These are the 5 Best Small-Cap stocks to buy in April 2024, according to Wall Street analysts. A small-cap stock is defined as shares of a company with a market capitalization between $300 million and $2 billion. Small-cap stocks offer an attractive risk-reward profile as these companies usually have a high growth potential compared to large-cap stocks. Although small-cap stocks bring along a high amount of volatility, they appear to be lucrative bets when the economy is expected to boom.

Several experts are projecting better days in 2024, with interest rates expected to decline and the overall economic sentiment improving. At such times, a small-cap company has the potential to grow its top and bottom lines much faster than a well-established larger company. With this background in mind, let us look at the 5 best small-cap stocks to buy in April, which have won analysts’ favor and are expected to offer at least a 50% share price appreciation potential in the next twelve months.

#1 Metropolitan Bank Holding Corp. (NYSE:MCB)

Metropolitan Bank Holding Corp. operates through its subsidiary, Metropolitan Commercial Bank, a community bank focused on entrepreneurial banking solutions. MCB offers business, commercial, and personal banking products and services to small and middle-market businesses, public entities, and affluent individuals in the New York metropolitan area. MCB’s banking centers are located in Manhattan, Brooklyn, and Long Island.

In Fiscal 2023, MCB reported a net interest margin of 3.49%, the same as in FY22, with year-end deposits of $5.7 billion and net loans of $5.6 billion. Also, the bank reported diluted earnings of $6.91 per share on total revenues of $250.74 million.

Importantly, MCB is exiting all of its Banking-as-a-Service (BaaS) relationships in 2024 to reduce its exposure to stringent regulatory standards related to these activities. MCB may lose roughly 14% of its total deposits owing to the exit. That said, the bank stated that the exit would not impact its business materially.

What is the Stock Price Prediction for MCB?

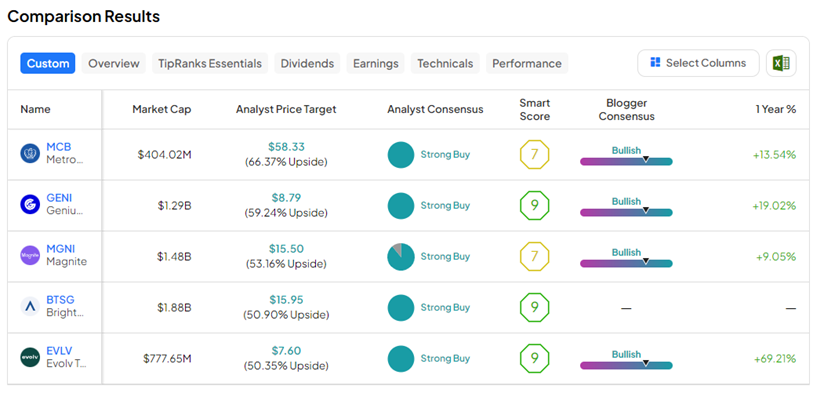

On TipRanks, the average Metropolitan Bank Holding price prediction of $58.33 implies 66.4% upside potential from current levels. With three unanimous Buys, MCB stock has a Strong Buy consensus rating. MCB shares have gained 13.5% in the past year.

#2 Genius Sports Limited (NYSE:GENI)

London-based Genius Sports Ltd is a betting data specialist and sports data technology company. It provides data management, broadcasting, and integrity services to sports leagues, bookmakers, and media companies. Currently, the company has more than 650 long-term partnerships in 18 locations, spanning five continents, with major offices in Sofia, Vilnius, Tallinn, New York City, Medellin, and Los Angeles. It has covered over 285,000 sports events.

In Fiscal 2023, GENI’s revenue grew 21%, beating its initial guidance, while adjusted EBITDA (earnings before interest tax depreciation and amortization) more than tripled compared to FY22. For Fiscal 2024, Genius Sports expects revenue to rise 16% to $480 million and adjusted EBITDA growth of 41% to $75 million.

Is GENI a Buy or Sell Stock?

With nine unanimous Buys, GENI stock commands a Strong Buy consensus rating on TipRanks. The average Genius Sports price target of $8.79 implies 59.2% upside potential from current levels. GENI stock has gained 17.9% in the past year.

#3 Magnite, Inc. (NASDAQ:MGNI)

California-based Magnite claims to be the world’s largest sell-side advertising platform offering solutions to automate the purchase and sale of digital advertising inventory. Publishers use Magnite’s technology to monetize their content across all screens and formats, including CTV (connected TV), online video, display, and audio.

In FY23, Magnite’s revenues and contribution ex-TAC (gross profit plus cost of revenue, excluding traffic acquisition cost) rose 7% each. Meanwhile, adjusted earnings per share (EPS) dropped 16% compared to Fiscal 2022. Furthermore, for the full-year 2024, Magnite guided for total contribution ex-TAC growth of 10% and adjusted EBITDA margin expansion of 100 basis points.

Is Magnite a Good Stock to Buy?

On TipRanks, MGNI stock has a Strong Buy consensus rating based on eight Buys and one Hold rating. The average Magnite price target of $15.50 implies 53.2% upside potential from current levels. In the past year, MGNI stock has gained 9.1%.

#4 BrightSpring Health Services Inc. (NASDAQ:BTSG)

Kentucky-based BrightSpring Health Services provides complementary home and community-based health services for complex populations in need of specialized and/or chronic care. BTSG’s services include home health care to seniors, long-term specialty care to behavioral and neurorehabilitation populations, and medication (pharmacy) management to customers and patients across many settings.

BTSG is a newly listed company and made its public market debut on January 26, 2024. In its first public earnings release, BTSG reported FY23 net revenue growth of 14.3% and adjusted EBITDA improved by 2.9% compared to the prior year. For Fiscal 2024, BrightSpring projects net revenue growth in the range of 5.9% to 7.6% and adjusted EBITDA growth of 2.3% to 4.9%.

Is BTSG a Buy, Sell, or Hold?

With 11 unanimous Buy recommendations on TipRanks, BTSG has a Strong Buy consensus rating. The average BrightSpring Health Services price target of $15.95 implies 50.9% upside potential from current levels. BTSG stock is down 3.9% since its listing.

#5 Evolv Technologies Holdings Inc. (NASDAQ:EVLV)

Evolv Technologies is a human security and screening company. It uses an industry-leading artificial intelligence (AI)-powered screening platform to detect weapons and intruders, with its solutions utilized across various industries, including casinos, healthcare, houses of worship, industrial workplaces, schools, stadiums, and ticketed venues.

In Fiscal 2023, Evolv’s revenue jumped 46%, while adjusted EBITDA loss reduced to $49.8 million from $69.7 million in the previous year. For FY24, the company expects total revenue of about $115 million and adjusted EBITDA to grow by more than 40% over FY23.

Is Evolv a Good Stock to Buy?

EVLV stock commands a Strong Buy consensus rating, backed by five unanimous Buys on TipRanks. The average Evolv Technologies Holdings price target of $7.60 implies 50.4% upside potential from current levels. EVLV shares have gained 67.4% in the past year.

Ending Thoughts

Investors can choose to diversify their portfolio by including selected small-cap stocks. These small-capitalization companies have a huge potential to grow in the future accompanied by meaningful share price appreciation. The above 5 best small-cap stocks catering to different industries have achieved highly bullish analyst views and could offer upside potential in the next twelve months.