Over the past 24 hours, several Wall Street banks and research firms have gone on a rating spree, launching coverage of the shares of engineering and construction firm Legence (LGN).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

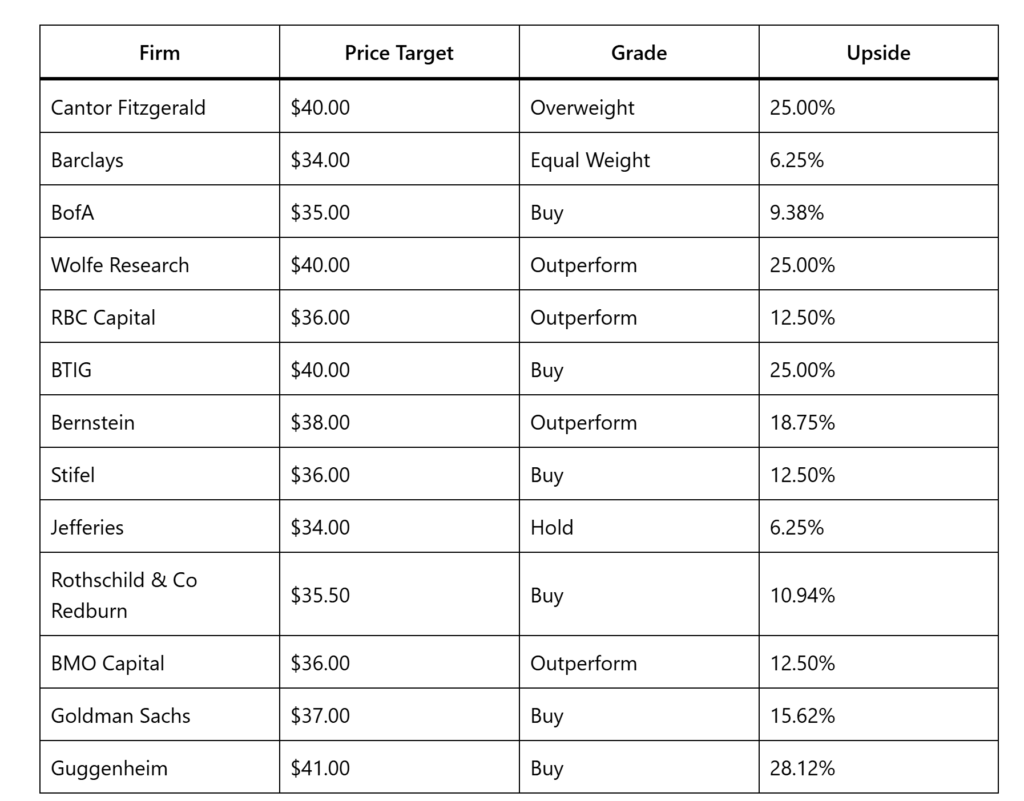

They have showered LGN stock with Buy ratings and price targets with significant upside potentials (when compared to the stock’s closing price of $32 per share on Tuesday, 8th September). The table below shows the price targets and the stock rankings.

Analysts ratings on Legence shares come a few weeks after the California-based company, which was founded more than ten decades ago, went public in mid-September on Nasdaq at $28.00 per share. It raised about $780 million from the initial public offering.

Why Is Wall Street Abuzz for Legence?

Legence provides its engineering, installation, and maintenance services to businesses across several industries, including data centers operators, semiconductor companies, life sciences firms, and commercial real estate organizations, among others.

Analysts from Barclays (BCS), Bank of America (BofA) (BAC), RBC Capital (RY), Bernstein (AB), Stifel (SF) and BMO Capital (BMO), among others, believe that Legence is well-positioned to benefit from the surge in demand for AI data centers to fuel the boom in artificial intelligence innovation.

Analysts Hail Legence’s Revenue

According to Stifel analyst Brian Brophy, 23% of Legence’s revenue came from data center demands last year. This is even as other analysts also pointed to Legence’s growth prospects and revenue potentials.

