GB:FUSA ETF Price & Analysis

FUSA ETF Chart & Stats

Day’s Range― - ―

52-Week Range$10.74 - $14.60

Previous Close$14.46

VolumeN/A

Average Volume (3M)5.64K

AUM260.00M

NAV14.53

Expense Ratio0.25%

Holdings Count112

Beta0.82

Inception DateMar 27, 2017

Next Dividend Ex-DateN/A

Dividend Yield

(―)Shares OutstandingN/A

Standard DeviationN/A

10 Day Avg. Volume2,245

30 Day Avg. Volume5,637

AlphaN/A

ETF Overview

Fide US Qlty In Accum Shs USD

Fide US Qlty In Accum Shs USD (Ticker: GB:FUSA) is an Exchange-Traded Fund (ETF) that offers investors a unique opportunity to gain exposure to the vast and diverse universe of the total U.S. stock market. Positioned within the 'Size and Style' category, this fund stands out by focusing on a broad-based niche that encompasses the entire market spectrum, from small-cap to large-cap stocks, blending growth and value styles.

The ETF is meticulously designed to capture the essence of U.S. market quality by selecting equities that meet stringent criteria of financial health and operational efficiency. This ensures that investors are not merely participating in the market but are strategically aligned with companies demonstrating robust balance sheets and sustainable growth potential.

Fide US Qlty In Accum Shs USD is particularly appealing to investors seeking a comprehensive market engagement strategy that doesn't compromise on quality. By accumulating shares in USD, it provides a seamless investment experience for those looking to enhance their portfolio with a currency advantage. This ETF symbolizes a confluence of breadth and depth, offering a balanced approach to capturing the holistic dynamics of the U.S. equity market.

Fide US Qlty In Accum Shs USD (FUSA) Fund Flow Chart

Fide US Qlty In Accum Shs USD (FUSA) 1 year Net Flows: -$114M

FUSA ETF News

FUSA ETF FAQ

What was GB:FUSA’s price range in the past 12 months?

GB:FUSA lowest ETF price was $10.74 and its highest was $14.60 in the past 12 months.

What is the AUM of GB:FUSA?

As of Oct 06, 2025 The AUM of GB:FUSA is 260.00M.

Is GB:FUSA overvalued?

According to Wall Street analysts GB:FUSA’s price is currently Undervalued.

Does GB:FUSA pay dividends?

GB:FUSA does not currently pay dividends.

How many shares outstanding does GB:FUSA have?

Currently, no data Available

Which hedge fund is a major shareholder of GB:FUSA?

Currently, no hedge funds are holding shares in GB:FUSA

FUSA ETF Smart Score

Neutral

1

2

3

4

5

6

7

8

9

10

Learn more about TipRanks Smart Score

For ETFs, the calculations for the Smart Score, Analyst Consensus, Price Target, Blogger Sentiment, News Sentiment and Insider Transactions are based on the weighted average of the ETF's holdings and some additional factors. Hedge Fund Trend, Crowd Wisdom and Technicals are based on the actual ETF ticker.

Top 10 Holdings

Nvidia Corporation

7.63%

Microsoft

6.54%

Apple Inc

6.48%

Alphabet Inc. Class A

4.57%

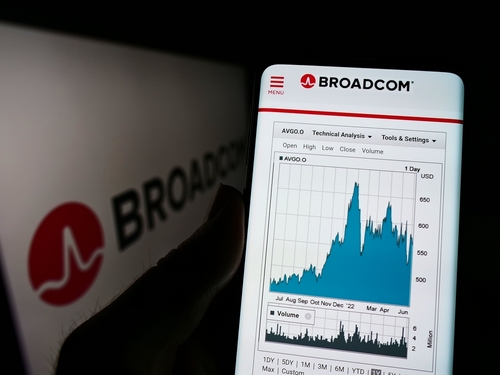

Broadcom Inc.

2.92%

Meta Platforms, Inc.

2.81%

JPMorgan Chase & Co.

1.95%

Eli Lilly And Company

1.54%

Visa Inc.

1.49%

Johnson & Johnson

1.30%

Total37.24%

See All Holdings