diversify its sources of income.

John Moore, senior investment manager at Brewin Dolphin, said, “Today’s mixed set of results from Abrdn confirm the tricky position the company finds itself in.”

He added, “The purchase of Interactive Investor has reshaped the company and appears to be performing well, but there are some more strategic moves required to get the fund manager back on track.”

View from the City

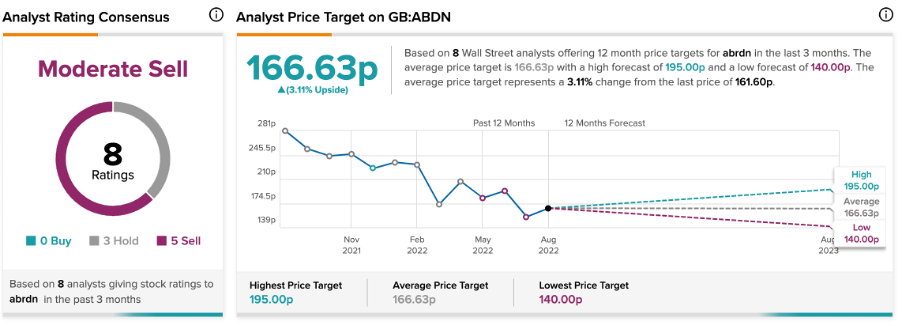

According to TipRanks’ analyst rating consensus, Abrdn stock has a Moderate Sell rating. The rating is based on five Sell and three Hold ratings.

The average price target is 166.63p, which shows a change of 3.1% from the price level of 161.6p. The analyst price targets range from a low of 140p to a high of 195p.

Bruce Hamilton from Morgan Stanley has recently reiterated his sell rating and reduced the target price from 186p to 168p.

Conclusion

Despite the gloomy results, the company is optimistic about its shareholders’ return. It announced an interim dividend of 7.3p as per its policy and started an initial phase of a £300 million share buyback program.

The overall global environment remains challenging. However, the diversification of its businesses is helping it to remain flexible and reshape its revenues and profits.