More than 60 percent of companies listed on the Nasdaq 100 index are Legence’s clients, noted Wolfe Research and Cantor Fitzgerald. The index, which tracks the 100 largest non-financial public companies in the U.S., includes major tech giants such as Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Nvidia (NVDA), among others.

Furthermore, Wolfe observed that half of Legence’s revenue is tied to high-growth markets, with the company’s backlog from its recent second quarter jumping 29% to $2.8 billion , when compared to the same period last year.

Legence Produces Double-Digit Growth

Moreover, BofA analyst Sherif El-Sabbahy pointed out that Legence has historically expanded at double-digit rates. Sabbahy expects the same growth trend over the next few years, even as Bernstein believes that the company’s revenue will expand by 11% into 2027.

Still on the positive, Stifel noted that Legence’s business model relies less on cyclical patterns compared to its public traded peers, while Goldman Sachs (GS) added that the Legence provides exposure to “high-growth” pockets in the non-residential construction industry.

However, Jefferies analyst Julien Dumoulin-Smith stood out as one of the rare lone voices not completely convinced by Legence. Barclays is also cautious as it sees future growth expectations as setting a very high bar for the company.

According to Dumoulin-Smith, while Legence is growing faster than its peers, these gains are weakened by the slimmer growth in its profit margin. The company also generates less-than-average cash flow, the analyst noted.

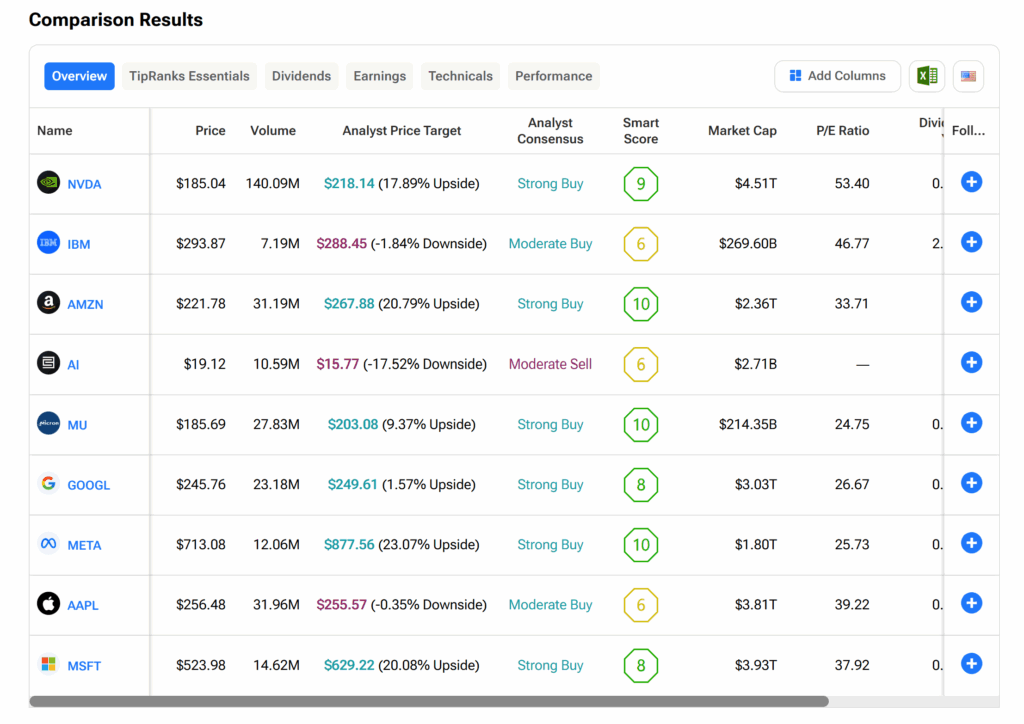

What are the Best AI Stocks to Buy?

As investments continue to pour into AI data centers and AI firms, knowing which stocks to buy is essential. The TipRanks Stock Comparison Tool provides some insight in this regard. Kindly refer to the graphics below.